Gold, Chart of the Week: Supply flooded the market in $1,850's, USD bulls hold the reins

- Gold is trapped in a wedge formation but tests the extremes of critical support and resistance.

- A breakout could be on the cards this week and events will be key.

North American equity markets staged a comeback on Friday, but there was mixed sentiment all around which supported near the heights of its biggest weekly rise in seven months as markets priced in a year ahead of aggressive hikes in US interest rates.

Nonetheless, US Treasury yields eased, with 10-year yields falling to about 1.77% for the day, well below two-year highs of nearly 1.9% hit at the start of the week which provided some late solace to otherwise battered gold bugs.

Gold was giving both the bulls and bears a slice of the pie last week with the extremes of both sides to the daily wedge formation being tested, albeit with no cigar for either party:

There was no breakout for the swing traders to capitalise on which makes this week key for price action. Considering the fundamental events that we have lined up in the US calendar and European Central Bank especially, a significant move in gold could be on the cards. The US dollar will be the most likely driver for gold prices this week and have already moved to new cycle highs, the greenback may remain supported as markets flirt with the idea of a 50bp March Fed hike.

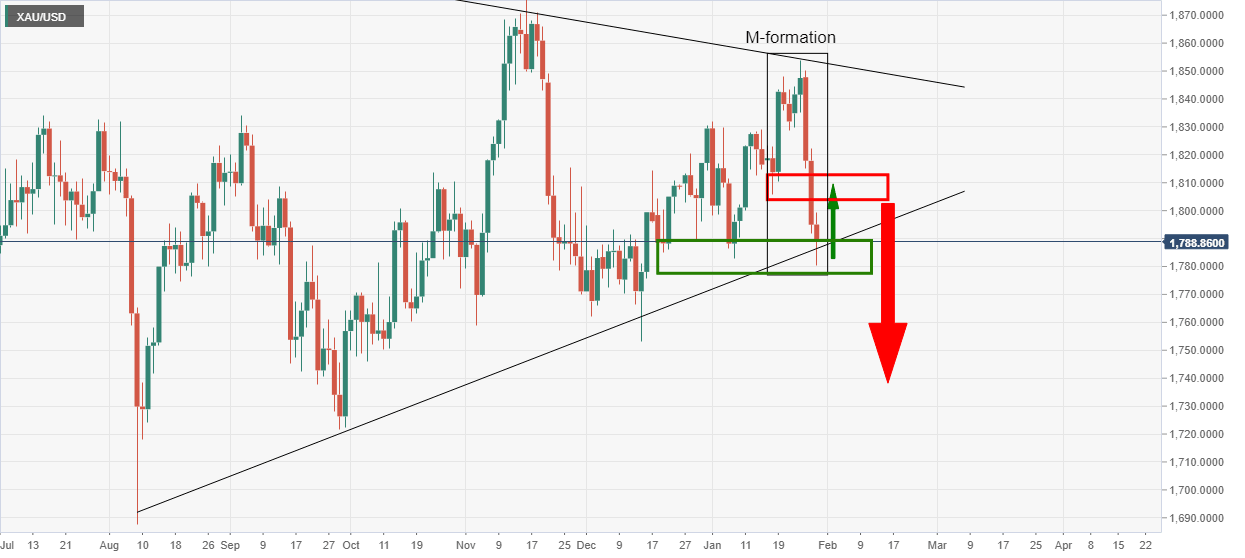

Gold daily chart

This should leave the emphasis on the downside for gold this week. However, considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play first of all:

The M-formation is a reversion pattern that has a high completion rate with the price usually moving back to test at least a significant portion of the prior impulse if not all the way back to the neckline of the M-pattern. In the case above, the 38.2% Fibonacci retracement level near $1,810 has a confluence with prior structure as illustrated.

Should this playout, and if the bears commit near to here, then additional supply could be straw that breaks the camelback for a sizeable continuation to crack the trendline support as follows:

On the other hand, if the US dollar gives way again, then the neckline of the M would be the last defence for a restest of the wedge resistance the $1,850's once again:

Key events

The week ahead is a very busy one in the US, where we see ISM surveys and the January Nonfarm Payrolls.

For the January NFP, consensus sits reasonably low in the 150-250k range, following a weak 199k reading in December. Meanwhile, surveys already released point to declines in both ISM indexes.

An eye will glance over the ECB which is in cruise control, at least for the first half of 2022.

Risk-off flows would be expected to benefit both gold and the greenback pertaining to risks of conflict over Ukraine.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.