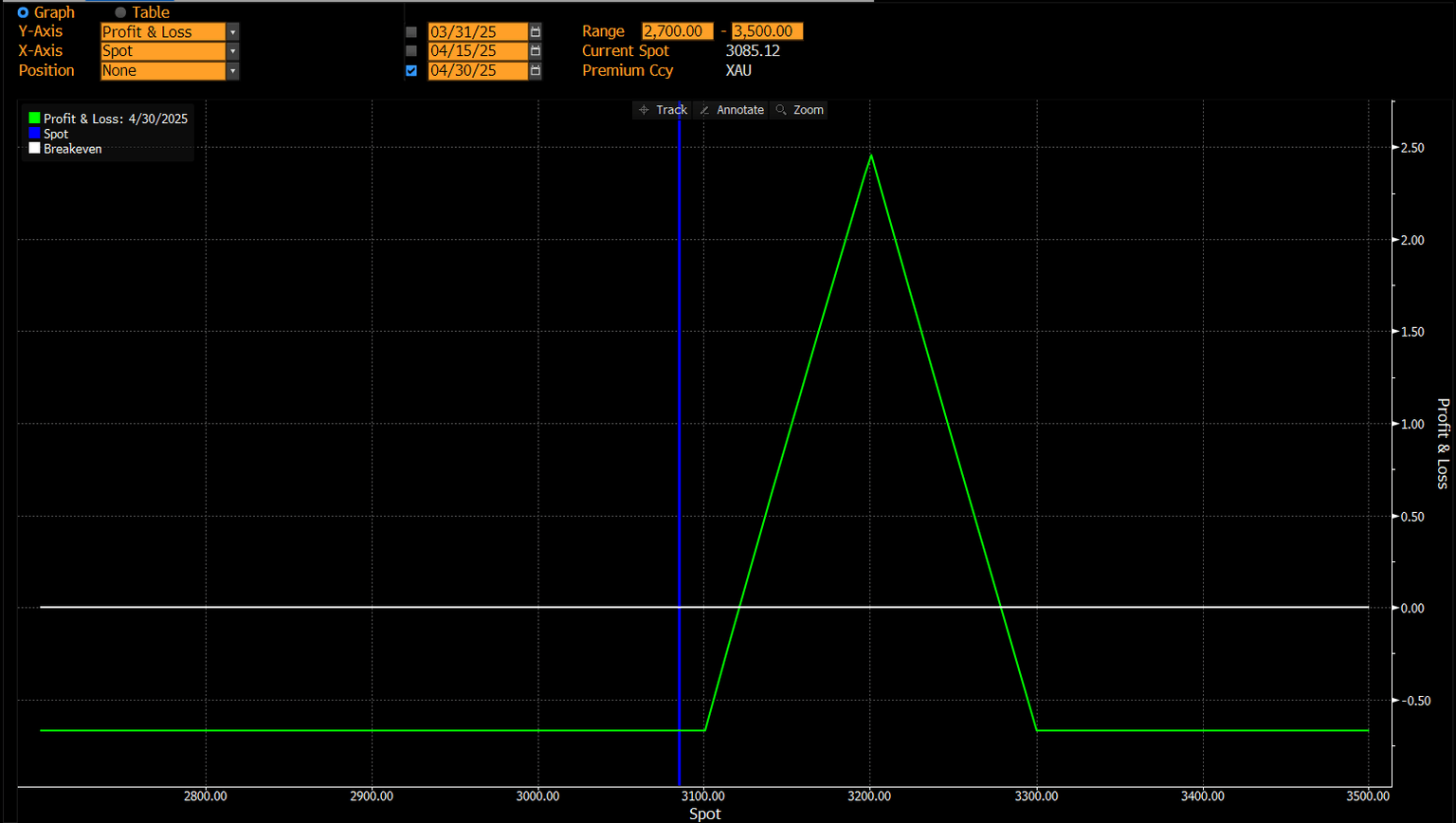

Gold call fly targeting $3,200

Given the recent move in the gold spot market, it’s tough to get a decent trade at spot, either long or short, with a solid risk/reward. Lower implied volatility alongside the lack of spot credibility right now means we turn to the options space for ideas.

Even with the Trump concern in the immediate days, the grind higher in gold can be argued to continue whatever outcome we see with tariffs. We believe using options can help to limit a high-vol move to the downside.

As a result, we look to isolate $3,100-$3,300 as a range where spot could trade over the coming month, with us building a call fly around this which creates a circa 4:1 risk reward.

Author

APFX Research

AlphaPicks

Multi-asset investment research.