German Elections Preview: Three EUR/USD scenarios for the post-Merkel dawn

- Germans go to the polls, and a centrist "traffic-light" government would trigger choppy trading.

- A victory for Merkel's successor and a consequent "Jamaica coalition," would boost the euro.

- Having the hard-left Die Linke party in government would hit the euro hard.

Who will succeed Angela Merkel at the helm of Europe's largest economy? The long-serving beacon of stability is stepping down as Germany's Chancellor after 16 years, and her big shoes leave a hole in the old continent's leadership. Traders are see set to brush aside the long-term implications and will respond to the initial results. Statements from party leaders will make the difference for EUR/USD.

Merkel's successor at the CDU/CSU bloc is Armin Laschet, the centrist yet gaffe-prone head of North Rhine-Westphalia. Laschet is trailing in the polls against SPD leader Olaf Scholz, who also offers continuity as finance minister. Critics of Scholz said he is mimicking Merkel's hand gestures.

With two all-too-similar potential chancellors, does the poll matter for markets? The answer is a definite Yes, as investors have preferences of who will lead Germany – and which parties will serve in government.

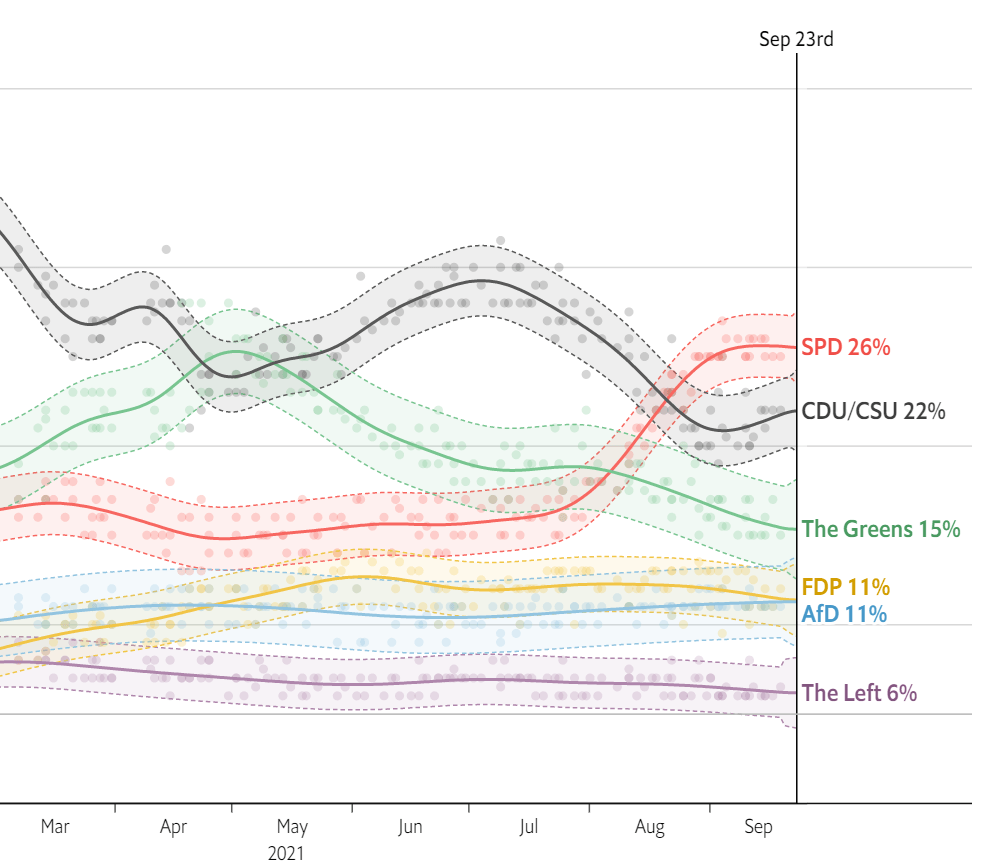

As the chart below shows, no party is set to gain a majority and various coalitions are possible. That is why the post-results speeches are no less important than the outcome.

Source: The Economist

Here are three scenarios:

1) Traffic light coalition

An alliance between the center-left SPD (red), the liberal FDP (yellow) and the Greens is the most probable scenario. The trio is set to easily have a majority. While a coalition between socialists and environmentalist parties would have disappointed investors in the past, these parties have moderated in recent years. It is also the most probable scenario.

As mentioned earlier, Olaf Scholz currently serves as finance minister in a center-right-led government and he overcame more left-leaning rivals in his party. His pro-European stance soothes markets.

The Greens have long pivoted to the center, abandoning their more radical roots and opting for "realpolitik." Greens and Conservatives cooperate in regional governments. While leader Annalena Bärbock is likely disappointed by losing the lead in the polls, she likely prefers a coalition with Scholz than staying out of power.

FDP leader Christian Lindner is also a pragmatist and also interested in influencing from within. He learned the hard way – after opting out of a government under Merkel, his business-friendly output moderated as well.

As this is the most probable scenario, it is mostly priced into the euro. However, Scholz's victory speech consists of reaching out the Greens and FDP, the common currency could trade choppily. Why?

Uncertainty about who would become finance minister could cause jitters. Investors would see Lindner as the No.1 economic persona in Europe rather than anyone else.

2) Jamaica coalition

The CDU/CSU center-right bloc – which has led Germany in all but 20 of the postwar years – may still come on top. Efforts by Merkel and a "coming home" effect by voters have already narrowed some of the gap with the SPD. If Laschet leads the biggest party, he would aim to form a coalition.

His preferred partners would be the same two partners courted by Scholz in the "traffic light coalition– the FDP and the Greens, but lead by the CDU/CSU (black) These are the colors of Jamaica's flag.

Such a bloc would be more favorable to markets, especially as the finance minister would likely come from the CDU/CSU or the FDP, both business-friendly. While the Greens would demand environmental concessions, the gap between the parties can be bridged.

Jamaica would likely make investors warm and fuzzy, boosting the euro. This trio of parties is somewhat less likely to muster a majority in parliament than the previous option, but still has a decent chance. The probability of a Jamaica coalition is medium.

A Jamaica coalition would have even greater chances of becoming reality if Die Linke stays out of parliament. The hard-left party hovers over the 5% minimum threshold to enter the Bundestag but could dip below that level. In case Die Linke stays out, the common currency could get another boost – also as the SPD's Scholz would have less bargaining power to form a traffic-light coalition.

3) Left-leaning coalition

Neither the Greens nor the SPD ruled out a coalition with Die Linke, only pointing to that party's desire to leave NATO as an issue. If Scholz's preferred alliance with the FDP fails to materialize, his left-leaning wing – and also that of the Greens – could push toward talks with the ex-communists. Current polling shows this trio could also muster a majority.

Investors fear that such a coalition would raise taxes, add red tape and have an unclear European policy after years of integration.

In this scenario, which has low chances, the euro would tumble. However, it is essential to note that coalition talks are a lengthy process in Germany, and as it is not the mainstream parties' first choice, an election-night market reaction is unlikely.

Other scenarios

The obvious other scenario is a repeat of the current grand coalition which consists of the CDU/CSU and the SDP. That would undoubtedly represent continuity, but the two ruling parties would prefer to lead rather than be led. A coalition of these two with the FDP – aka "Germany coalition" – is a more realistic option in terms of securing a majority, but the same lack of appetite applies to such a move.

Other scenarios are of a CDU/CSU-Greens alliance, or an SPD/Greens one. The first is more market friendly than the other, but both have low chances of securing enough seats in parliament.

What about the extreme right? Alternative für Deutschland (AfD), is set to gain around 11% of seats in parliament but no support from any other party. The party, which can be charitably described as populist, has also been dogged by infighting and could lose seat. In any case, there is no chance it would participate in government.

Conclusion

Europe's largest country is set for a change at the top with short and long-term consequences for the euro. On election night, investors would cheer higher chances of the center-right staying power, react choppily to the most likely center-left coalition, and fear a left-leaning pact, which seems less likely.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.