Gold: A near term unwind would help to renew upside potential [Video]

![Gold: A near term unwind would help to renew upside potential [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-gm187363896-28836378_XtraLarge.jpg)

Gold

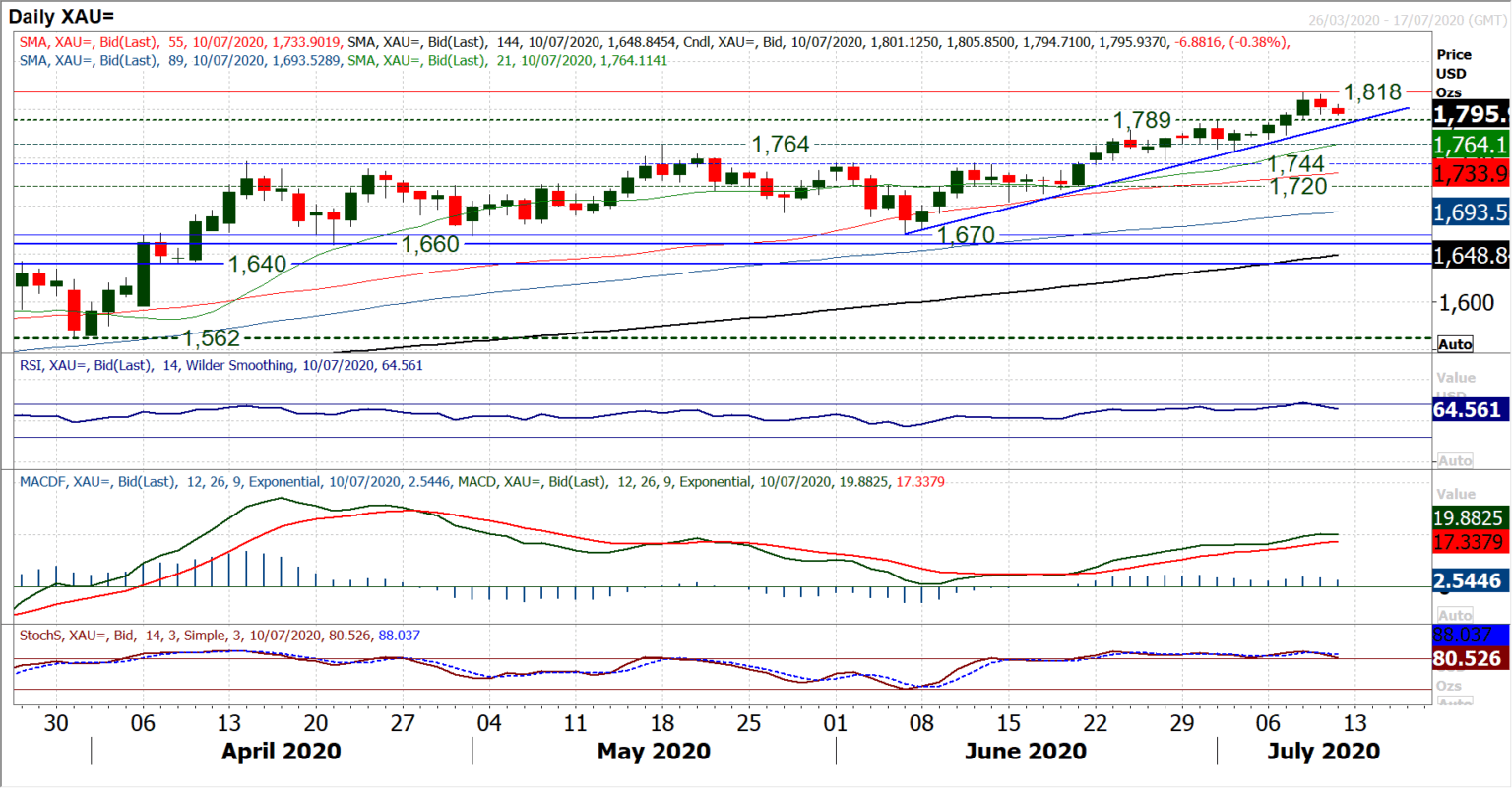

After the breakout comes the pullback. This seems to be a feature of breakouts on gold over recent months. We do see that the breakout this time has been built on firmer positive ground, but it will be interesting to see just how far this unwind now goes. A mild negative candlestick yesterday has taken some of the sheen off the move to multi-year highs, but for now this seems likely to provide the next opportunity to buy. The support of the latest breakout is at $1789, whilst support of a five week uptrend is at $1783 today. This is a good basis for the bulls to work with as the market slips a shade further this morning. We look for buying opportunities now between the $1764 and $1789 old breakouts. This is now a zone of underlying demand. During previous breakouts, momentum indicators have had questionable strength. However, this time we see RSI pulling back from the 70s, MACD lines rising for the past three weeks and Stochastics strongly configured. A near term unwind would help to renew upside potential and should (at this stage) be viewed as a positive move. Below $1764 would be disappointing for the bulls now, whilst below $1744 would start to become a decisive bull failure. For now, we see this as an opportunity for the bulls.

Author

Richard Perry

Independent Analyst