The GBPUSD pair rallied after the relatively strong UK jobs numbers. The data revealed that the number of job vacancies rose to more than 1 million for the first time on record. This happened as the country’s unemployment rate declined to 4.6% in the three months to July. This was relatively lower than the previous 4.7%. More people moved to the workforce as more opportunities came up and economic inactivity fell. This increase was mostly led by young people, who were hit hard during the pandemic. The pair will next react to the latest UK inflation numbers scheduled for Wednesday. Meanwhile, the FTSE 100 declined after the weak trading statement by Ocado and the strong results by JD Sports.

The US dollar index held steady after the latest American consumer inflation data. The numbers showed that the country’s consumer price index (CPI) dropped from 5.4% in July to 5.3% in August. On a month-on-month, the CPI declined from 0.5% to 0.3%. Meanwhile, the core consumer price index dropped from 4.3% to 4.0% in August. These numbers are still above the Federal Reserve’s target of 2.0%. Therefore, with the unemployment rate in the country falling, there is a likelihood that the Fed will maintain a cautious but hawkish stance in its coming meetings. The currency will next react to the upcoming US retail sales data.

The price of crude oil held steady after the latest report by the International Energy Agency (IEA). The report by the France-based organization said that oil demand had declined in the past three consecutive months because of the Covid cases in Asia. Still, the organization expects that demand will rise by about 5.2 million barrels per day this year and by 3.2 million barrels in the coming year. The report came a day after OPEC said that demand will rise to more than 100.8 million barrels per day in 2022. This increase will be higher than where it was before the Covid-19 pandemic.

UK100

The FTSE 100 index declined to £7,015 after the strong UK jobs numbers. This decline was likely because investors are now pricing in a more hawkish Bank of England. On the four-hour chart, the index is slightly below the 25-day moving average. It has also formed a bearish flag pattern while the MACD remains below the neutral level. Therefore, the index will likely break out lower, with the next key support level being at £6,990.

EUR/USD

The EURUSD pair was little changed after the latest American inflation data. The pair is trading at 1.1808, which was slightly below the intraday high of 1.1820. On the hourly chart, the pair is along the 25-day moving average. It is also below the 38.2% Fibonacci retracement level. It has also formed a small inverted head and shoulders pattern, which is usually a bullish sign. The pair will likely break out lower in the next few days.

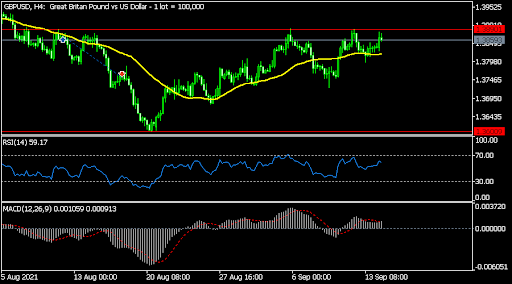

GBP/USD

The GBPUSD pair tilted upwards after the relatively strong UK jobs numbers. The pair is slightly below the key resistance level at 1.3890, where it has struggled moving above in the past few days. It is also slightly above the 25-day moving average while the MACD is slightly above the neutral level. Like the EUR/USD pair, it will likely break out higher, with the next key resistance being at 1.3950.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD holds the uptick above 0.6450 after mixed Chinese data

AUD/USD is holding higher ground above 0.6450 in Friday's Asian trading, shrugging off mixed Chinese activity data for October. Traders are looking to cash in after the recent downfall even though the US Dollar stay firm and market mood remains cautious. US data is next in focus.

USD/JPY reverses Japan's GDP-led spike to 156.75

USD/JPY pares gains to near 156.50 in Asian session on Friday, revesing the early spike to 156.75 fuelled by unimpressive Japanese Q3 GDP data. The pair is facing headwinds from Japanese verbal intervention and a tepid risk tone, despite the sustained US Dollar strength.

Gold price struggles to gain ground on bullish US Dollar, US PPI data looms

Gold price struggles to gain ground around $2,570 on Friday after bouncing off a two-month low in the previous session. The precious metal remains under selling pressure amid the strong US Dollar and the rising uncertainty surrounding the Federal Reserve's pace of interest rate reductions.

Bitcoin Price Forecast: BTC eyes $100K, what are the key factors to watch out for?

Bitcoin trades below $90K in the early Asian session on Friday as investors realized nearly $8 billion in profits in the past two days. Despite the profit-taking, Bitwise CIO Matt Hougan suggested that BTC could be ready for the $100K level, fueled by increased stablecoin supply and potential government investment.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.