Gold adjust lower on US Dollar recovery

- The temporary rebound of the US Dollar Index has caused a short-term correction in gold prices, despite an overall upward trend.

- This market dynamic suggests that any further corrections in gold prices due to fluctuations in the USD may offer buying opportunities for investors.

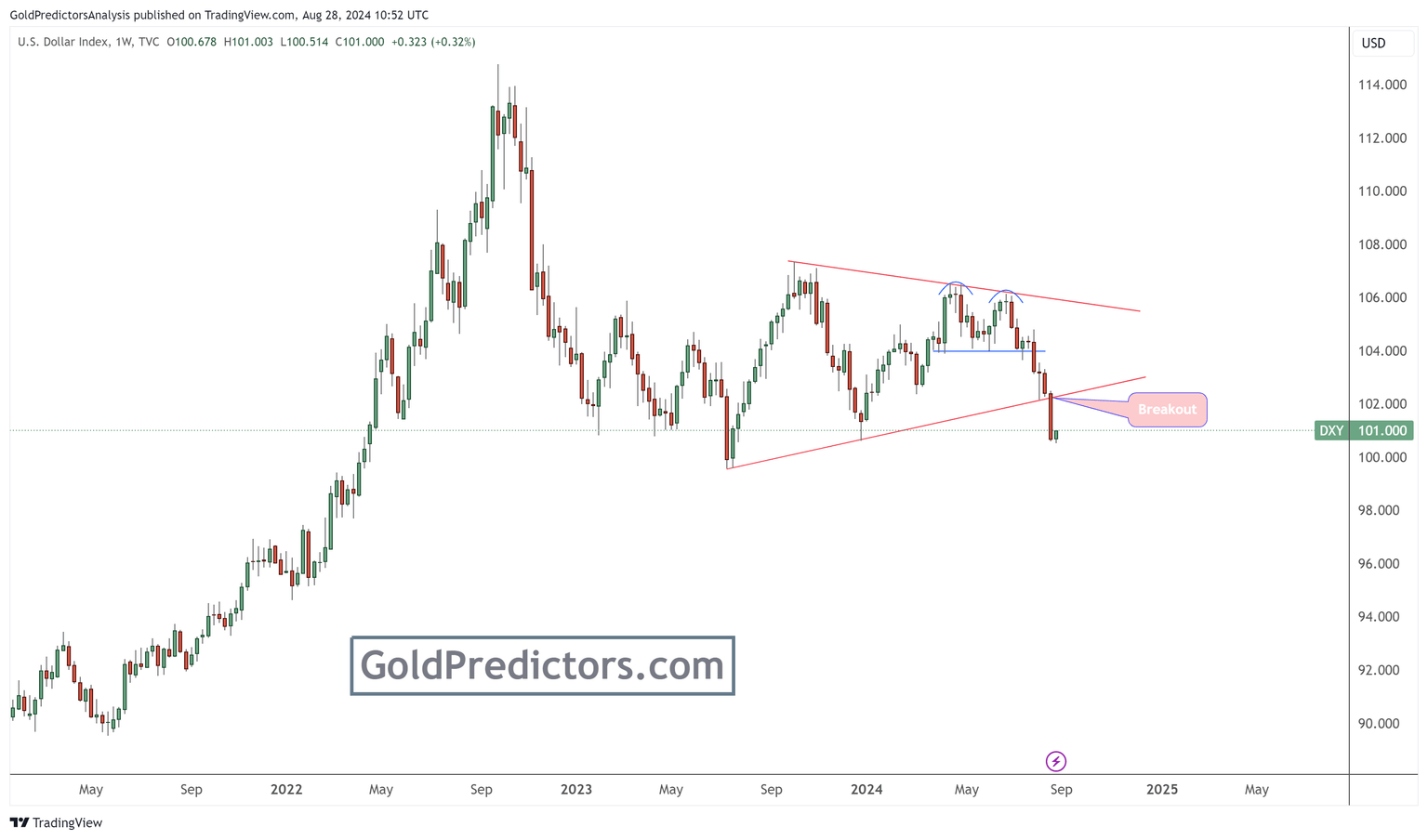

The chart below shows that the Dollar Index broke out of a triangle pattern and initiated a strong drop, which pushed gold prices higher. However, after this decline, the US Dollar Index is bouncing back upward on Wednesday, causing a correction in the gold market.

The price behaviour in the gold chart below indicates that the short-term market is consolidating after the breakout, but the overall direction remains upward. The strong rebound from the $2,360 level suggests significant potential for a strong gold market in the coming weeks. Therefore, any price correction due to the US dollar rebound is considered a buying opportunity for gold investors.

Bottom line

In conclusion, the recent movements of the US Dollar, characterized by its initial drop and subsequent weak recovery, have played a crucial role in shaping the outlook for gold prices. As the USD's appeal as a safe-haven diminishes and a risk-on sentiment takes hold in global markets, gold has become increasingly attractive to investors seeking stability amid uncertainty. While the temporary rebound of the US Dollar Index has led to a short-term correction in gold prices, the overall upward trend and consolidation suggest continued strength for gold. Thus, any further corrections in gold prices due to fluctuations in the USD present potential buying opportunities for investors looking to capitalize on the anticipated upward momentum in the gold market.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.