GBP/USD finds resistance at 23.6% Fibonacci in descending channel [Video]

![GBP/USD finds resistance at 23.6% Fibonacci in descending channel [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/brisiith-currency-14493013_XtraLarge.jpg)

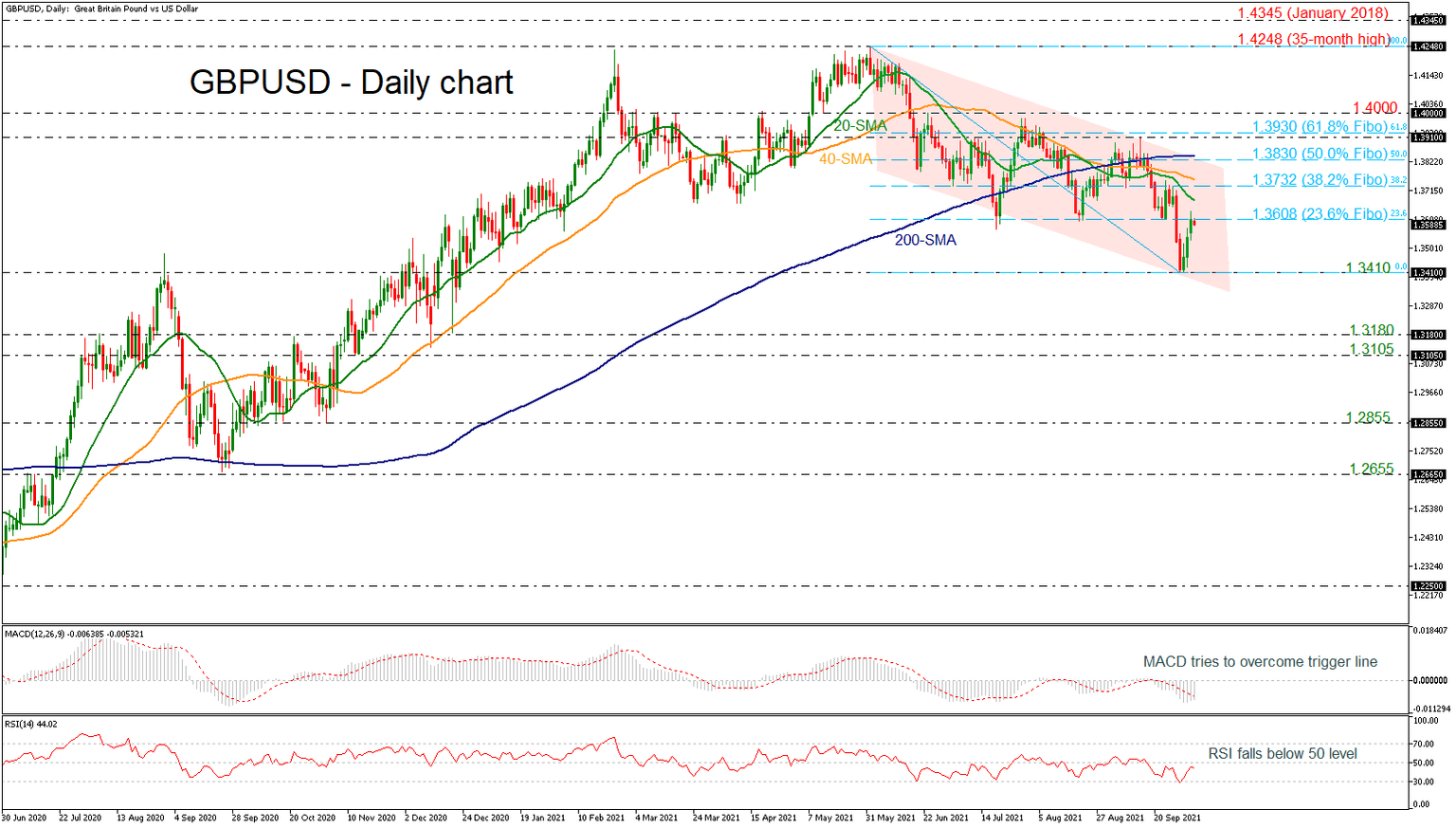

GBPUSD has been developing in a downward sloping channel since the beginning of June, with the price recently posting another rebound at the bottom of this structure at 1.3410.

The cable is currently testing the 23.6% Fibonacci retracement level of the down leg from 1.4248 to 1.3410 at 1.3608.

In technical indicators, the MACD oscillator is trying to overcome its trigger line in the negative territory. However, the RSI indicator is pointing down below its neutral threshold of 50, while the short-term simple moving averages (SMAs) are heading south for the moment.

If the pair fails to surpass the 1.3600 handle, the market could move lower again to meet the 1.3410 barrier, taken from the latest lows. Steeper decreases could open the way towards the 1.3105-1.3180 support area.

Alternatively, a jump above the immediate resistance of 1.3608 could see the market testing the 20-day SMA at 1.3678 and the 38.2% Fibonacci of 1.3732. Stretching higher, the bulls may head towards the 50.0% Fibonacci of 1.3830, which overlaps with the 200-day SMA.

To sum up, GBPUSD is in a bearish trend in the medium-term picture and only an advance above the 200-day SMA may change this outlook to neutral again.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.