GBP/JPY at seven-year high, bulls look tired [Video]

![GBP/JPY at seven-year high, bulls look tired [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/GBPJPY/iStock-688526532_XtraLarge.jpg)

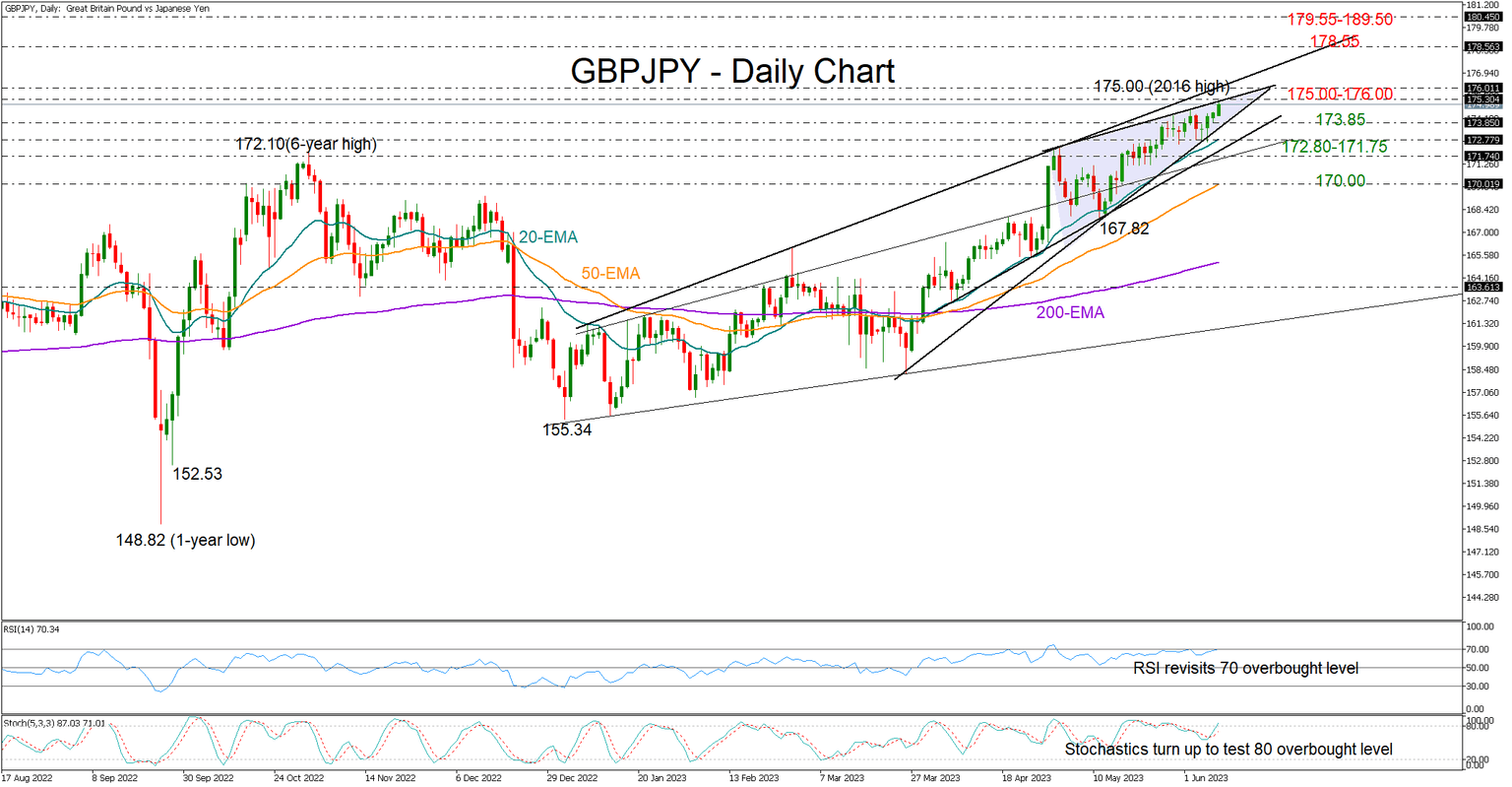

GBPJPY picked up steam to extend its uptrend towards the 2016 high of 175.00 and further above its exponential moving averages (EMAs) early on Friday.

The RSI and the stochastic oscillator are hinting at overbought conditions in all timeframes, warning that the bullish wave in the price is nearing a peak. The pair also seems to be trading within a rising wedge triangle, increasing the risk of a bearish correction.

Nevertheless, the clear positive trajectory in the price might keep buyers active in the short term, especially if the 175.00-176.00 wall, which includes the triangle’s upper band and the resistance trendline from January, collapses. If that proves to be the case, the rally could accelerate towards the 178.55 barrier or higher to the 179.55-180.50 constraining zone last active in 2015-2016.

Should the pair exit the rising wedge on the downside (173.85), it may initially seek support somewhere within the 172.80-171.75 area, where the 20-day EMA and a couple of trendlines are placed. Falling lower, the next pivot could occur near the 50-day EMA and the 170.00 psychological mark, a break of which could see a continuation towards the previous low of 167.82.

In brief, GBPJPY has a bullish outlook, although the momentum indicators warn of some caution. A sustainable bounce above the 175.00-176.00 territory is required to add fresh impetus to the price.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.