Gold advances in an elliott corrective wave

Gold continues moving mostly bullish on Thursday fueled by the bearish pressure of the US Dollar Index, and the uncertainty risen by risk on economic growth raised by the virus.

The precious metal in its 2-day chart and log scale shows the advance that the price is developing since mid-December 2015 when the yellow metal found fresh buyers at $1,047.75 per ounce.

Gold's traders had boosted the price in a three-wave sequence, which found its peak in early March 2020 when it reached $1,703.28 per ounce.

Once the yellow metal found sellers at the $1,703.28 completing a wave (3) or (C) of Intermediate degree labeled in blue, the price made a retrace that led it to pierce the bullish trendline linking the waves 2-4 of Minor degree identified in green.

The breakdown made by price leads us to conclude that Gold finished a bullish sequence and began a corrective structure that is still in progress. The correction under development could correspond to a wave (4) or (A) of Intermediate degree labeled in blue.

According to Elliott's wave theory, a corrective wave is composed of three internal segments. So in the following 12-hour chart, we observe Gold moving upward on a wave ((b)) of Minute degree labeled in black.

From the figure above, we note that the yellow metal runs bullish on an incomplete wave ((b)). As a consequence, Gold should develop a new bearish movement within the next sessions.

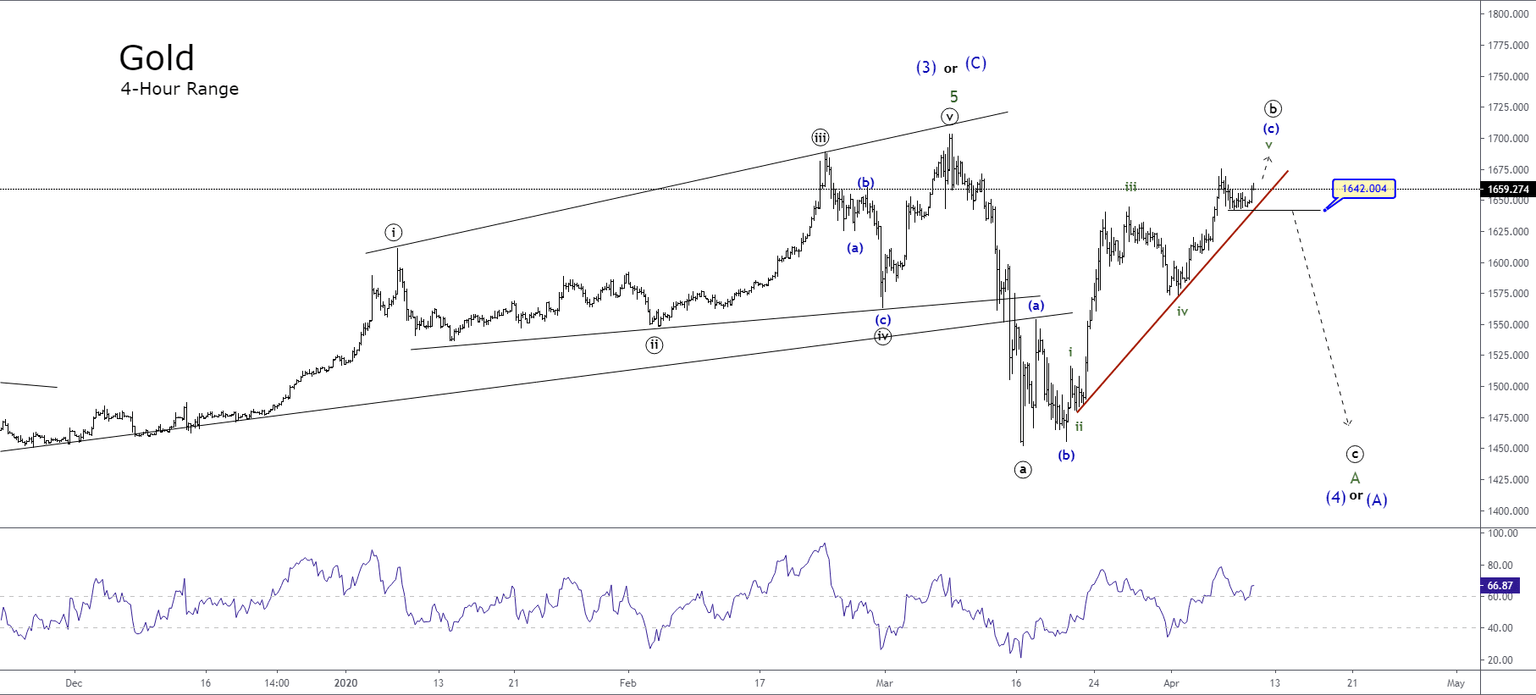

The following 4-hour chart shows Gold advancing on a wave ((b)), which by definition, must it be built by three internal segments. As seen in the figure, the yellow metal is moving in a wave (c) of Minuette degree identified in blue.

The upward trendline that links waves ii and iv of Subminuette degree in green remains intact, leading us to conclude that Gold maintains its current bullish bias. However, we should keep in mind that the price moves in the fifth wave in green; therefore, the price could make a reversal move soon.

To conclude, in the short-term, the pressure is maintained on the bullish side; however, considering that currently, the progression of the price on its fifth wave of the upward wave (c), our bias remains neutral. In the long-term, considering that the future bearish movement will correspond to a wave C of Minor degree in green pending, our positioning remains on the bearish side.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and