- GBP/USD has rocked and rolled in response to the BOE and Nonfarm Payrolls.

- UK GDP, US inflation and covid headlines are set to shake cable in the upcoming week.

- Early August´s daily chart is painting a mixed picture.

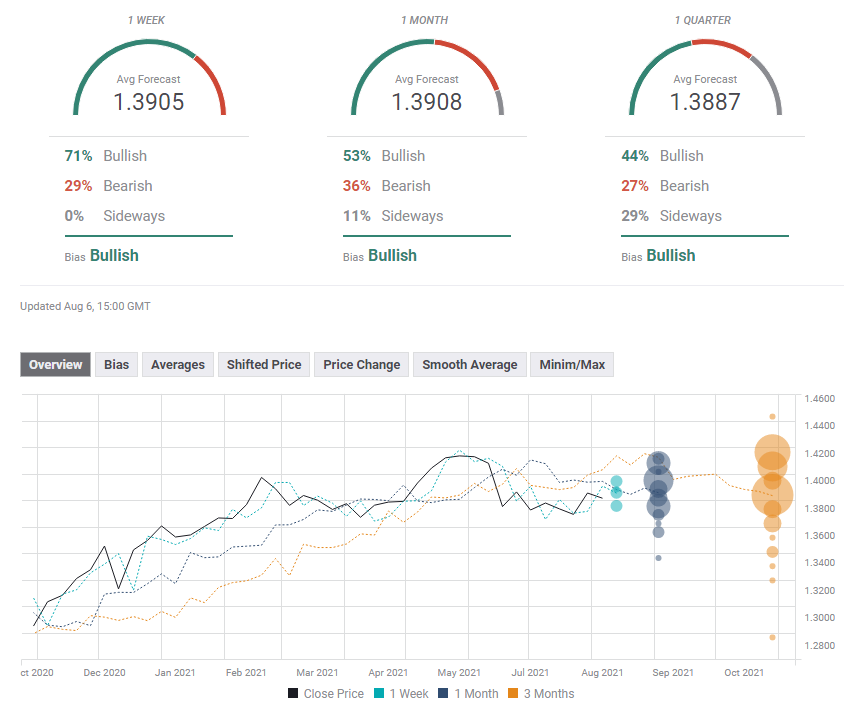

- The FX Poll is showing a bullish trend on all timeframes.

Resisting gravity and set to skyrocket? GBP/USD has weathered hawkish tunes from the Fed, strong US jobs and BOE caution. Can it move higher now? The next moves hinge on critical US inflation figures, Britain's covid advantage and UK growth data.

This week in GBP/USD: BOE remains cautious, Fed less so

Toeing the line: the Bank of England has left its policy unchanged, refraining from tapering and labeling inflation as transitory. Only one member, Michael Saunders, voted in favor of tapering down the BOE's bond-buying scheme. The absence of additional hawkishness and a suggestion that monetary policy would only be "modestly" tighter initially sent sterling lower. That did not last too long.

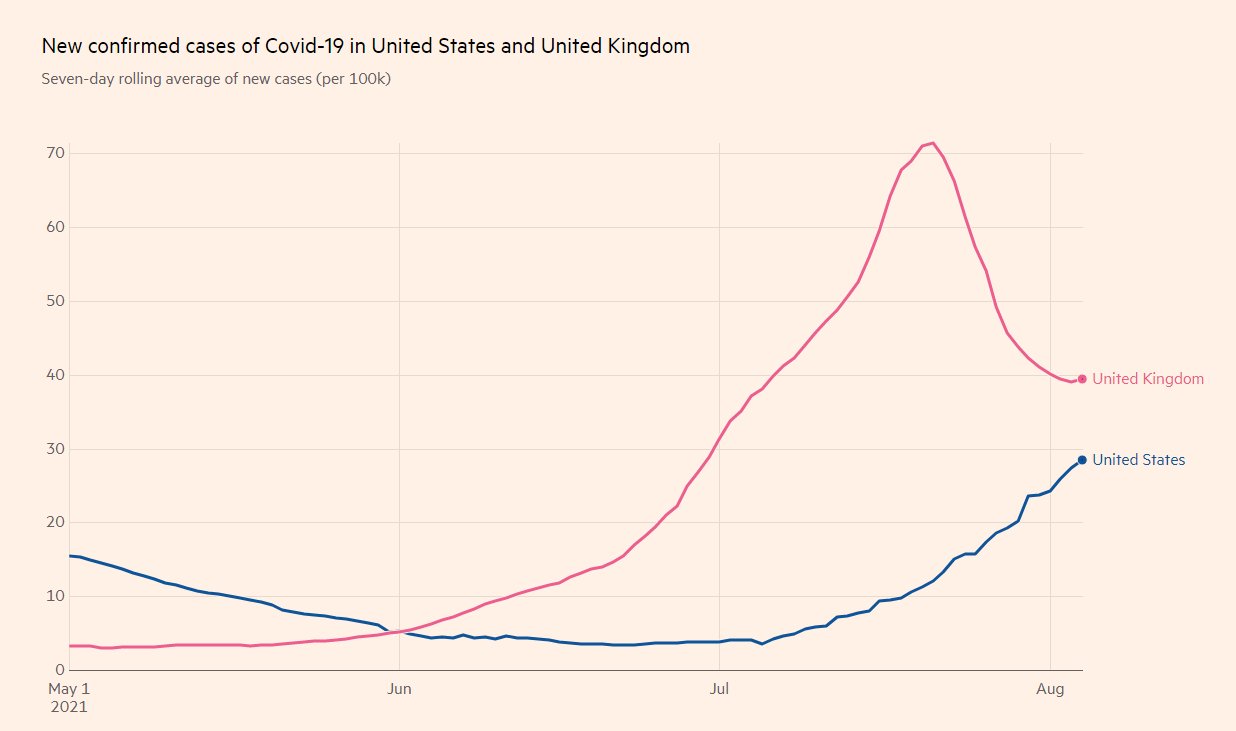

The pound benefited from an upgrade to Markit's Services Purchasing Managers' Index for July and enjoys an advantage over the US when confronting the Delta COVID-19 variant. Cases in Britain maintain their downward trajectory while they are relentlessly rising in America. Moreover, the UK population is vaccinated at higher rates than those in the US.

COVID-19 infections in the US and UK are also off their lows

Source: FT

GBP/USD's strength is especially telling given the hawkish twist from several Federal Reserve officials, who are taking bigger steps toward tapering. Fed Vice-Chair Richard Clarida said an announcement about reducing purchases could come this year. San Francisco Fed President Mary Daly opened the door to cutting buys – not only talking – already in 2021.

The dollar reacted positively to news that the Fed would bring down its $120 billion/month scheme, but GBP/USD dropped only when US Nonfarm Payrolls came out – and only in a limited manner.

The world's largest economy gained no fewer than 943,000 positions in July. Moreover, it came on top of upward revisions worth 119,000 and alongside a robust increase of wages by 0.4% MoM. On a yearly basis, earnings are up 4%, pointing to inflationary pressures that may catch the Fed's eye. The dollar soared to higher ground across the board – yet once again, GBP/USD held up better than its peers.

In Washington, lawmakers made progress in advancing the bipartisan infrastructure spending bill, but more hurdles remain. While President Joe Biden got Republicans and moderate Democrats on board for one bill, he needs to make progress on a larger one to enable progressive House Dems to support it.

Overall, the pound showed its strength in a week that could have sent it lower.

UK events: Covid follow-up and GDP in focus

Has "Freedom Day" been a flop? The grand UK reopening on July 19 has found Brits either "pinged" – required to self-isolate – or hesitate to return to normal life. That may have been somewhat disappointing to growth prospects but has contributed to the fall in covid cases. However, that drop may have stalled.

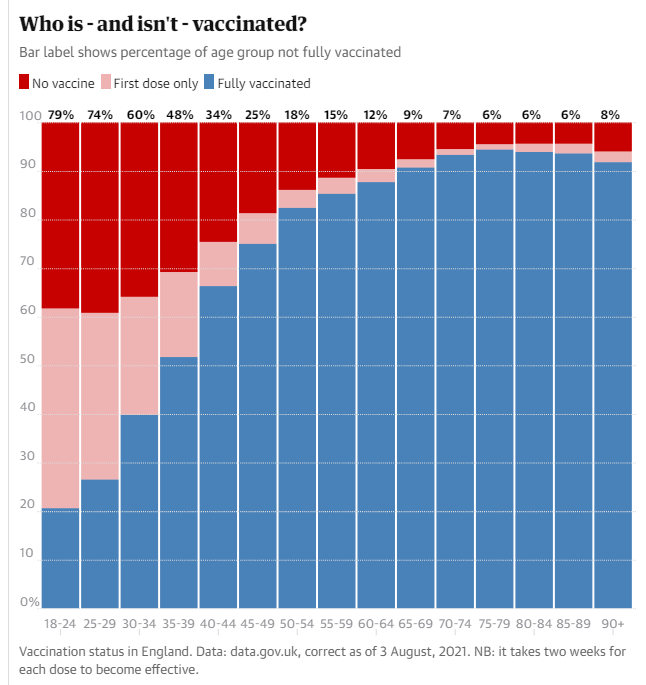

Apart from following the infection numbers, investors will want to see more Brits receiving their second jabs. While over 70% of the population is fully vaccinated, second doses have been administered to only 58%. A single shot is less effective against the highly transmissible Delta variant.

Investors will want to see more blue and less pink and red in this chart:

Source: The Guardian

The main event on the economic calendar is the first release of second-quarter Gross Domestic Product figures. After a squeeze of 1.6% in the first three months of 2021 – due to a nationwide lockdown – a sharp rebound of some 5% is on the cards, according to the Bank of England.

Brexit is benefiting from the summer lull, and Brits' ability to travel for a holiday in France – after the most recent changes – also helps ease cross-Channel tensions. No Brexit news is good news for sterling.

Monthly GDP data for May somewhat disappointed with an increase of only 0.8%, but an increase in consumption has likely supported the expansion in June. Industrial output statistics will also be of interest.

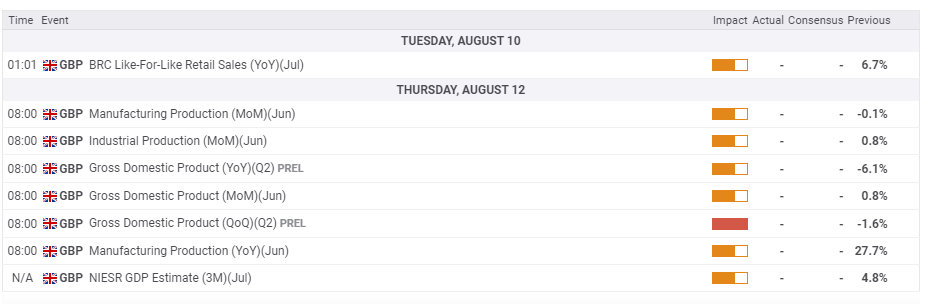

Here is the list of UK events from the FXStreet calendar:

US events: Inflation, Consumer Sentiment and Delta eyed

The Fed sees every covid wave as having diminishing damage on the US economy – but what if the Delta wave wreaks even more havoc? Daily cases are marching above 100,000 per day from a low of 15,000 in June. They are hurting mostly undervaccinated areas, which are more common in the US than in the UK and Europe.

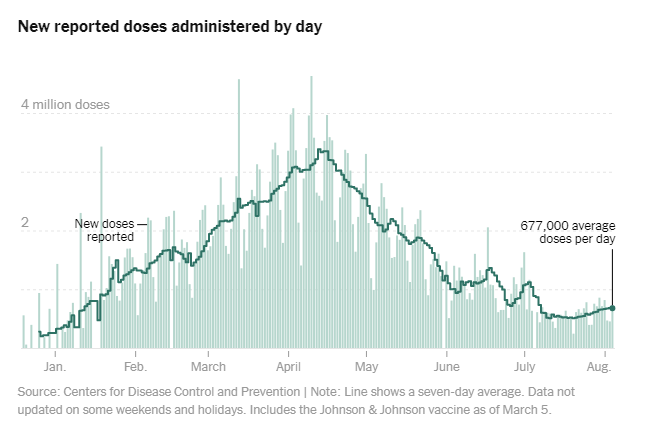

The amount of doses has risen from the lows of around 500,000 but remains well below the peak of some 3.3 million. A pickup in inoculations would help cheer investors.

Vaccine progress in the US:

Source: NYT

The advance of the $1 trillion bipartisan bill on Capitol Hill may become more important – especially if it brings along progress on the Democratic $3.5 trillion package, which is far more reaching. Contrary to Europe, American lawmakers are set to remain busy in August. Markets currently want to see it before they believe it.

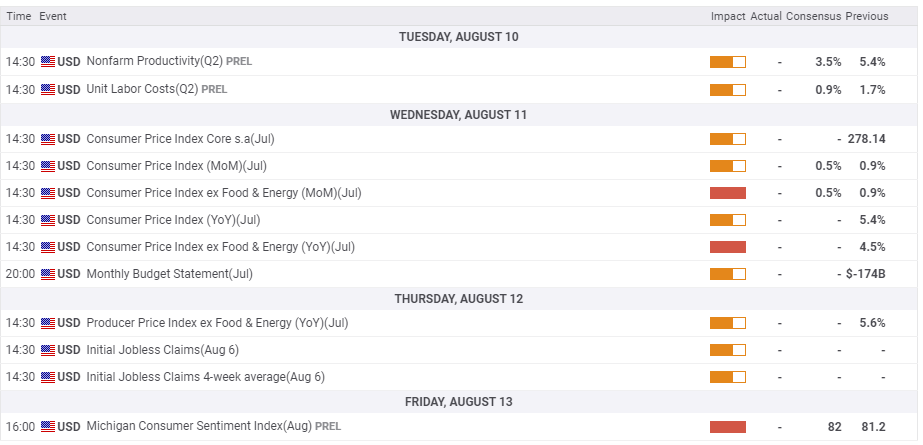

That contrasts with a forward-looking approach on other topics such as inflation. The Consumer Price Index (CPI) report for July stands out on the calendar, with economists unsure if inflation has already peaked or could still rise. Monthly increases are set to moderate from 0.9% to 0.5% on both the headline and the core.

If headline annual CPI falls from 5.4% to below 5%, it could send the dollar spiraling down. The same could happen if Core CPI slips from 4.5% to under 4%. In case inflation statistics remain at current levels, it would strengthen the case for tapering by the Fed, triggering a rush to the greenback.

Thursday's Producer Price Index (PPI) and jobless claims are also of interest, but the last word of the week belongs to the University of Michigan's preliminary Consumer Sentiment Index for August. Last month's publication missed estimates and caused jitters in markets. Apart from the headline number, traders will eye the inflation expectations data, which shot higher last month and could edge lower this time.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar bulls are struggling to hold onto their lead. Momentum on the daily chart has flipped to the upside, but only just. The recent upswing has saved the currency pair from dipping below the 50-day Simple Moving Average (SMA), and it has recently been setting lower highs – a bearish sign. On the other hand, GBP/USD is trading above the 100 and 200-day SMAs.

Some resistance awaits at the early August high of 1.3950. It is followed by 1.3980, which is a double-top formed in late July. The next levels to watch are 1.4030 and 1.4130.

Significant support is at 1.3875, which is a double-bottom formed in the past few weeks. It is followed by 1.3845, which was a cushion last month and also where the 200 SMA hits the price. Further down, 1.3760 and 1.3730 are additional levels of interest.

GBP/USD sentiment

After cable held up against the one-two punch from central banks – and also the super-strong NFP – it has room to rise. Weak US inflation could spark an upswing, while Britain's vaccination advantage may provide additional support.

The FXStreet Forecast Poll is showing that experts foresee a bullish trend for cable on all timeframes, despite a drop in average targets. While there is a wide variety of opinions, it seems that cable is set to never stray away from 1.39 in the forecast´s horizon.

Related reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.