GBP/USD rises, EUR/USD retreats after diverging central bank decisions

The GBPUSD price jumped sharply after the latest Bank of England (BOE) interest rate decision. As was widely expected, the bank decided to implement another 25 basis point rate hike. This made it the first time since 2004 that the bank has implemented back-to-back rate hikes. The bank attributed this hike to the strengthening of the economy and the fact that inflation has jumped to the highest level in 30 years. Analysts now expect that the bank will implement more rate hikes this year. Some even believe that the bank will hike interest rates by 1.5% in September. Another key policy by the BOE was to end its bond-buying program.

American equities slumped in the premarket session as investors reflected on the weak quarterly results by Meta Platforms. In its results, the company said that its revenue rose at a slower pace than expected. It also attributed the performance to the growing popularity of TikTok and the supply shortages that affected most small businesses. The company also complained about the recent iPhone upgrade that gave more users more power about privacy. Meanwhile, Spotify share price slumped by 20% in the premarket session after it reported weak quarterly results. The company has been under pressure because of Joe Rogan’s podcast.

The EURUSD pair declined after the latest interest rate by the European Central Bank. The bank decided to leave interest rates unchanged as was widely expected. The bank also decided to continue with its asset purchase program. It intends to buy 40 billion euros of assets per month in the second quarter of this year. On interest rates, the ECB committed to leave rates at the current level until it sees its inflation at 2%. This decision was different from what the Fed and the BOE did this month.

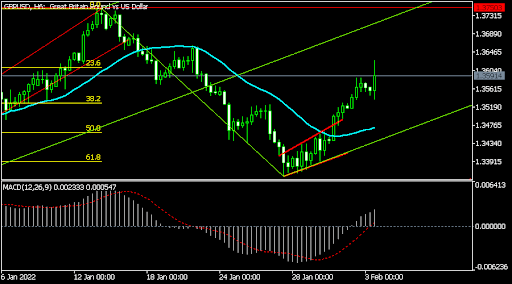

GBP/USD

The GBPUSD pair rose to a high of 1.3627 after the latest decision by the Bank of England. This was the highest price that the pair has been since January 20. It managed to move above the 25-day moving average and the first support of the Andrews Pitchfork tool. It is also approaching the 23.6% Fibonacci retracement level. Therefore, there is a likelihood that the pair will continue its bullish trend during the American session.

NAS100

The Nasdaq 100 futures declined sharply after the latest earnings by Facebook and Spotify. The index slipped to a low of $14,822, which was the lowest level since last week. It is slightly below the middle line of the Bollinger Bands while the Relative Strength Index has been retreating. It is also along the 50% retracement level. Therefore, the index will likely continue falling today.

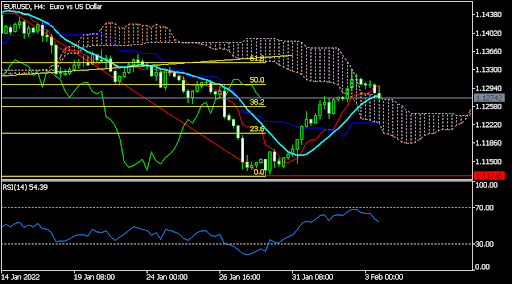

EUR/USD

The EURUSD pair declined after the latest ECB decision. It is trading at 1.1275, which is slightly below its highest level this week. The pair has moved into the Ichimoku cloud on the four-hour chart. It has also moved below the 50% Fibonacci retracement level. Still, there is a likelihood that it will bounce back during Christine Lagard’s press conference.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.