GBP/USD approaches key support after weak UK Retail Sales data

The British pound declined sharply after the relatively weak UK retail sales numbers. The data showed that the overall retail sales declined by 2.5% in July after rising by 0.2% in the previous month. At the same time, the sales rose by 2.4% on a year-on-year basis. Meanwhile, core retail sales declined by 2.4% after rising by 0.3% in June. These numbers came a few days after the UK published the relatively weak consumer inflation numbers. Therefore, there are signs that the country’s recovery is slowing down after recording a stellar performance in the first half of the year. Meanwhile, the country’s public finances did better than expected as the net public sector borrowing rose to 10.4 billion pounds. This was half of where it was in June.

Global stocks declined after China continued its crackdown on the technology sector. In Europe, the DAX, FTSE 100, and CAC 40 indices declined by more than 0.25%. Similarly, in the United States, Dow Jones and S&P 500 futures declined by more than 150 and 20 points respectively. In China, the country’s decision-making agency passed a strict privacy law that targets the technology sector. Part of the draft said that companies that harvest customer data without consent will be charged $7.7 million or 5% of annual revenue for serious violations. Some of the top Chinese shares to watch during the American session will be Alibaba, DiDi, and Tencent.

Cryptocurrency prices bounced back on Friday after being calm throughout the week. The price of Bitcoin rose to more than $47,000 while Ethereum and Cardano jumped to $3,200 and $2.50 respectively. In total, the market capitalization of all cryptocurrencies rose to more than $2 trillion. At the same time, the volume of cryptocurrencies traded has also risen. In the past 24 hours, Binance processed cryptocurrencies worth more than $27 billion while Coinbase and Huobi processed crypto worth more than $9 billion.

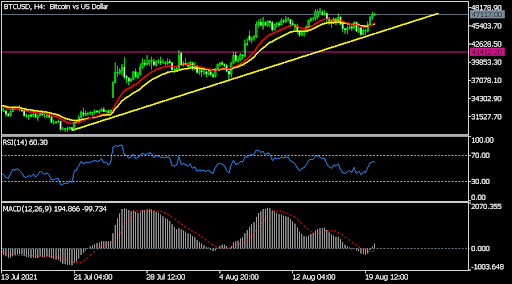

BTC/USD

The BTCUSD pair rose to 47,117, which was slightly below this week’s high of more than 48,000. On the four-hour chart, the pair remains above the 25-day and 15-day moving averages. The Relative Strength Index (RSI) has risen to 60 while the MACD has moved above the neutral level. The price is above the upper side of the ascending trendline. Therefore, a bullish breakout will be confirmed if the price manages to move above this week’s high of 48,092.

EUR/USD

The EURUSD pair declined to a low of 1.1678, which was the lowest level since November last year. Along the way, the pair declined below the March low at 1.1700. It also dropped below the 38.2% Fibonacci retracement level and the 25-day and 50-day moving averages. The Relative Strength Index (RSI) has also moved close to the oversold level. The path of least resistance for the pair is lower, with the next key reference level being at the 50% retracement at 1.1420.

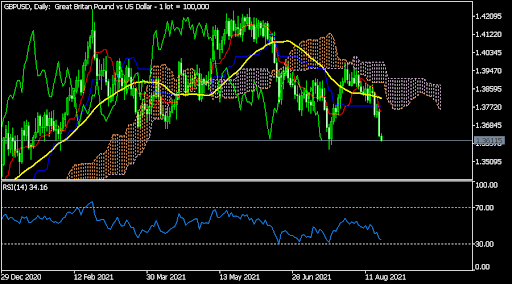

GBP/USD

The GBPUSD price declined to 1.3610, which was the lowest level since July 21. On the daily chart, the pair has moved below the 25-day and 50-day moving averages. It has also declined below the Ichimoku cloud while the Relative Strength Index (RSI) has declined to 35. A bearish breakout will be confirmed if the price drops below 1.3560, which was the lowest level in July.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.