Gold back to inflection point

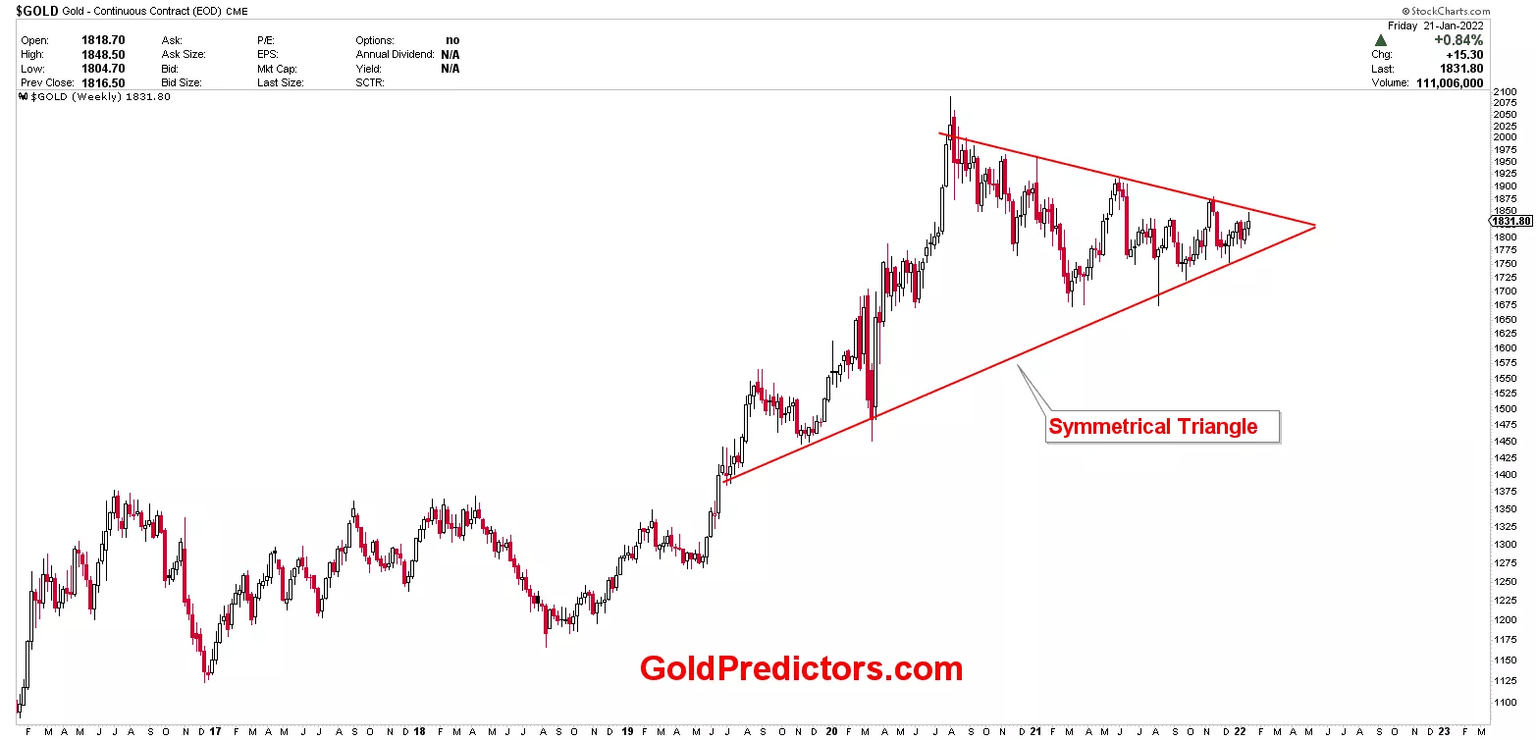

Precious metals, stocks, and forex instruments were expected to experience unprecedented volatility, by the end of 2021 and the start of 2022. So far, there have been no surprises or disappointments. Last week, Nasdaq experienced the biggest selloff and then recovered sharply within a day. The same thing happened in gold markets, where prices fell from $1,850 to $1,780 support. The recent drop in gold was not unexpected since it had been well anticipated and managed. It was a clear warning to members and social media about the upcoming drop. Technically, this drop can be viewed as the strong resistance juncture of a symmetrical triangle, as shown in the chart below.

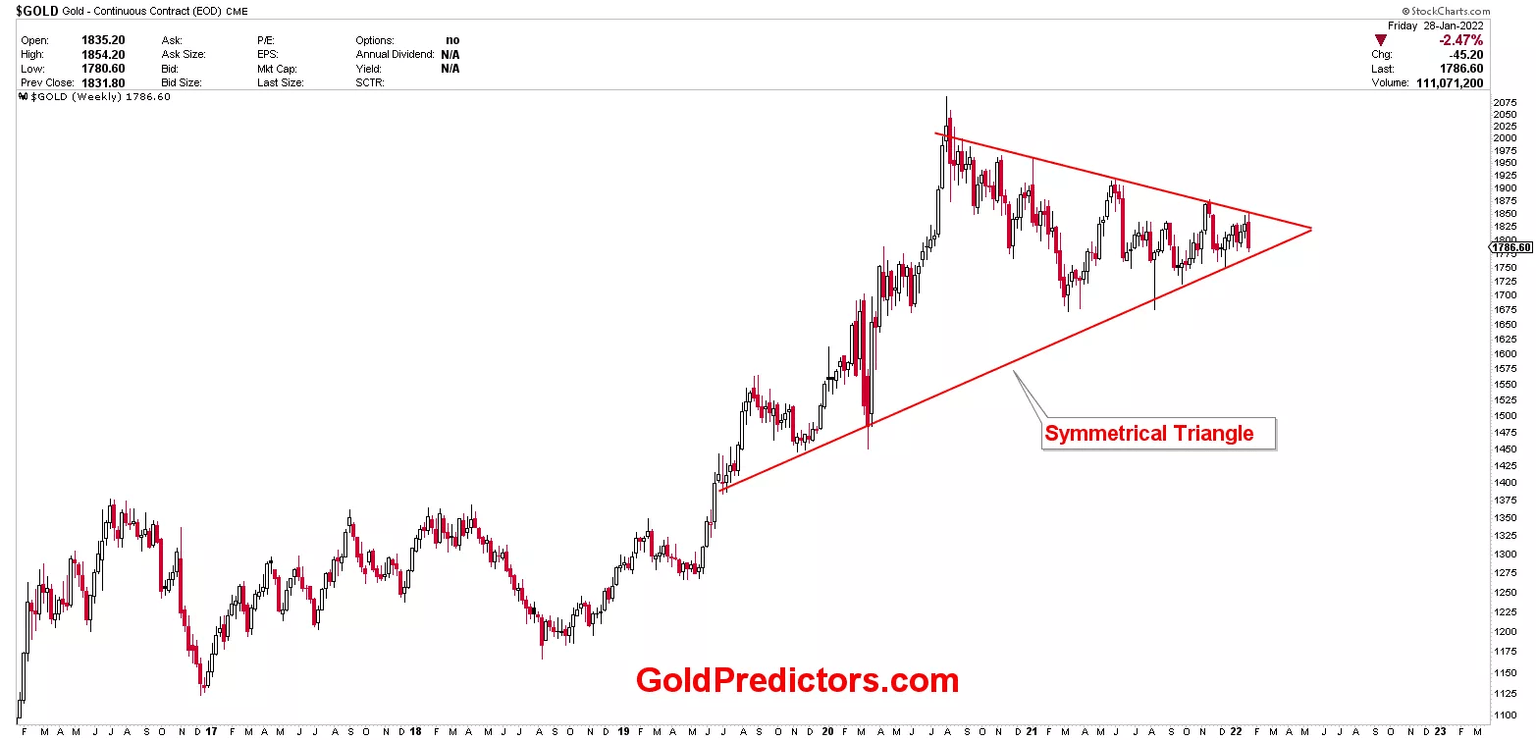

The trading environment for precious metals, particularly gold and silver markets, has been extremely volatile and risky. There has been no direction, and prices are moving in congested areas while waiting for the big decision to be made in the FEB/MAR timeframes. We sold the rally at $1,838.50 and booked profits at $1,783, as shown in the chart below. After profits were taken, gold prices produced a bottom in $1,780 and began to rally from there. This was the first biggest trade of 2022, and it appears that the trading environment will provide some genuine direction in the first quarter of 2022.

Bounce after profit taking

Gold prices have currently hit the edge of a symmetrical triangle at $1,780, where we booked profits, and are now bouncing back towards the congestion zones, as shown in the chart below. This article will go over the upcoming scenarios, pivots, and inflection points to help you make some trading decisions. Due to the strong consolidation, trading activity has been muted.

Edge of Symmetrical Triangle

The dollar recently caught a bid near the bottom of a trading range. In anticipation of the upcoming carnage in the asset markets, the US dollar may experience a “flight to safety.” However, this may only be a short-term flight, and long-term trends remain bearish.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.