- GBP/USD hit by dovish BOE, Delta plus covid strain despite Fed’s mixed signals.

- The cable’s fate hinges on UK quarterly GDP, Brexit updates and US data.

- GBP/USD decline is far from over, speculative interest aims to 1.3660.

Central banks’ monetary policy signals from both sides of the Atlantic dominated GBP/USD’s price action in the aftermath of the Fed-led 300-pip blow witnessed a week ago. Going forward, GBP/USD will look for some temporary reprieve from the UK’s quarterly GDP amid renewed Brexit optimism. However, the rapid spread of the Delta plus covid strain in Britain could threaten the already delayed economic reopening, which may exacerbate the pain in the pound.

GBP/USD in hindsight: Dovish BOE pounds the pound

GBP/USD witnessed an eventful week with good two-way businesses and increased volatility. However, the currency pair held its range between THE 1.3850-1.4000 levels, keeping its recovery momentum intact from the Fed’s hawkish surprise-led 300-pip knockdown to near the 1.3785 region.

The bulls fought back for control as GBP/USD staged an impressive recovery in the first half of the week. The rebound in the cable was mainly driven by a corrective pullback in the US dollar against its major rivals after investors reassessed the Fed’s tightening expectations. Fed Chair Jerome Powell turned dovish during his testimony before the House Select Subcommittee on the Coronavirus Crisis on Tuesday. Powell played down inflation risks but acknowledged significant uncertainty as the US economy reopens.

Following Powell’s testimony, speeches from several policymakers from the world’s most powerful central bank kept the dollar on the defensive. Atlanta Fed President Raphael Bostic said, “given the upside surprises and recent data points, I’ve pulled forward my projection for our first move to late 2022.” Dallas Fed Chief Robert Kaplan noted he sees the first rate hike in 2022. These hawkish comments were offset by dovish remarks from Fed Governor Michelle Bowman, who said that the high inflation in the US would last longer than expected, although it will prove temporary. The conflicting messages from the Fed policymakers on downbeat US Markit Services PMI and Durable Goods Orders data weighed on the economic optimism and the prospects of the withdrawal of monetary stimulus.

Additionally, a bipartisan $579 billion US infrastructure deal stoked economic optimism and added to the dour sentiment around the greenback.

In the second half of the week, the UK fundamentals also had a significant impact on the major. As markets continued to gauge the Fed’s next policy moves, the Bank of England (BOE) disappointed the hawks by unexpectedly offering a dovish tone while maintaining the key policy settings. The cable lost almost 100 pips on the BOE’s dovish surprise, although the downside remains cushioned by a fresh bout of optimism on the Brexit front. The UK’s Environment Secretary said Thursday,that there have been “positive indications” that an agreement will be reached in the “sausage war” trade dispute with the European Union (EU).

However, broader issues concerning Irish fishermen’s dissatisfaction with the EU quotas will continue to temper sterling’s recovery moves. Further, a dramatic rise in Britain’s Delta plus covid strain continued to weigh on the cable, as it threatens the already delayed economic reopening, now planned for July 19.

As the week came to an end, the US published the May Core Personal Consumption Expenditures Price Index, which advanced from 3.1% to 3.4% YoY as expected. The greenback suffered a temporal setback as the announcement hardly affected the ruling optimism. However, the GBP/USD pair remained subdued near the lower end of its weekly range.

GBP/USD week ahead

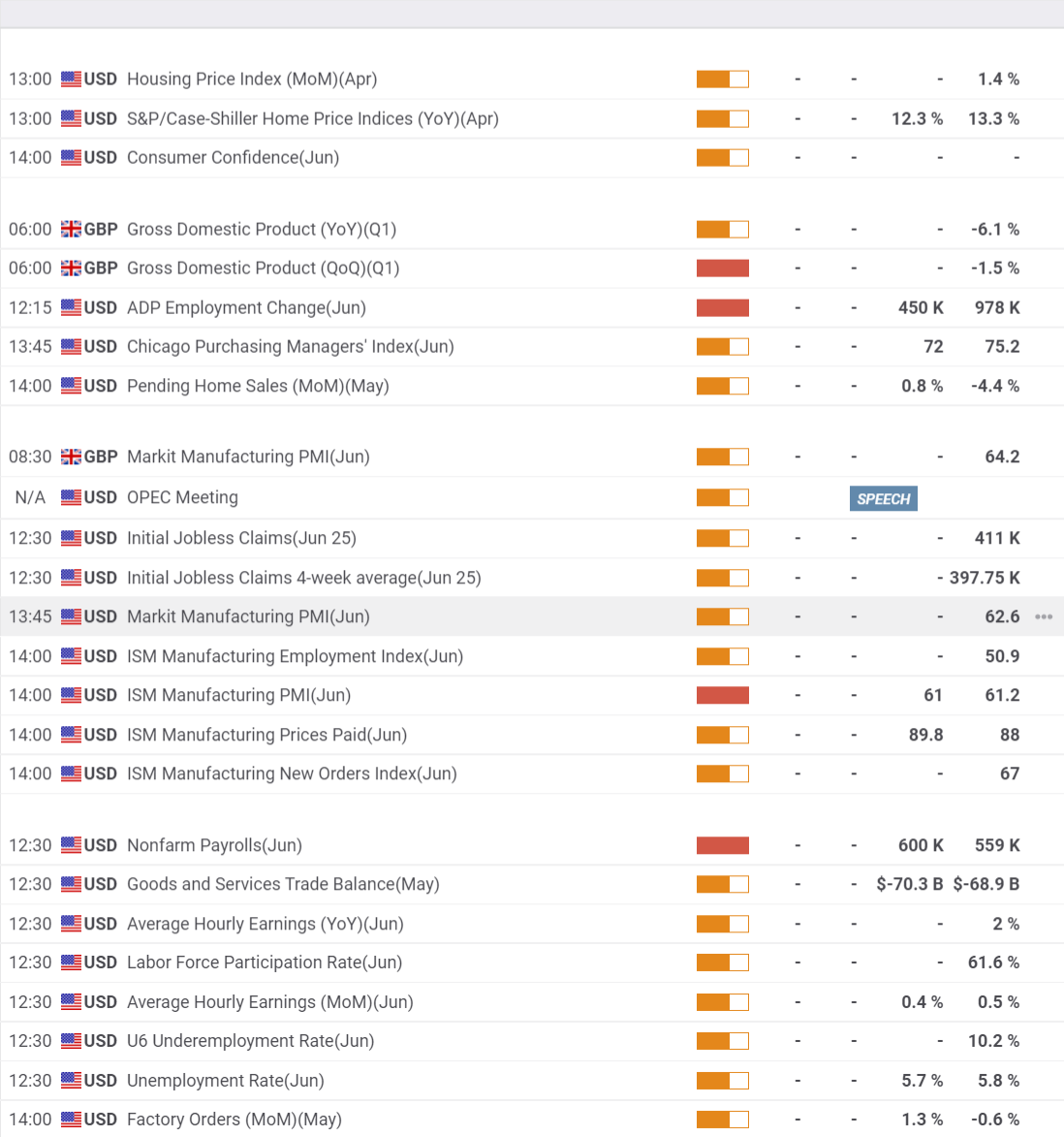

The currency pair maintains its bearish undertone heading into a new week. The economic calendar appears scarce at the beginning of the week, with the US CB Consumer Confidence data dropping in on Tuesday.

Wednesday sees the quarterly release of the UK’s Q1 Gross Domestic Product (GDP), with the quarterly Current Account and monthly GDP numbers to be released alongside. Annualized UK GDP contracted 6.1% in the final quarter of 2020.

On Thursday, GBP traders will await the UK final Manufacturing PMI for June, which is likely to be revised lower to 62.8 vs the flash estimate of 63.1. However, the US ISM Manufacturing PMI is likely to stand out next week ahead of the critical June Nonfarm Payrolls release on Friday.

The US ISM Manufacturing PMI is seen lower at 61.0 in June vs. 61.2 booked in May. Meanwhile, the US economy is expected to have added 600K jobs in June when compared to a meager 559K jobs created in May. The Unemployment Rate is likely to drop to 5.7% vs the reported 5.8% last month.

Apart from the macro data, the developments surrounding the NI protocol issue and the new covid strain will be closely followed for fresh trading opportunities in the pair next week.

GBP/USD technical outlook

The GBP/USD pair has broken below a daily ascendant trend line coming from 1.2075, the low from May 17, currently at around 1.3950, providing resistance. From a technical point of view and in the long term, the pair is neutral-to-bearish.

In the weekly chart, the pair has broken below a now flat 20 SMA, and selling interest has aligned around it. The Momentum indicator hovers around its midline, reverting its bearish stance but without clear directional strength, while the RSI presents similar behaviour.

On a daily basis, the bearish potential is firmer. The pair has spent the week below its 100 SMA, while the 20 SMA turned lower above the longer one. Meanwhile, technical indicators resumed their declines within negative levels after corrective extreme oversold conditions.

The pair topped for the week at the 1.4000 figure. A bullish acceleration through the level may encourage bulls and push the pair up to the 1.4100 region and beyond. However, the closer the pair gets to 1.4200, the higher the risk of a sharp retracement.

The first support level is 1.3860, followed by 1.3785, June’s low. A break below it exposes the 1.3660 price zone.

GBP/USD sentiment poll

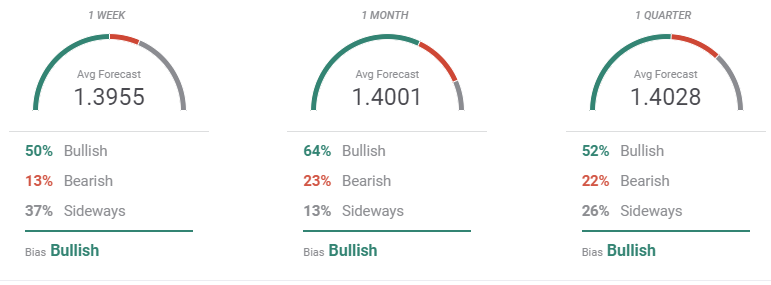

The FXStreet Forecast Poll indicates that bulls are the majority in all the time frames under study, but the average target in all the cases stands around the 1.4000 threshold. Buying interest is larger in the one-month view standing at 64%.

The Overview chart shows that the ranges of possible targets in the weekly and monthly views are well limited, expanding just partially in the quarterly perspective, somehow indicating high levels of uncertainty.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.