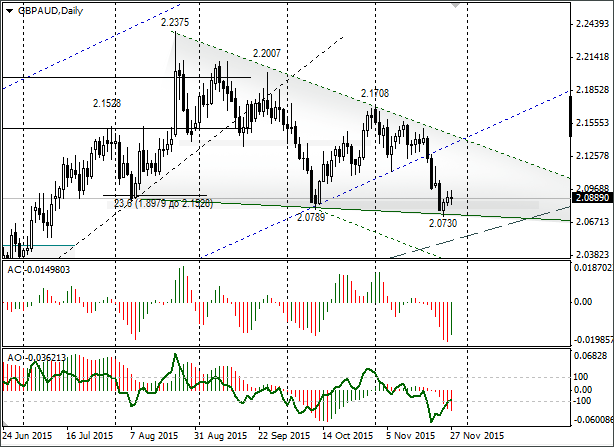

Trading opportunities for currency pair: a strong support from which the GBP/AUD managed to return to 2.0889 has formed. I’ll take a risk in saying that there’ll be growth to 2.13. Any growth above 2.1046 should tell you to hold off selling. A break through 2.0730 will see the rate drop to the trend line at 2.0525.

Background:

The last GBP/AUD idea I made came out on 14th September. The rate at that time was 2.1750. In September I looked at two scenarios. The first was a rebound (sticking basically with the trend) and the second was for if a break in the trend was to take place. In actual fact, the GBP/AUD broke the trend line and after a recoil the pound reached the calculated 2.0913 level (23.6% 1.8979 – 2.1528).

As things are at the moment:

Since August a support (2.0730-2.0873) has been forming. The support is strong. If we make a line along the minimums, we can see a formation that comes together. We now need to set out what we expect from the pair in December.

All trader attention is now on the ECB and FOMC meetings, along with the NFP that is on the horizon. For this cross it’s more important how the pound and the Aussie act against the USD. At the moment, we can look at setting buy stops below 2.0730 as well as pound sales if there’s a break in the support.

The potential for a strengthening of the pound is significantly higher than the potential for a weakening of the currency. If we see a bounce of the price from the support, we can set our eyes on 2.13 and if we see this break then we’ll be looking to 2.0525. I reckon that a fall in the pound will hold the main trend line from the 1.7212 (8th September, 2014) minimum – 1.8979 (6th May, 2015).

Last week saw representatives of the Bank of England, in addition to UK stats, disappoint the buyers. However, whilst the support isn’t broken, we better work with a rebound. A growth above 2.1046 should make you more than think twice about selling.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.