Gold at yesterday’s high

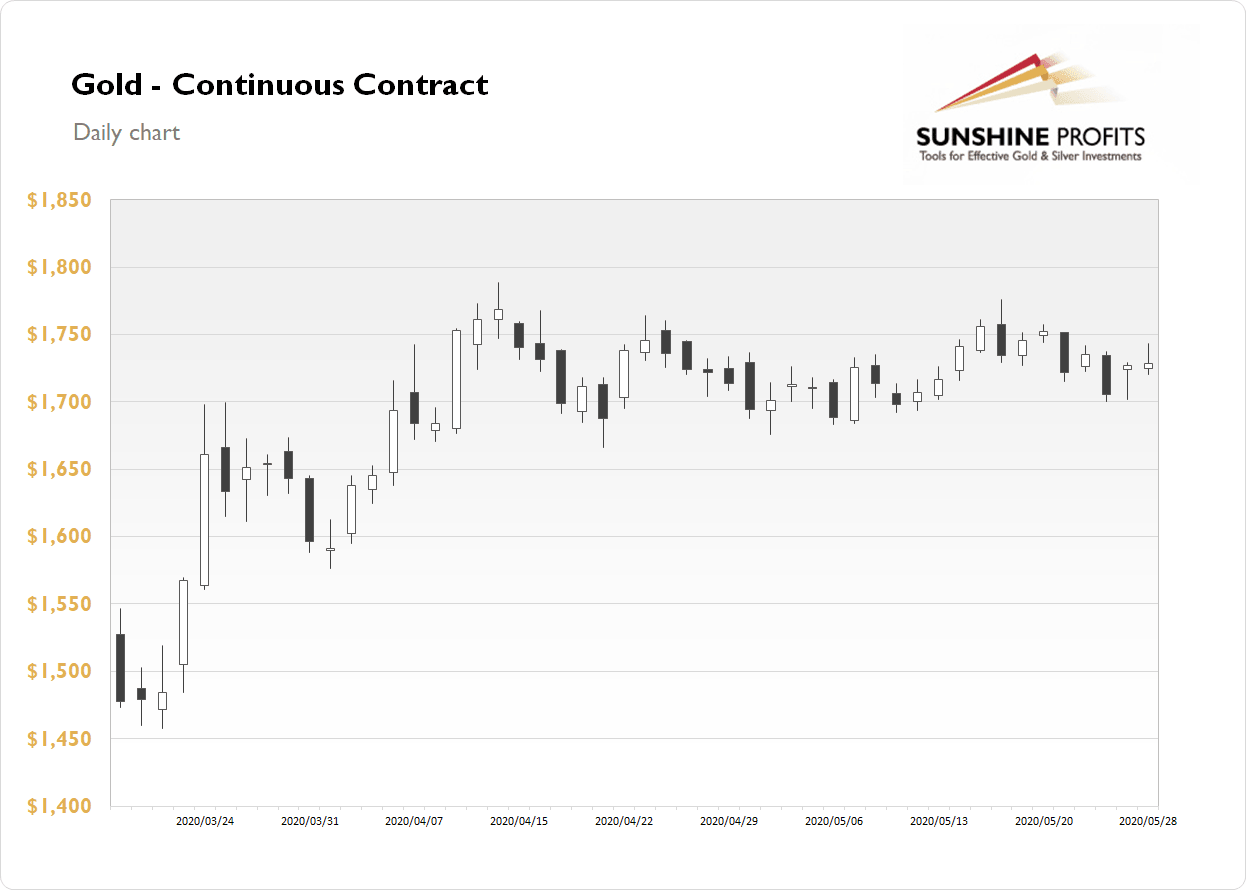

The gold futures contract gained 0.09% on Thursday, as it extended its consolidation following bouncing off $1,700 support level on Wednesday. Gold has been trading within a downward correction after reaching new monthly high of $1,775.80 on Monday almost two weeks ago. Wednesday’s price action was quite bullish, but gold keeps extending over month-long consolidation, as we can see on the daily chart:

Gold is 0.6% higher today, as it gets back to yesterday’s high. Financial markets remain in risk-on mode, as stocks hover along their new medium-term highs. What about the other precious metals?: Silver gained 1.18% on Thursday and today it is 2.6% higher, platinum lost 1.14% and today is trading 0.4% higher. Palladium lost 1.61% yesterday and today it is 1.6% lower again.

The recent economic data releases have been confirming negative coronavirus impact on global economies. Today’s Personal Spending number release came out worse than expected. However, the Personal Income data was better than expected. The market will await today’s Fed Chair Powell speech at 11:00 a.m. We will also have a speech from President Trump today. Investors are now waiting for the Chicago PMI release at 9:45 a.m. There will also be Michigan Sentiment number release at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, May 29

- 5:00 a.m. Eurozone - CPI Flash Estimate y/y, Core CPI Flash Estimate y/y

- 8:30 a.m. Canada - GDP m/m, RMPI m/m, IPPI m/m

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m, Core PCE Price Index m/m, Goods Trade Balance, Preliminary Wholesale Inventories m/m

- 9:45 a.m. U.S. - Chicago PMI

- 10:00 a.m. U.S. - Revised UoM Consumer Sentiment, Revised UoM Inflation Expectations

- 11:00 a.m. U.S. - Fed Chair Powell Speech

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.