German IFO Survey Preview: EUR to reach fresh highs

- German IFO Business Climate seen recovering further in June.

- The upbeat market mood could suffer a setback if it numbers surprise to the downside.

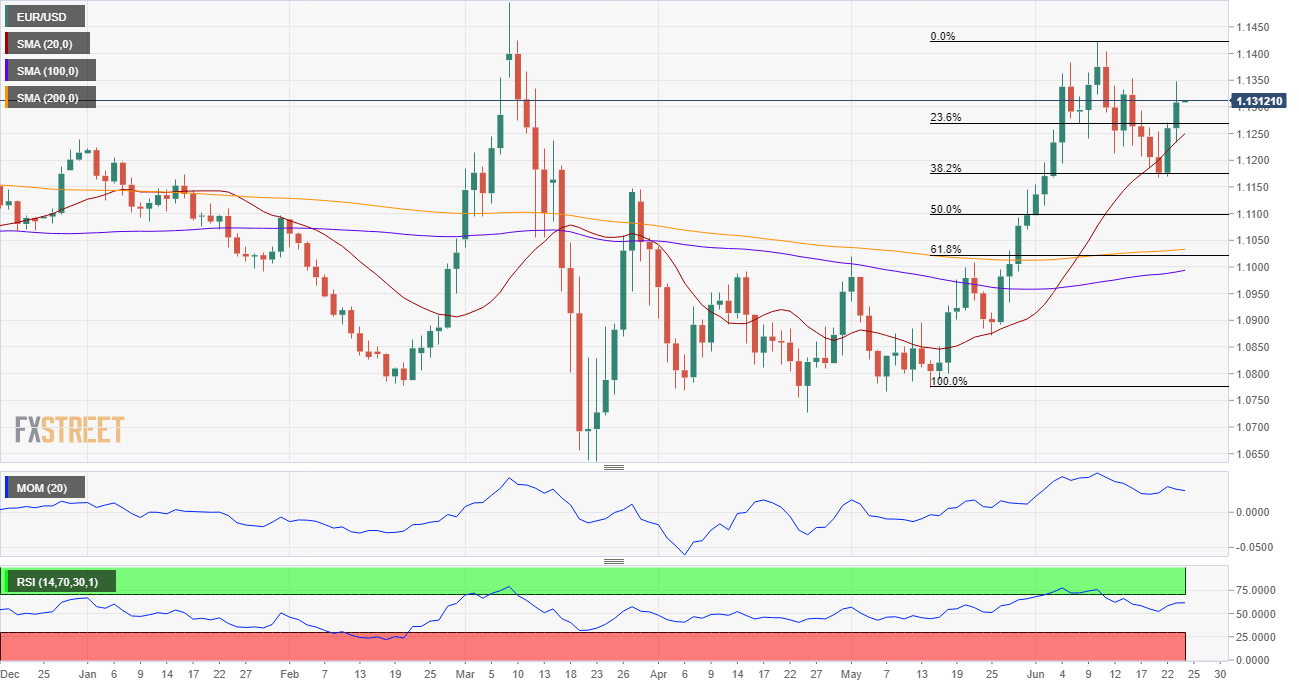

- EUR/USD poised to test the monthly high and extend rally to 1.1460.

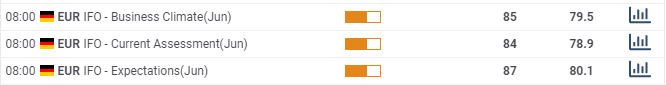

Germany will release its IFO Survey on Business Climate for June this Wednesday, and optimism is seen recovering further, from 79.5 in May to 85. The assessment of the current situation is also seen improving, from 78.9 to 84, while Expectations are expected at 87 from 80.1.

Germany economic comeback in 2022

Economic activity in the country has been improving nicely from March catastrophic slump due to the coronavirus pandemic. “June’s flash PMI data pointed to further signs of a turnaround in the German economy following a record downturn,” according to the latest Markit report. The Composite Output index bounced sharply to 45.8 from 32.3 in May.

Nevertheless, the country’s GDP is expected to drop by 6.5% this year and according to the German Council of Economic Experts, and that in the case the coronavirus crisis does not worsen. Most indicators related with industrial activity have plummeted to record lows, as well as export indexes. The same experts believe that the country won’t recover to pre-pandemic levels at least until 2022.

Yet at the end of the day, hopes overshadow reality. Speculative interest welcomes better-than-expected numbers, despite figures indicate that contraction extended into June. Expectations are that the economic recovery will start in the second half of the year.

EUR/USD levels to watch

With the ongoing upbeat mood, a report better-than-anticipated can push the pair towards its monthly high at 1.1422. Beyond this level, there’s a long-term static resistance in the 1.1460/70 price zone. The immediate support is 1.1270, although a more relevant one is 1.1170, the 38.2% retracement of the latest daily advance.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.