GBPUSD Forecast: Sellers look to take action as Pound Sterling tests key support

- GBPUSD has turned south and declined below 1.1500.

- Near-term outlook suggests that buyers are moving to the sidelines.

- Investors keep a close eye on the US Midterm Elections.

GBPUSD has reversed its direction and retreated below 1.1500 early Wednesday after having managed to close in positive territory on Tuesday. Following the latest pullback, the pair's near-term technical outlook suggests that buyers are struggling to retain control of the action. In case safe-haven flows start to dominate the financial markets, GBPUSD could extend its slide in the second half of the day.

The upbeat market mood didn't allow the safe-haven US Dollar (USD) to outperform its rivals in the American session on Tuesday and helped GBPUSD erase its daily losses. The US stock index futures are down 0.2% during the European trading hours, pointing to a cautious sentiment.

Investors seem to be staying on the sidelines while awaiting the outcome of the US Midterm Elections. Republicans remain on track to gain the majority in the House but the contest for the Senate majority looks to be tighter than initially estimated. According to the Associated Press, Democrats and Republicans have 46 and 47 Senate seats, respectively, with 5 seats remaining out of the 35 called up for election.

If Wall Street's main indexes fail to build on Tuesday's gains and stage a deep correction with Democrats gaining the majority in the Senate, the US Dollar could continue to strengthen and force GBPUSD to stretch lower.

On the other hand, GBPUSD needs one more risk rally to regain its traction. Ahead of Thursday's Consumer Price Index (CPI) data, however, market participants could look to stay away from risk-sensitive assets.

GBPUSD Technical Analysis

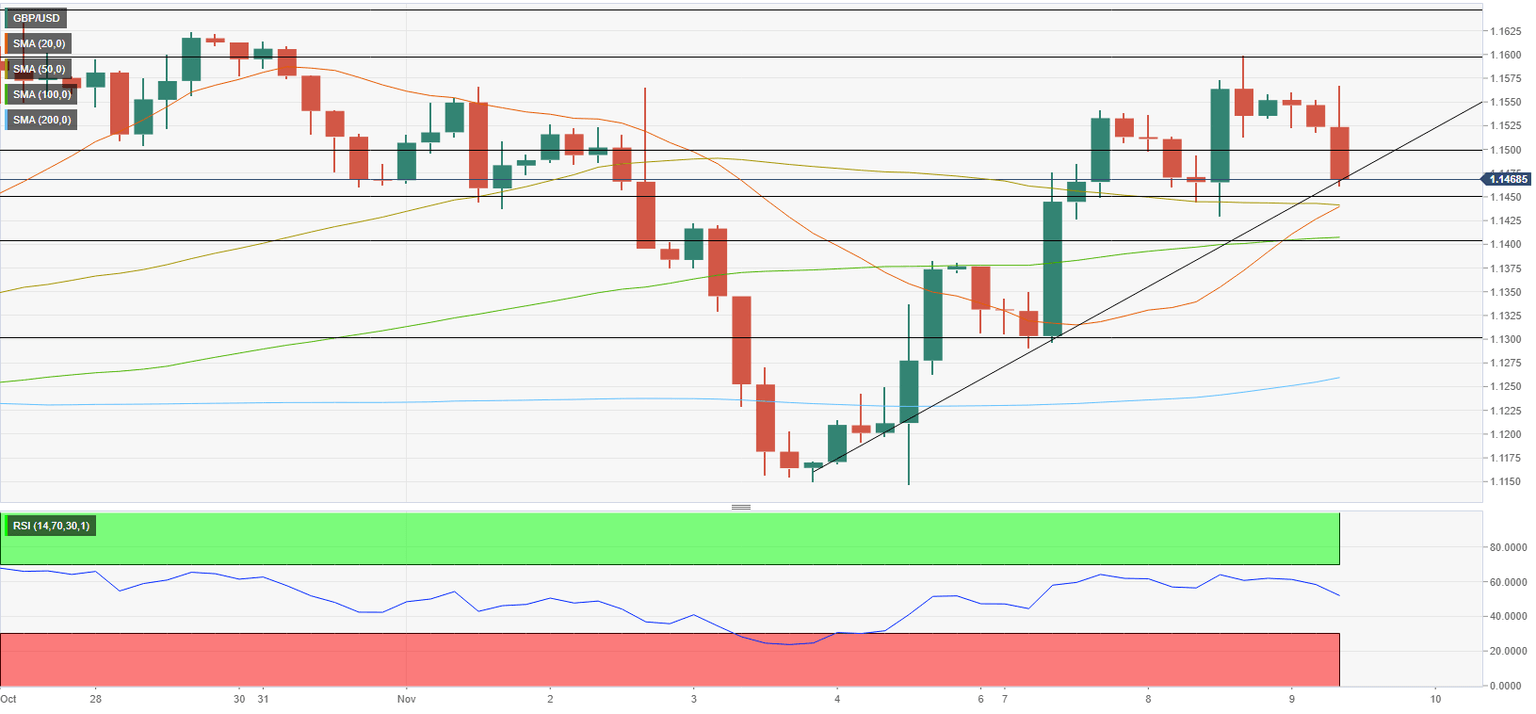

GBPUSD was last seen testing the ascending trend line coming from October 3 at 1.1470. With a four-hour close below that level, the pair could face the next support at 1.1450 (50-period Simple Moving Average (SMA)) before testing 1.1400 (psychological level, 100-period SMA).

On the upside, 1.1500 (static level, psychological level) aligns as first resistance before 1.1550 (static level) and 1.1600 (psychological level, static level).

Meanwhile, the Relative Strength Index (RSI) indicator closes in on 50, confirming the view that buyers are losing interest.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.