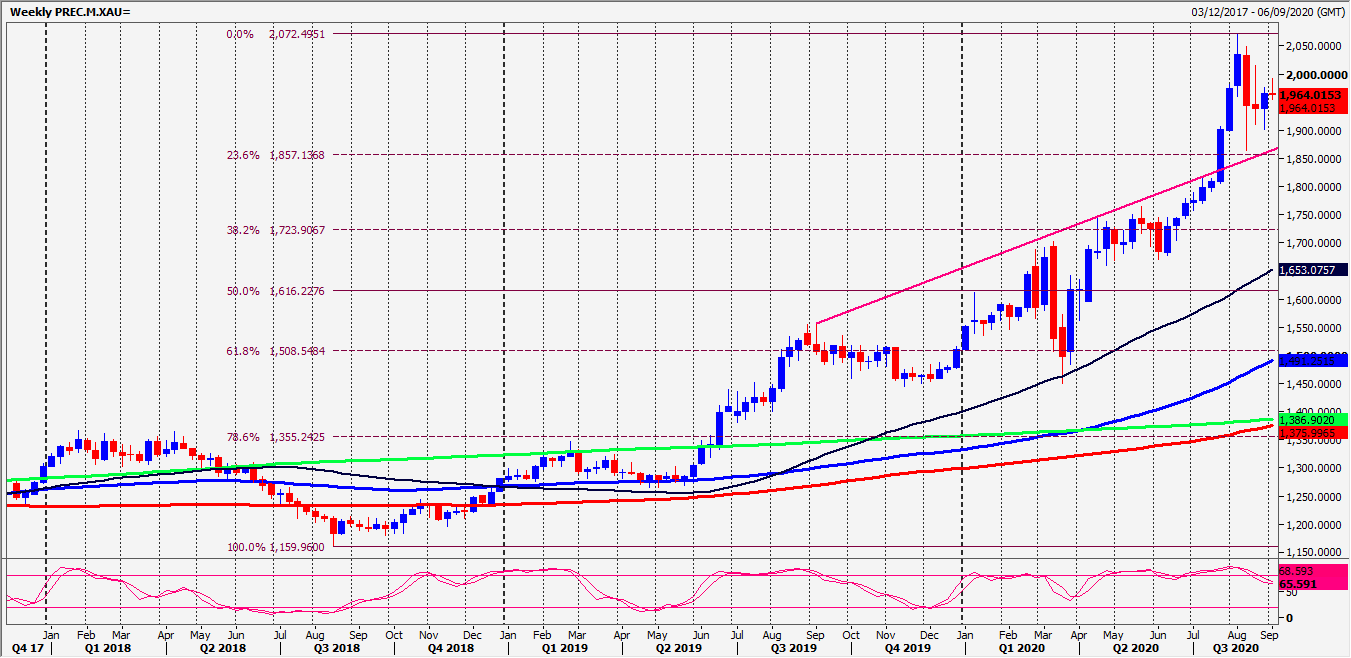

Gold: A break above 1961 is a short term buy signal

Gold – Silver

Gold Spot broke below 1942 for a short term sell signal targeting 1937, 1931 & our buying opportunity at 1924/22. This trade worked perfectly as we bottomed exactly here & shot higher to 1941.

Silver Spot longs at 2725/15 worked perfectly as we shot higher to the target of 2760/70 & topped exactly here. However we reversed & broke 2725/15 for our sell signal targeting 2650/40 & bottomed exactly here.

Daily Analysis

Gold meets first resistance at 1947 for some profit taking on any remaining longs. Sell at 1950/55 with stops above 1961. A break higher is a short term buy signal targeting 1970/72 & perhaps as far as strong resistance at 1983/86. Shorts need stops above 1991.

1 month trend line support is much weaker today, at 1929/26. Longs are more risky but stop below 1921 if you try. A break lower targets 1917/15, 1910/09 & perhaps as far as 1904/02.

Silver holding 2650/40 allows a recovery to to 2715 then a selling opportunity at 2725/35 with stops above 2745. A break higher targets 2770/75, perhaps as far as 2800/2810.

Be ready to sell a break below 2635 targeting 2615 & 2610/05. Be ready to sell a break below 2600 targeting 2573/70.

Author

Jason Sen

DayTradeIdeas.co.uk