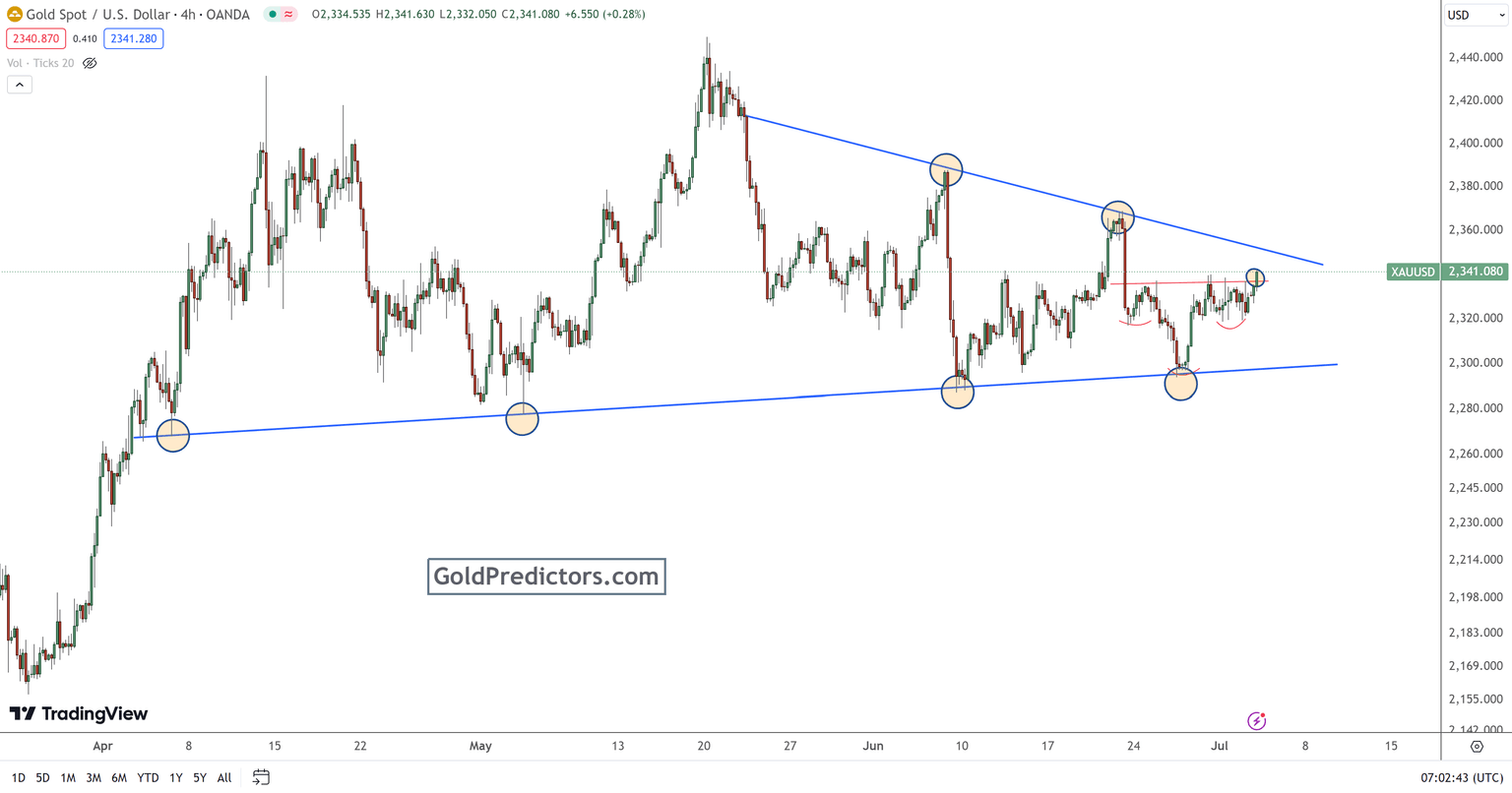

Gold approaches key triangle apex ahead of FOMC Minutes

-

Gold prices fluctuate within the apex of the triangle as traders await crucial US economic data and Federal Reserve updates, reflecting a cautious market stance.

-

Recent dovish comments from Fed Chairman Jerome Powell and declining US Treasury bond yields have supported gold prices.

-

From a technical perspective, the gold market remains range-bound and waits for major catalysts to break the current consolidation.

Gold prices fluctuate in ranges, reflecting a cautious market stance ahead of crucial US economic data and Fed updates. Traders are eyeing the upcoming US ADP Employment Change report and the Minutes from the Fed's June policy meeting for further direction. The US Treasury bond yields have slightly declined following Powell's comments, supporting gold prices. The latest World Gold Council report also highlighted significant gold purchases by central banks, including the National Bank of Poland, indicating continued demand for the precious metal. Market participants are also considering the weaker-than-expected China Caixin Services PMI, which has rekindled concerns about global economic growth. As markets now see a higher probability of a Fed rate cut in September, these developments collectively influence gold prices, making the upcoming economic indicators pivotal for future price movements.

Gold approaches near the apex of triangle

From the technical perspective, gold prices are fluctuating, but Monday's consolidation has kept them stable within the apex of the triangle, as shown in the chart below. However, prices are struggling to take a clear direction. Last week's rebound and Monday's consolidation have produced an inverted head and shoulders pattern on a short-term basis, indicating a potential price move toward the $2,350 level. Nevertheless, the overall market remains sideways, and prices are expected to fluctuate within a broad range until a significant announcement or major catalyst breaks the current pattern. With June now ended, markets are anticipated to mark a bottom for the next move higher, so a price drop before the next upward move is not out of the question.

Bottom line

In conclusion, gold prices fluctuate within the apex of the triangle as the market adopts a cautious stance ahead of critical US economic data and Federal Reserve updates. Traders are closely monitoring the US ADP Employment Change report and the Fed's June policy meeting minutes for further direction. Recent dovish comments from Fed Chairman Jerome Powell and declining US Treasury bond yields have provided some support for gold, while significant central bank purchases, notably by the National Bank of Poland, underscore ongoing demand for the metal. Despite short-term technical patterns suggesting a potential rise towards $2,350, the market remains range-bound, awaiting a major catalyst to break the current consolidation. As the seasonal correction period for gold ends in the June/July, a potential bottom formation is expected soon, which may lead to higher prices for the remainder of the year.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.