Gold and WTI Crude: Technical analysis and trade ideas for today [Video]

![Gold and WTI Crude: Technical analysis and trade ideas for today [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stacked-gold-bars-13094022_XtraLarge.jpg)

Gold

-

Hit support at 2028/25 with a low for the day exactly here.

-

Gold then bounced to 2033 so this did offer a 5 to 7 point profit as I suggested. I am happy we maximised the opportunity on a very quiet day.

-

We can only scalp in the short term while we wait for a breakout & indication that a trend is forming. We could be waiting for a coupe of weeks.

Two support levels again at 2028/25 & at 2020/2018. Keep stops tight, I suggest 2-3 points stops with a 5-7 point target.

Obviously a break above last week's high on Friday at 2041/42 should be a buy signal & can target 2 month trend line resistance at 2049/50. Shorts need stops above 2053. A break higher could see 2050/49 act as support to target 2057/58.

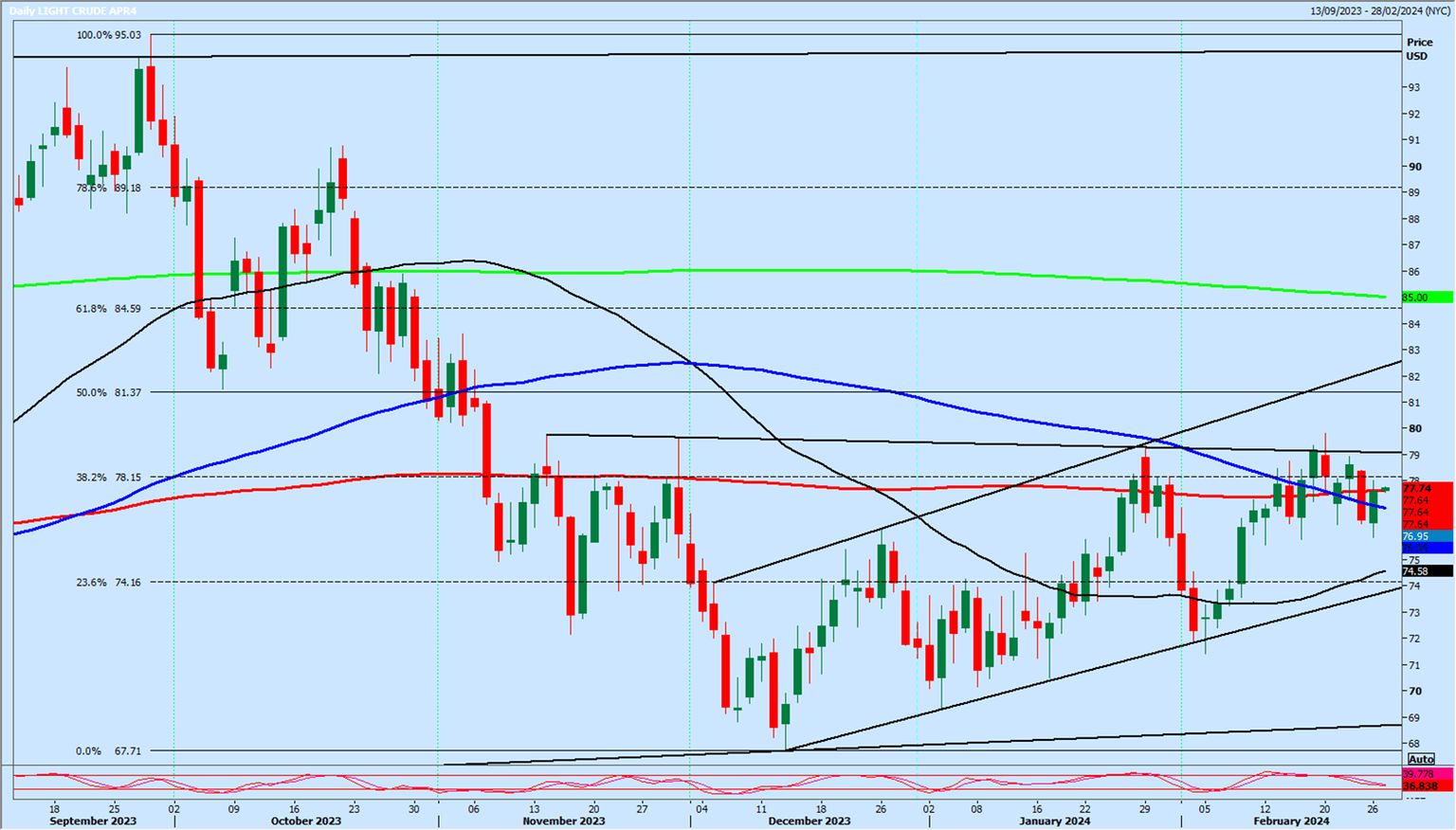

WTI Crude April future

-

Reversed from just below resistance at the mid/late November high & the January/February high from 7929 up to 7980 on Friday.

-

Prices collapsed throughout the session to first support at 7780/7740 but did not hold here & continued lower to the next target of 7660 & as far as the next target of 7580/60 on the open yesterday.

We made a low for the day only 4 points above the next downside target 7580/60 & raced straight back up to 7803 to recover most of Friday's steep losses. Prices are up for a day or two then down for a day or 2 as we remain in a choppy sideways channel, ranging from 7580/50 up to 7930/80.

A break above 7810 today can target 7880/7920. Obviously bulls need a break above 8000 for a buy signal this week.

Holding below 7740/80 risks a slide to 7650/20, perhaps as far as 7580/60. A break below 7530 could test some support at 7450/7400.

Author

Jason Sen

DayTradeIdeas.co.uk