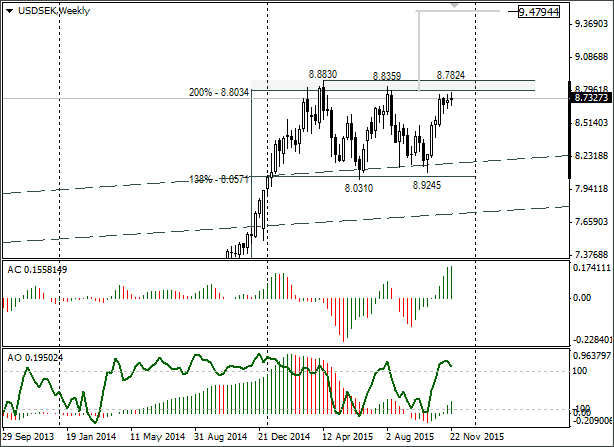

Trading opportunities for currency pair: a W-shape pattern is just about formed. If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. It has until April 2016 to reach the target. The interim target is at 9.3259 (March 2009 maximum). Growth will cancel if the weekly candle closes below 8.4933. Following a rebound from 8.83, I will be waiting for a return to 8.18 along the same W-shaped pattern.

Background:

The last USD/SEK idea I made came out on 26th October. The rate at that time stood at 8.4945. I was waiting for the dollar to strengthen to 8.8359 along the W-shaped pattern. The target still hasn’t been reached. In actual fact, the USD/SEK lifted to 8.7824.

As things are at the moment:

So what should we do if it reaches 8.8359? Market participants are expecting the US Fed to put up their rates. On the 4th December a US labour market report will be out. After the trading session closes on Friday, ready yourself for a break in the 8.88 resistance or the formation of an inverted candle combination (bounce from the resistance).

If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. The interim target in this case will be 9.3259 (March 2009 maximum). If we see a rebound from 8.83, I’ll be expecting a return of the rate to 8.18 along the same W-shaped pattern.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.