GBP/USD Weekly Outlook: Pound Sterling faces resistance ahead of BoE decision

- The Pound Sterling hit three-week highs above 1.2500 versus the US Dollar, then corrected.

- GBP/USD braces for the BoE rate call and US labor data for further trading impetus.

- A Bear Cross paused the Pound Sterling recovery. What’s next?

The Pound Sterling (GBP) recovery gathered steam against the US Dollar (USD), driving GBP/USD to three-week highs above 1.2500 before buyers turned to the sidelines.

Pound Sterling took a breather

Sentiment surrounding US President Donald Trump’s tariff plans and the US Federal Reserve’s (Fed) policy outlook remained the primary drivers for the GBP/USD pair in the past week.

GBP/USD set off the week on a firm footing, hitting the highest level in three weeks at 1.2523 after witnessing good two-way businesses. On Sunday, President Trump slapped a 25% tariff on all Colombian imports, which would be escalated to 50% in a week after the South American country refused to take back deported migrants. Colombia’s President Gustavo Petro threatened his own 50% tariff hours later.

However, the White House said on Monday that “Colombia has agreed to all of President Trump’s terms, including unrestricted acceptance of all illegal aliens from Colombia returned from the United States (US),” easing trade concerns and sending risk in a sweeter spot. The positive shift in risk sentiment allowed the pair to continue the uptrend above 1.2500.

The tide quickly changed in favor of Pound Sterling sellers as the US Dollar jumped back into the game on broad risk aversion.

Late Monday, US Treasury Secretary Scott Bessent called for new universal tariffs on US imports, starting at 2.5% and rising gradually, per the Financial Times (FT). Meanwhile, President Trump noted that he plans to impose tariffs on imports of computer chips, pharmaceuticals, steel, aluminum, and copper. He added that he “wants tariffs “much bigger” than 2.5%” as Treasury Secretary Bessent proposed.

Moreover, the global market sell-off induced by China’s low-cost artificial intelligence (AI) model - DeepSeek-led smashed current AI leader Nvidia by roughly 18% on Tuesday, accentuating the market’s gloom. Traders expected the US Federal Reserve (Fed) to offer some respite on Wednesday.

However, as perceived by markets, the Fed’s hawkish hold rate decision provided extra legs to the US Dollar recovery and sent the major back toward the 1.2400 neighborhood. The Fed held the benchmark policy rate in the 4.25%-4.50% target range but removed the earlier statement saying that inflation "has made progress" towards its 2% inflation goal while noting only the pace of price increases "remains elevated."

In his post-policy press conference, Fed Chairman Jerome Powell said the Fed wants to see further progress on inflation and could see a pathway for that, adding, “we don't need to be in a hurry to make any adjustments.”

The hawkish hold outcome boosted the expectations of divergent policy outlooks between the Bank of England (BoE) and the Fed, acting as a headwind for the Pound Sterling and the GBP/USD pair.

In the latter half of the week, disappointing US economic growth numbers offered temporary relief to the pair, only to be hurt again by Trump’s reiteration of his tariff threats on Canada, Mexico, China and BRICS (Brazil, Russia, India, China, and South Africa) nations.

US Gross Domestic Product (GDP) rose at an annualized pace of 2.3% in the fourth quarter, the Commerce Department said on Thursday, falling short of the 2.6% increase expected after reporting a growth of 3.1% in the third quarter.

Late Thursday, the 47th US President noted that his administration is set to impose a flat 25% import tax on February 1 "because of fentanyl" on all goods crossing the border into the US from Canada or Mexico while adding that “we're in the process of doing a China tariff.”

On Friday, Trump repeated his warning that he would impose 100% tariffs on BRICS nations if they try to replace the USD with a new currency in international trade. The USD found fresh haven demand at the expense of the Pound Sterling following this development. Later in the day, the data published by the US Bureau of Economic Analysis showed that the core Personal Consumption Expenditures (PCE) Price Index rose 2.8% on a yearly basis in December, matching the market expectation and November's increase. In turn, the USD held it ground and didn't allow GBP/USD to stage a rebound heading into the weekend.

All eyes are on the BoE rate call and Nonfarm Payrolls

With the Fed out of the way, the focus now shifts toward the BoE policy announcements in a US employment data-dominated week.

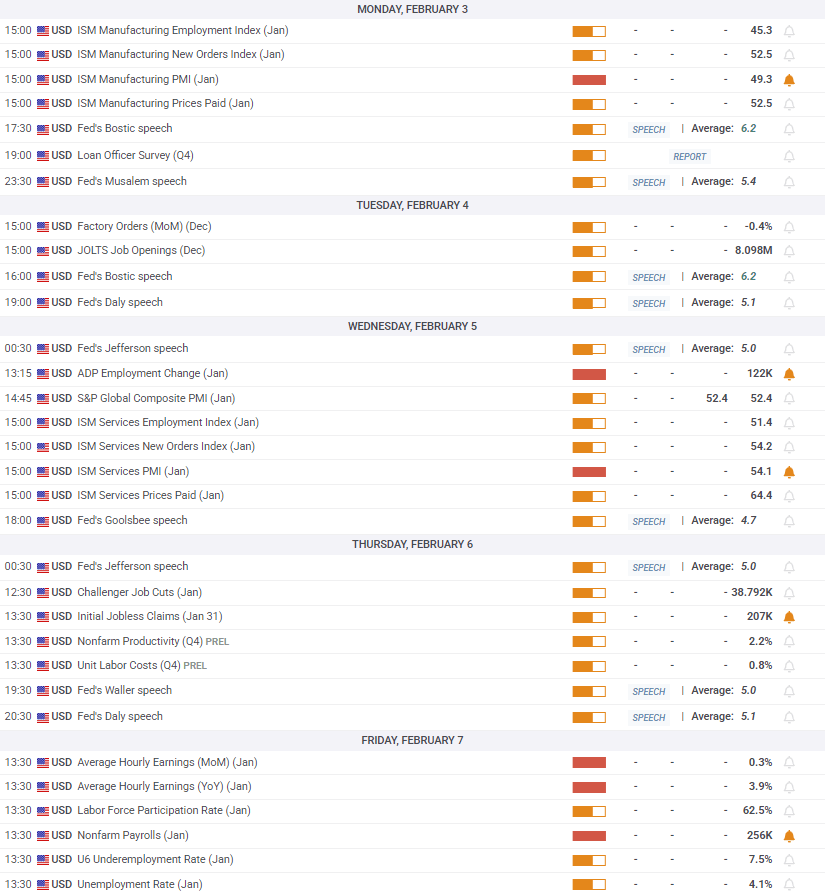

Monday will feature the final S&P Global Manufacturing PMI data from the US and the UK. However, the ISM Manufacturing PMI will likely stand out at the start of the week.

The US JOLTS Job Openings survey will fill an otherwise light docket on Tuesday, paving the way for a busy Wednesday. The final S&P Global Services PMI from both sides of the Atlantic will be released that day. The ADP Employment Change and the ISM Services PMI will be the main market movers on Wednesday.

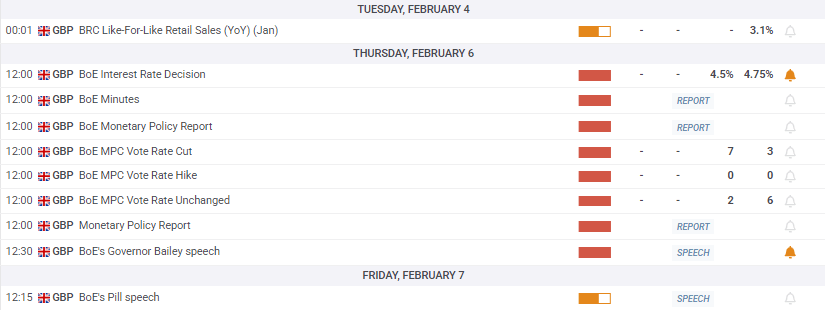

It’s a ‘Super Thursday’ as the BoE interest rate decision will accompany the quarterly economic forecasts, followed by Governor Andrew Bailey’s press conference. Later that day, the weekly US Jobless Claims will keep the American traders entertained.

The US Nonfarm Payrolls (NFP) report will hog the limelight on Friday. The preliminary University of Michigan (UoM) Consumer Sentiment and Inflation Expectations data will be also released on Friday.

Apart from the data releases, US President Donald Trump’s tariff plans and speeches from Fed policymakers will drive markets during the week. Fed policymakers have returned to the fore as the ‘blackout period’ ended last Friday.

GBP/USD: Technical Outlook

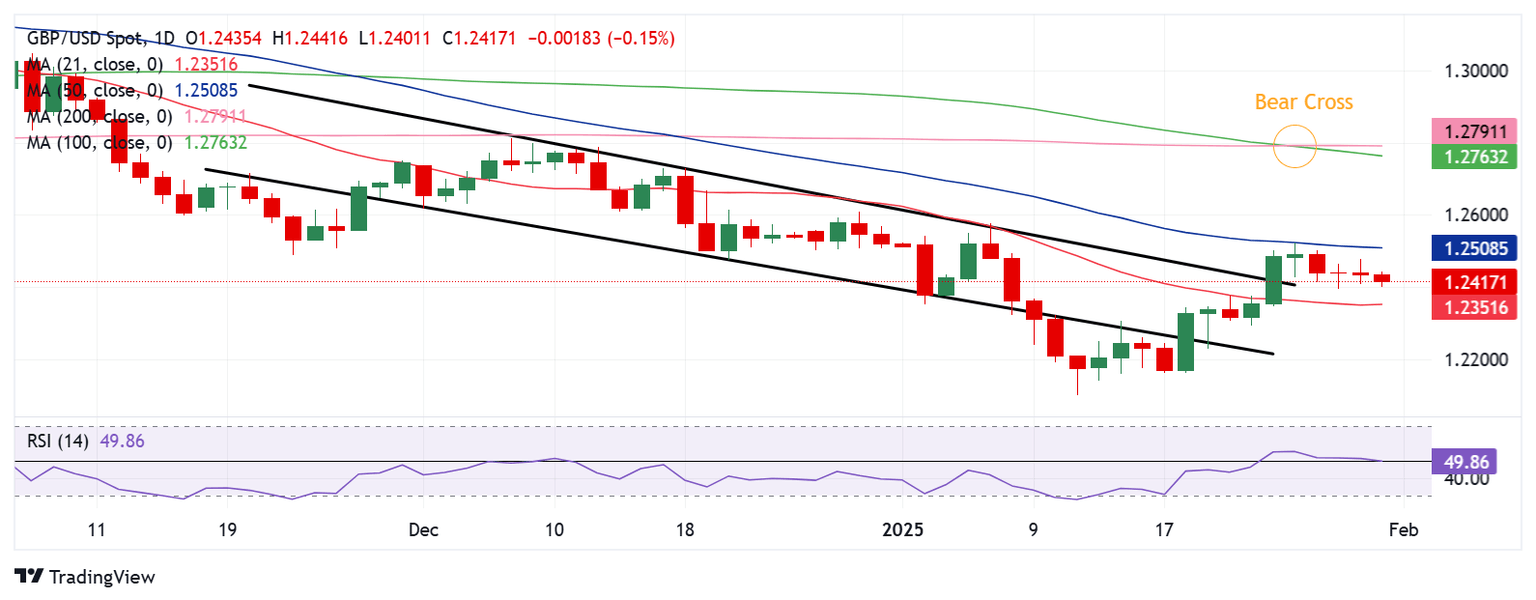

The daily chart shows that GBP/USD extended the break above the upper boundary of the six-week-long falling wedge formation at 1.2406.

However, the Pound Sterling recovery faced strong resistance at the 50-day Simple Moving Average (SMA), now at 1.2509.

Buyers must crack the abovementioned barrier on a daily candlestick closing basis to boost the bullish momentum toward the December 30 high of 1.2608.

The next relevant upside target is aligned at the 1.2650 psychological level, above which a fresh uptrend could initiate toward the 1.2770 area, where the 100-day SMA lurks.

The 14-day Relative Strength Index (RSI) has declined to test the midline, currently near 50.50, suggesting that buyers are facing exhaustion.

Adding credence to the downside bias, the pair confirmed a Bear Cross after the 100-day SMA closed below the 200-day SMA on Monday.

If the correction gains traction, the 21-day SMA at 1.2352 could offer immediate support. A sustained break below that level will trigger a fresh downtrend toward the January 20 low of 1.2160.

The last line of defense for buyers is at the 14-month low of 1.2100.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.