Gold: a close above $1487 would be a six week high and suggest bull traction [Video]

![Gold: a close above $1487 would be a six week high and suggest bull traction [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-14424039_XtraLarge.jpg)

Gold

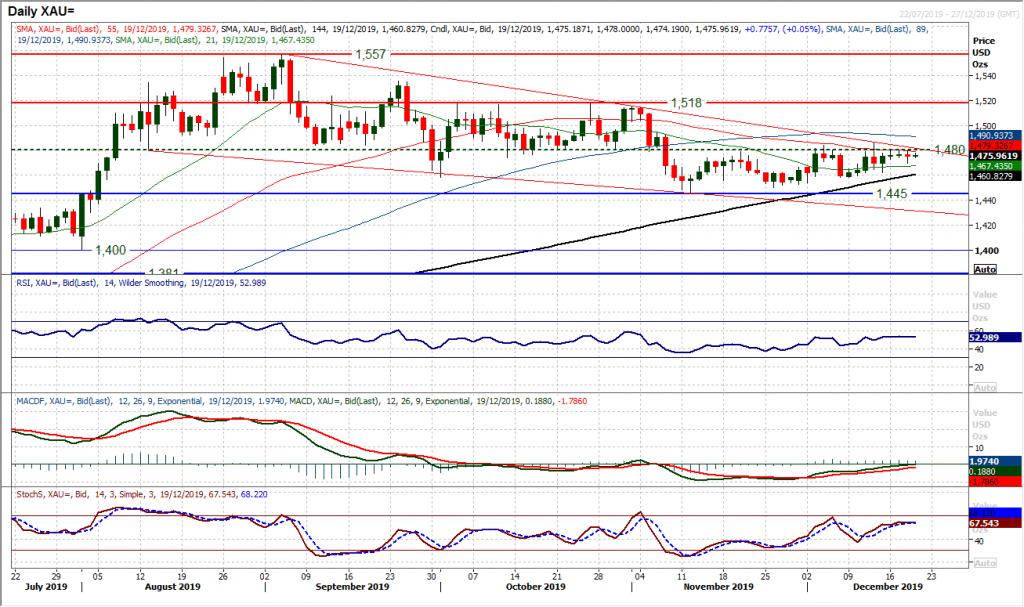

Gold continues to struggle with the overhead supply around $1480 restricting upside. This remains a crucial crossroads with the added resistance of the upper bound of the downtrend channel (today coming at $1482). In recent sessions we have seen momentum indicators drifting higher into an area where the previous rallies of the past four months have failed, so this seems to be a key inflection point. This week has seen a run of candle almost entirely lacking conviction and direction has been lost. This is another very important crossroads which will define the next near to medium term direction. Given the consideration the market is lending to this resistance around $1480, any closing breakout would be a key shift in sentiment. A close above $1487 would be a six week high and suggest bull traction. The hourly chart shows initial support at $1470 but a move back under a pivot at $1465 would signal another bull failure.

Author

Richard Perry

Independent Analyst