Global trends signal a calm day ahead for Asia

U.S. stocks staged a modest comeback Monday, clawing back some of last week’s steep losses. The S&P 500 gained 0.4%, snapping a two-day losing streak, while the Nasdaq Composite added 0.6%. However, the Dow Jones Industrial Average bucked the trend with a slight dip of 0.1%, as cautious optimism permeated the markets.

This modest recovery was fueled by easing Treasury yields and a renewed focus on earnings. All eyes turned to Nvidia’s much-anticipated report, a potential make-or-break moment for the market’s AI-fueled optimism.

Overall, the rebound reflects growing confidence in U.S. markets, as Trump’s economic playbook—centred on domestic stimulus—offers an initial boost to earnings growth through solid economic channels. Meanwhile, the looming spectre of punitive trade tariffs keeps investors wary of international markets, making U.S. equities appear more attractive by comparison.

The broader market sentiment remains cautious, with futures showing resilience even as reasonable fears of a looming global trade war cast a shadow over bolder directional moves.

All eyes are laser-focused on Nvidia as the tech titan gears up for its blockbuster earnings report on Wednesday. With its towering presence in both market cap and artificial intelligence, Nvidia has become the ultimate market heavyweight. Boasting an astonishing 7% weight in the index and nearly 800% stock gains over the past year, its results are set to either crown AI as the undisputed king or trigger a dramatic rethinking of the sector’s sky-high valuations.

According to projections, the $3.5 trillion juggernaut is expected to post net income of $18.4 billion, fueled by an 80% revenue surge to $33 billion. Nvidia’s results will likely steer broader tech market sentiment, underscoring its pivotal role as a bellwether for tech and AI-related stocks.

Treasury markets offered some respite, with 10-year yields holding steady well below 4.5%. Rate traders showed holiday some holdiy spirit , as futures pricing suggests a 62% probability of a Federal Reserve rate cut in December. The market has now baked in 75 basis points of easing through the end of next year, offering a slight tailwind for sentiment.

Recent Fed commentary softened fears of a pause in monetary easing, which was bullish for stocks but less promising for the dollar. Austan Goolsbee highlighted that rates could be significantly lower within the next 12–18 months if inflation keeps trending down.

The confluence of earnings optimism, AI sector resilience, and potential Fed easing provides a tentative foundation for recovery. Still, with geopolitical uncertainties and tariff risks lingering, markets remain on edge, awaiting clarity on the direction of Trump's trade and economic policies.

Wide goal post

As if the markets weren’t confusing enough, we’re entering that time of year when Wall Street banks flood client inboxes with their infamous year-ahead forecasts. If someone bothered to tally up a Brier score on these, they’d quickly discover just how notoriously inaccurate they tend to be.

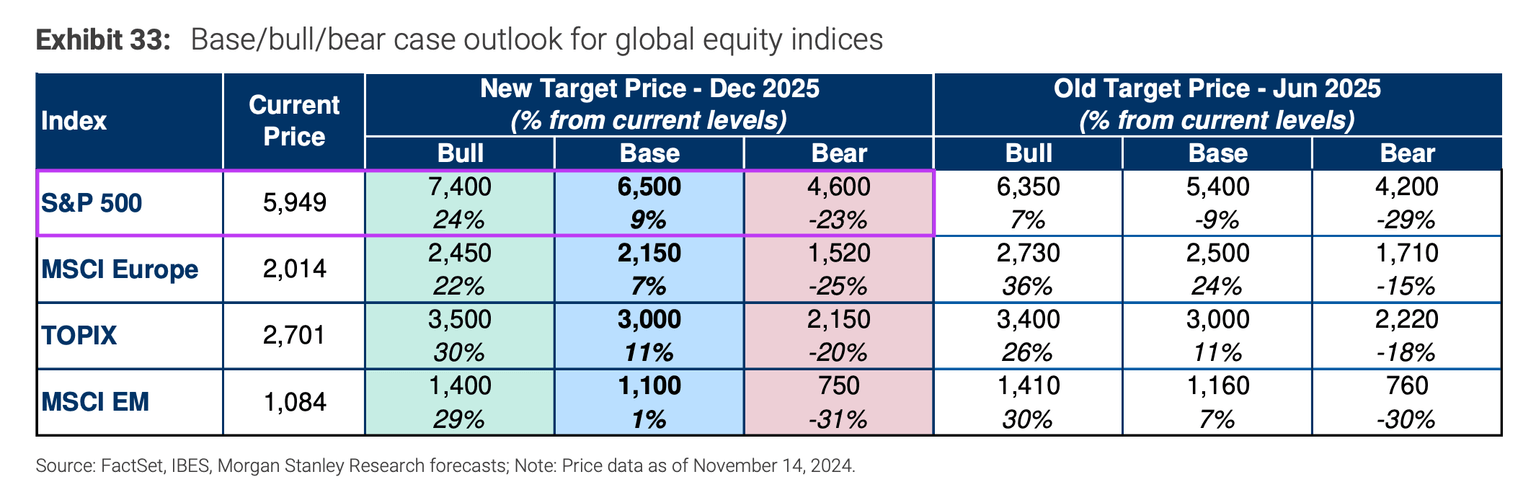

Case in point: Morgan Stanley’s Mike Wilson—once a proud bearer of bearish sentiment—has flipped his script. His year-end 2025 bull case for the S&P 500 now stands at an eyebrow-raising 7,400, projecting a potential 26% surge. But don’t put all your chips on the table just yet. Wilson’s hedged bets include a worst-case scenario where the index sinks to 4,600—a steep 22% drop.

So, where does that leave us? Somewhere between boundless optimism and cautious despair, which is precisely why these forecasts should always be taken with a hefty salt. After all, the market rarely plays by anyone’s neatly written script.

Asia markets

Investors are cautiously navigating the week, regaining their footing after last week's market turbulence. With a noticeable void in high-profile economic data from both East and West, global cues are taking center stage, all while the spectre of looming tariffs hums ominously in the background.

Following last week’s stomach-churning sell-off, this week begins with a rare sense of calm—volatility subsided, bond yields eased, and the dollar softened, opening the door to a modest yet much-needed recovery in Asia risk assets.

Commodities

Crude oil roared to life, surging nearly 3%, as geopolitical tensions reignited. The U.S. greenlighted Ukraine’s use of long-range missiles against Russia, energizing an already volatile energy market. Brent crude led the charge as traders recalibrated for heightened risk in the region, while a slightly softer U.S. dollar added momentum to the rally.

Gold, meanwhile, caught its own spark, riding the wave of geopolitical anxiety and a weakening greenback. The precious metal’s safe-haven allure is glowing brighter with the spectre of an intensified trade war on the horizon.

Gold, as always, thrives on uncertainty, shining brighter as the world grows darker.

But for gold bulls, the real question looms large: when the U.S. dollar inevitably strikes back on the heels of higher yields, will gold defy its textbook inverse relationship with real yields and the dollar again? Or will this delicate dance unravel, testing gold's resilience once again?

As December rate cut probabilities linger, NFP ranks high on the Fed reaction function list.The interplay between a strong dollar and gold’s shine will define the coming weeks. The yellow metal has managed to keep its glow, but the real test lies ahead.

Goldman likes Gold

Goldman Sachs has struck a golden chord in its 2025 commodity outlook, boldly projecting gold to shine at $3,000 per ounce by year-end. Their call isn’t just a stab in the dark—it’s a “high-conviction” view anchored by structural support from relentless central bank buying and cyclical tailwinds from Federal Reserve rate cuts.

Goldman analysts Daan Struyven and Samantha Dart highlight that the swirling vortex of U.S. policy uncertainty under President-Elect Donald Trump—especially his trade and fiscal shake-ups—makes gold an essential portfolio hedge. Trade wars with ruinous global economic implications? Check. A Fed easing cycle to stave off any economic fallout? Double check. And let’s not forget that recent market consolidations have carved out what Goldman calls an “attractive entry point”( last week’s low) for savvy gold bulls. Triple Check

With Trump’s unpredictable policy playbook keeping markets on edge, gold might be the insurance every portfolio needs. Goldman’s bullish call isn’t just a forecast—it’s a dare to investors: bet on gold or risk missing out on the metal’s moment to shine.

Forex markets

The recent EUR/USD moves defy logic, particularly with Eastern European tensions flaring up. The U.S. administration’s green light for Ukraine to deploy American missiles against Russian targets has amplified geopolitical risks—a scenario that often puts downward pressure on the euro.

Adding fuel to the fire, oil prices have jumped $2.00, further tilting the scales against the euro. Yet, the market narrative seems stubbornly resilient to these headwinds, but heavy short euro positions are always precarious setups.

Why so in this case?

Markets are barely pricing in 15 basis points of Fed rate cuts, leaving plenty of room for a dovish repricing that could weaken the dollar. Still, let's be real: the Fed isn’t likely to sit on its hands with President-elect Trump preparing to take office. Rate cuts ahead of the inauguration seem almost inevitable. Still, the real rate action likely won’t kick in until after the jobs data drops in two weeks—a veritable eternity in FX trading. NFP will give either the doves or hawks all the ammunition they need.

The long-dollar "Trump trade" remains the go-to strategy for medium-term FX plays, with traders likely stepping in as buyers on any dips. However, with euro shorts heavily loaded, the possibility of a squeeze looms in the background, adding an air of unpredictability to the market.

For those planning a re-entry, keeping an eye on EUR/USD climbing into the 1.0650–1.0700 range could offer the ideal mix of strategy and opportunity. It’s a delicate balance that could pay off—fingers crossed.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.