-

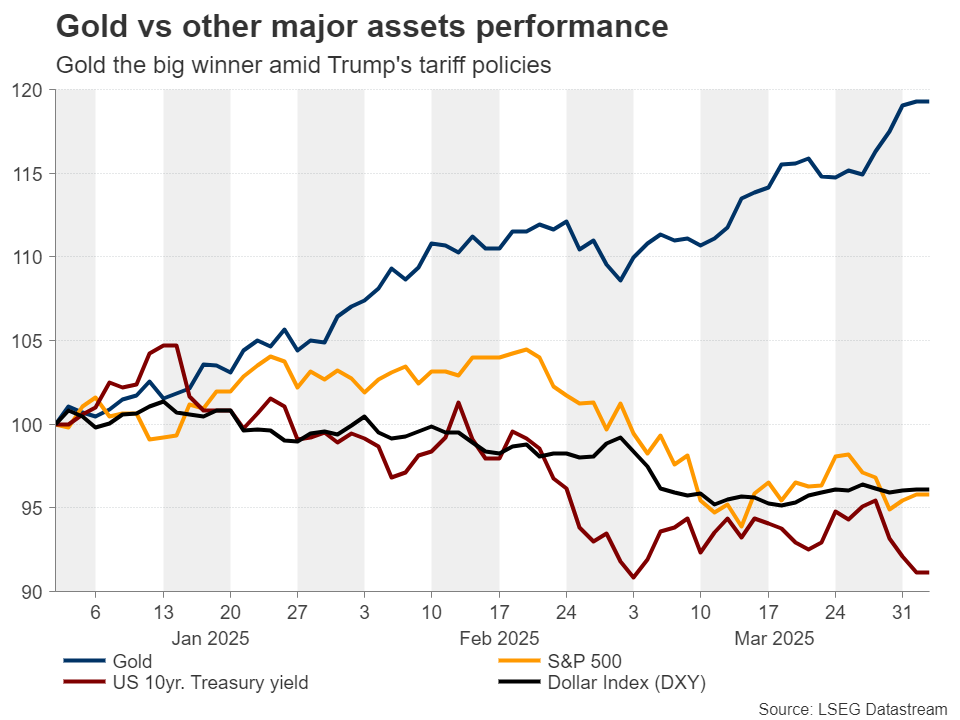

Gold gains nearly 20% year-to-date due to safe-haven flows.

-

Trump’s tariff policies are fueling inflation and recession fears.

-

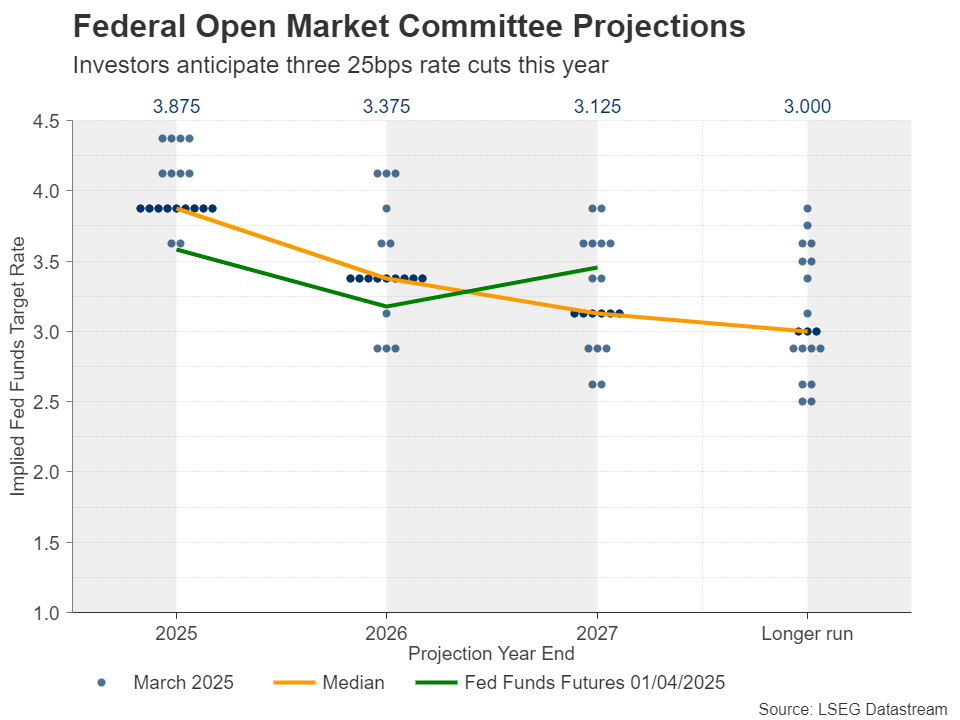

Investors expect three quarter-point rate cuts by the Fed in 2025.

-

But regardless of the Fed’s stance, gold may be destined to climb higher.

Tariffs are fueling Gold’s engines

Gold has been the best performing asset year-to-date, gaining nearly 20% and breaking record high after record high. The S&P 500, Treasury yields, and the US dollar are in the red, with Bitcoin suffering even more.

At this point it is worth noting that recently, equities have been positively correlated with the US dollar. The reason why this has been the case is the same reason why gold has been flying sky high, and it is no other than recession fears due to Trump’s tariff rhetoric and policies, as well as the broader uncertainty his policies are generating.

Although reports around a week ago suggested that Trump will adopt a softer and more flexible stance than previously anticipated on April 2, when the reciprocal tariffs are scheduled to take effect, the US President himself said last Wednesday that he is planning to proceed with a 25% levy on imported cars and light trucks on April 3. Duties on auto parts will take effect on May 3. And as if this was not enough, during this weekend, a report hit the wires saying that Trump will consider higher tariffs against a broader range of countries, as he aims at correcting trade imbalances against the US.

Recession fears intensify ahead of “Liberation Day”

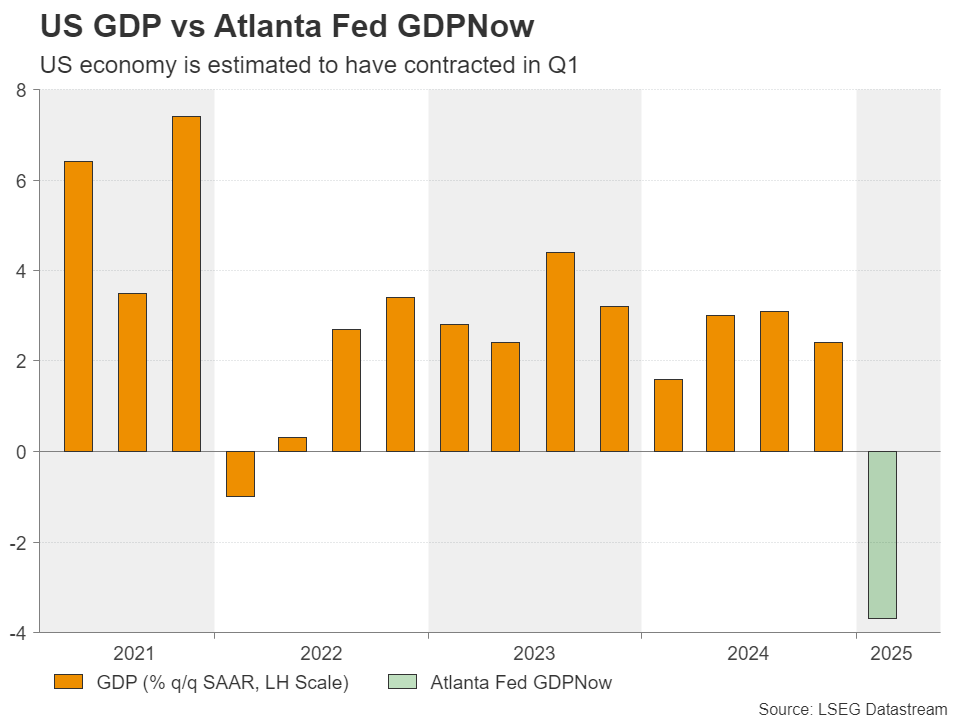

Initially, investors were afraid that tariffs would refuel inflation. However, although this still may be the case, they have lately shifted their focus on the impact Trump’s trade policies may have on the world’s largest economy. Following the latest toughening of Trump’s stance, Goldman Sachs is now projecting a 35% probability of a recession in the next 12 months, while the Atlanta Fed has revised down its GDPNow model estimate for Q1 to -3.7%.

The heightening concerns about deep wounds in US economic activity have prompted investors to bring back to the table some of the rate cut bets they recently removed. Currently, they are pencilling in around 75bps worth of additional rate cuts by the end of the year, even though the Fed’s latest dot plot continued pointing to only two quarter point reductions.

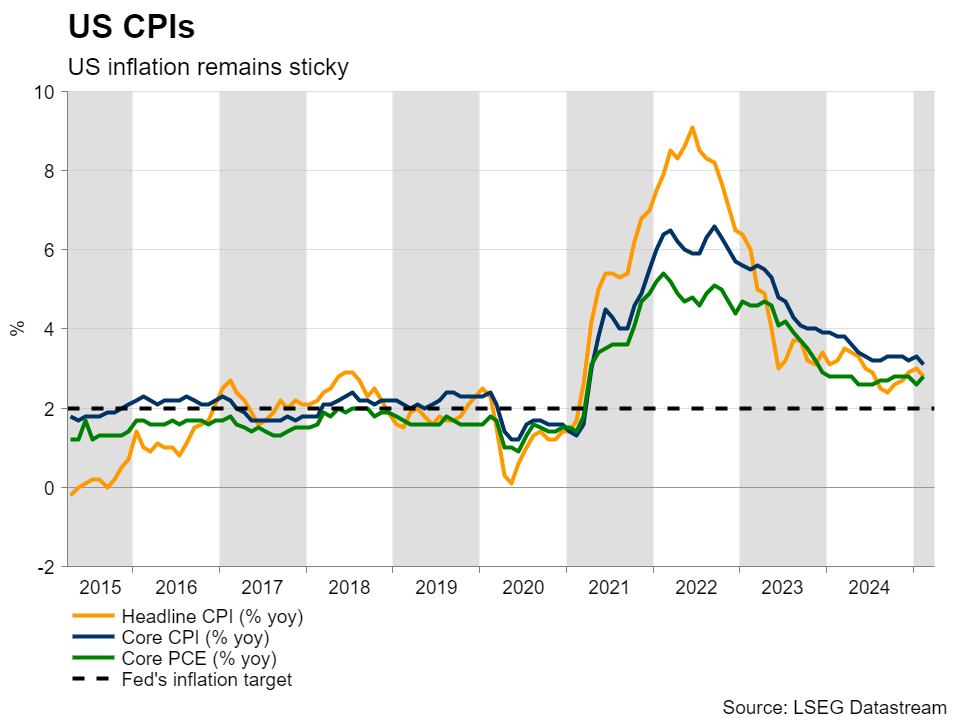

And indeed, with the core PCE price index, the Fed’s favorite inflation metric, surging to 2.8% y/y in February, the path of monetary policy from here onwards is far from being crystal clear. The Fed may find itself between a rock and a hard place. On the one hand, they need to safeguard the economy, and on the other, they need to make sure that inflation does not get out of control again.

Gold could continue exploring uncharted territory

Either way, in the current landscape, it may be a win-win situation for gold. If the Fed decides to hold interest rates steady, investors may become even more worried, as high borrowing costs could be an extra drag for the economy. They could then buy more gold due to its safe-haven status. On the other hand, an accelerating rate reduction process may reduce even further the opportunity cost for holding the precious metal, which is again positive.

The fact the Peoples’ Bank of China (PBoC) continued buying gold in February for the fourth straight month may be another important factor underpinning gold. Chinese officials may be willing to continue adding to their reserves in an attempt to further loosen their dependency to the US dollar in order to minimize the economic damages from an escalating trade war between the world’s two largest economies.

Correction is likely, but broader uptrend remains well intact

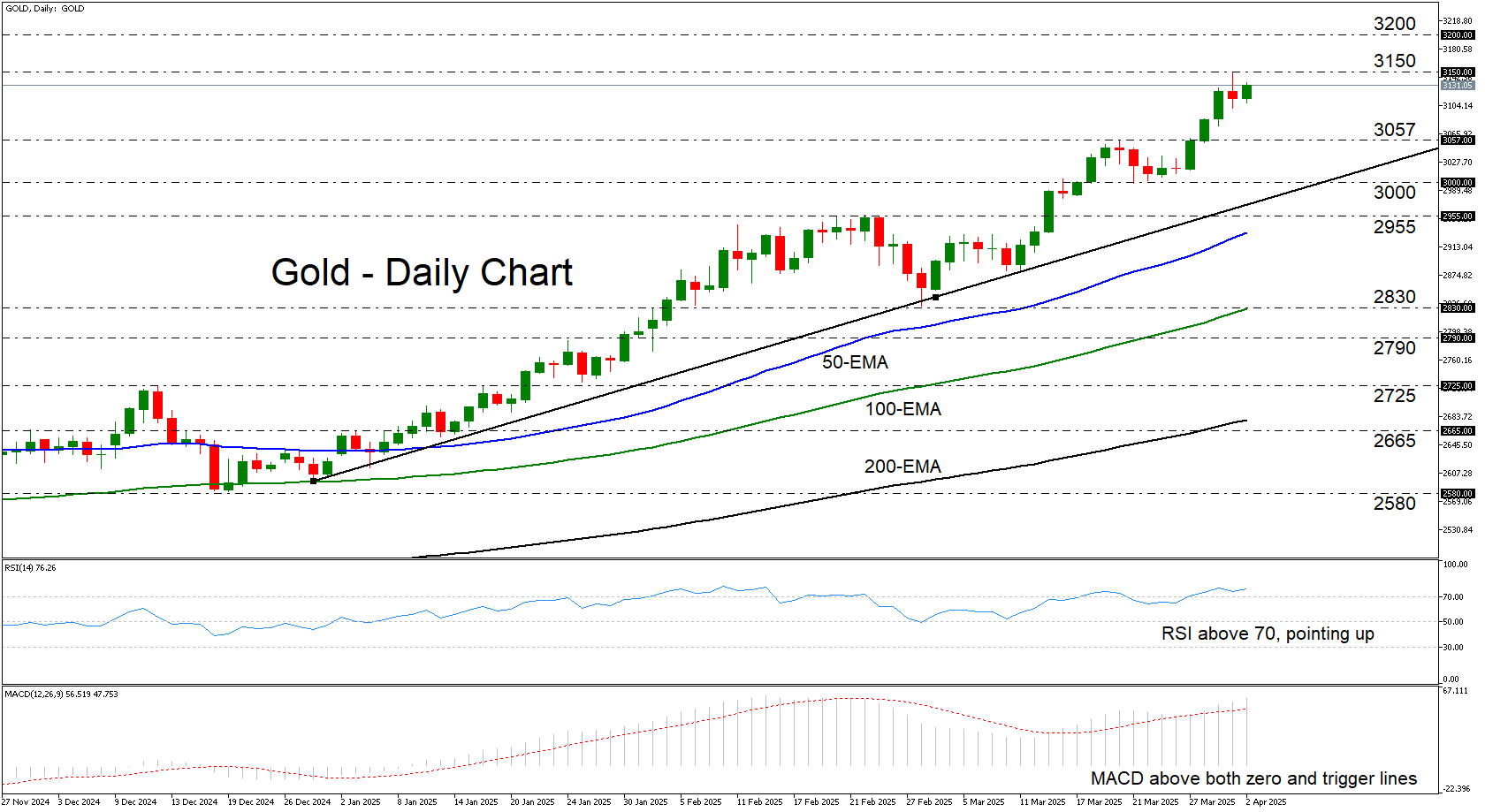

From a technical standpoint, gold hit a new record high near $3,150 on April 1, before pulling back. The prevailing uptrend remains well intact and very strong, with both the RSI and the MACD pointing to strong upside momentum.

The announcement of tariffs today and tomorrow may result in a “sell the fact” market reaction, but the uncertainty about Trump’s future trade policies may allow the bulls to jump back into the action from near the $3,067 zone, marked by the inside swing high of March 20. If this is the case, a rebound could aim for another test near the all-time high of $3,150, the break of which could allow extensions towards the $3,200 zone. That zone is the 261.8% Fibonacci extension level of the October 30 – November 14 correction.

For the outlook to start shifting to bearish, a decisive dip below the round number of $3,000 may be needed. Such a move would confirm a lower low on the daily chart, as well as the break below the near-term uptrend line drawn from the low of December 30. This scenario may materialize if Trump’s actions turn out to be way softer than what he initially signalled.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.