GBP/USD weekly outlook: Pound might continue its long-term uptrend

In this article, GBP/USD is analyzed using Harmonic Elliott Wave and H.E.R. Harmonic Elliott Wave modified traditional Elliott wave 5 wave moves into three-wave moves for each main wave of an impulsive structure, also, H.E.R uses Nodes and Cluster combined with Fibonacci ratios to find out most potential reversal zones for each wave.

Monthly outlook

If we look at the chart using one-month time frame, we will see a 3 move down was made from 1971, after the zigzag was completed, another three-wave started to cover half of the down-trend.

The question is, the 3 waves up were wave one or wave x, as long as we don't have access to the past data, we should consider two scenarios for the trend, by the way, my first scenario is: the three waves up are wave one of the primary cycle. so i consider the down-trend after that zigzag as wave two of the primary cycle and i guess the correction is completed.

Time cycles

Time cycle shows, the trend might be bullish until 2023 up to 2025.

Weekly outlook

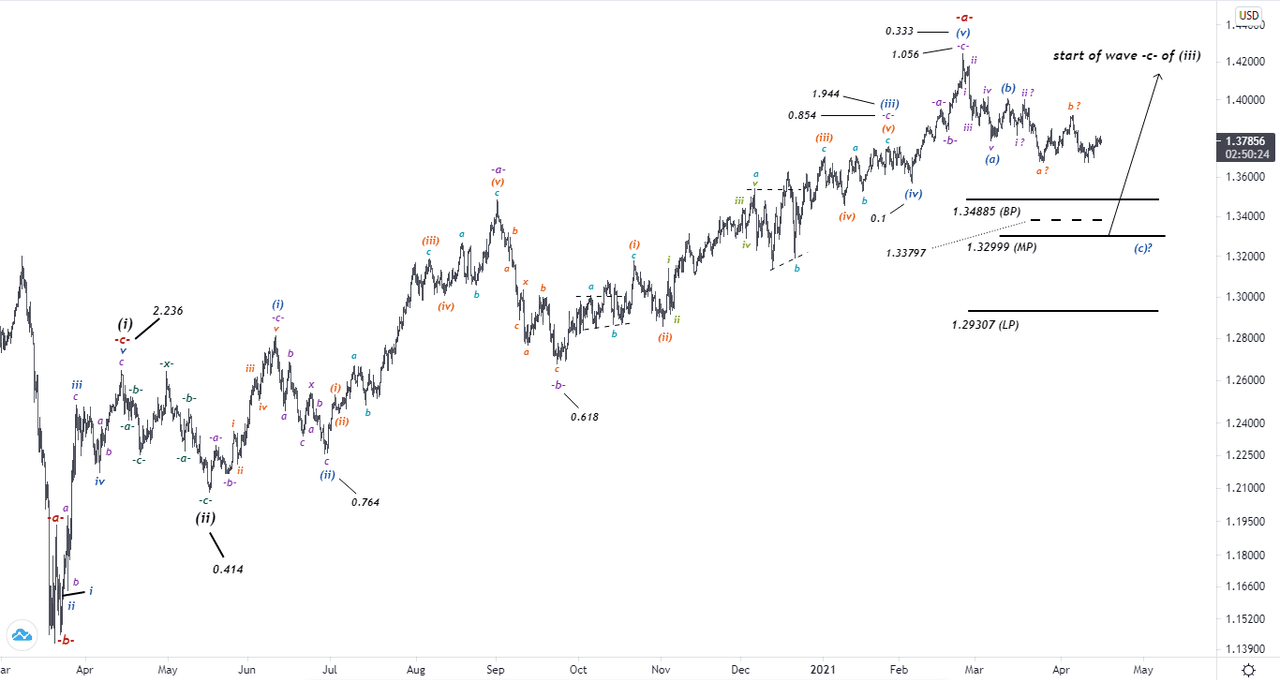

Here is the current uptrend in 4-hour chart. what i see is, GBP had wave one of wave A (primary cycle) and wave two is somehow shallow. after that we see wave a of wave three is completed. wave b of wave 3 can be so deep and might take a lot of time to be completed, also, that can be normal and correct around 30 percent of wave A.

What i expect is, more downtrend in the short-term and then i think it will rise to complete the wave 3 of primary wave A.

• 1.34885 (BP): it's base point reversal zone and wave C of wave B might move down to the point.

• 1.32999 (MP): its most potential reversal zone.

• 1.29307 (LP): it's the last point and i suppose, if price breaks 1.32999, then price can move down to the point.

Author

Elizabeth Nersesian

HarmonicEquilibriumRouting

Elizabeth Nersesian is a Russian/Iranian technical analyst and trader which started her early experience in 2014 in Forex Market.