GBP/USD Weekly Forecast: The tide has turned against the Pound

- GBP/USD dropped from 14-month highs near 1.2850, ending a three-week positive streak.

- Despite a hawkish BoE, economic uncertainties are likely to limit the Pound's gains.

- The US Dollar was supported by Fed Chair Powell's rate outlook and risk aversion in the markets.

Despite a larger-than-expected rate hike from the Bank of England (BoE), GBP/USD ended a three-week positive streak and retreated from a 14-month high. The challenges for the Pound are increasing as markets focus on the potential negative impacts of rate hikes on the UK economy and after Federal Reserve (Fed) Chair Powell indicated that more rate hikes are likely. This was compounded by a bearish market sentiment. The outlook for the Pound has changed significantly over the last five days.

BoE hikes not enough

It was a busy week in the United Kingdom regarding economic events, starting with crucial inflation figures, followed by the Bank of England meeting that ended with a hawkish surprise. At the same time, the dynamics around the US Dollar were complex, with a hawkish Fed Chair Powell, mixed employment data, and a surprising uptick in housing figures.

Fed Chair Powell continues to lean towards a hawkish stance, mentioning that more rate hikes are likely. Other Fed speakers, including Bowman, also spoke about potential rate hikes. Even a doves like Goolsbee said that the last FOMC meeting was a close call. With “live meetings” ahead, economic data will be watched very closely.

Regarding US data, Initial Jobless Claims came in at 264K, marking the highest level since October 2021, while Existing Home Sales rose 0.2%, surpassing expectations. The S&P Global Manufacturing showed an unexpected slowdown to 46.3 in June while the Service sector declined to 54.1.

The market currently shows diminishing bets for rate cuts by year-end from the Fed, with a 70% probability of a hike at the July meeting, according to the CME FedWatch Tool. These expectations have supported the US Dollar in the market and have helped limit its losses.

The UK inflation report on Wednesday showed that core inflation rose by an annual 7.1%, up from 6.8% in April, which is the highest rate since 1992. The Consumer Price Index (CPI) index rose 8.7%, unchanged from April. These figures were above expectations.

The UK CPI numbers led to a larger-than-expected rate hike from the Bank of England. Although the announcement on Thursday was above consensus, it was not a complete surprise. However, the consequences were felt across the globe, triggering some risk aversion. The BoE raised rates by 50 basis points to 5.00% by a 7-2 majority. This was the first upward surprise from the BoE in this tightening cycle.

The Monetary Policy Committee (MPC) acknowledged that second-round effects may take longer to unwind, mentioning a tight labor market and continued resilience in demand. The documents delivered by the BoE point to further rate hikes ahead.

Economists see three more 25 basis point rate hikes by the BoE, with the rate reaching 5.75% by November. This could lead to a recession that could trigger rate cuts by Q1 2024. What the BoE does will depend on the data flow. As of now, the question for August is whether the rate hike will be 25 or 50 basis points.

On Friday, UK Retail Sales data was a positive surprise with a 0.3% increase in May, against expectations of a 0.2% decline. The numbers show a still-resilient consumption. The flash PMI survey pointed to a downturn as it did in the Eurozone. The Manufacturing PMI dropped to 46.2 from 47.1 and the Services PMI to 53.7 from 55.2. The first glimpse at economic activity in June shows a deterioration as the readings were the slowest in three months. The slowdown was sharper than expected and shows the Manufacturing sector contracting and the Services sector growing at a slower pace. "June's flash PMI survey indicates that the UK economy has lost momentum again after a brief growth spurt in the spring and looks set to weaken further in the months ahead," explained Chris Williamson, Chief Economist at S&P Global Market Intelligence."

Pound needs good news from the UK

Economists fear a looming recession in the UK, and without new information, these considerations could continue to weigh on the Pound next week. Another factor that could likely keep GBP/USD under pressure is risk-averse sentiment. The latest round of rate hikes and mixed economic data could favor an extension of the ongoing correction across equity markets. Such an environment is negative for the pair.

If the situation deteriorates significantly, it could weigh on Fed rate hike expectations and on the DXY, which could limit losses in the GBP/USD. But for the pair to hit fresh highs, it would take more than falling US yields.

The economic calendar for the UK next week is light. The BoE will release its Quarterly Bulletin on Wednesday, Consumer Credit, Mortgage Approvals, and Net Lending to Individuals on Thursday, and a new estimation of Q1 GDP Growth on Friday.

The Pound needs good news, which could come from easing inflation and good economic performance. Inflation headlines and rate hikes put the problems that arise from higher inflation on the political table and could become a source of pressure for Prime Minister Rishi Sunak. Government officials are asking banks and building societies to support households that have seen rising mortgage payments. The media is starting to talk about a "mortgage crisis" that could worsen further with BoE rate hikes. The average rate on a two-year fixed mortgage surpassed 6% this week.

In the US, the highest-impact reports will be Durable Goods Orders, Consumer Confidence, and New Home Sales on Tuesday, Jobless Claims, GDP, and Pending Home Sales on Thursday, and Consumer Inflation and UoM Consumer Confidence. Fed Chair Powell will speak again on Wednesday.

The key report will be on Friday with the Core Personal Consumption Expenditures (PCE) Index for May, which is the Fed's preferred inflation measure. The Core PCE is expected to rise 0.4% on a monthly basis, with the annual rate staying at 4.7%. That reading will be critical for Fed rate hike expectations for the next meeting. Additionally, analysts and economists will watch closely for housing numbers in the context of the recent rebound in housing data.

GBP/USD: Technical outlook

The GBP/USD is currently moving with a bearish bias in the short term; however, the bullish trend is intact. The current correction still has room to go, according to technical indications on the daily chart. The Pound needs to reach 1.2800 to alleviate the bearish pressure. Above that, the focus will turn to the key resistance area of 1.2850 that capped the upside during the last two weeks. A break above would clear the way for more gains.

Despite falling for several days in a row, no positive signs for the Pound are seen. A consolidation under 1.2700 should put more pressure on the bearish side.

The weekly chart shows that the rally stalled before the 200-Simple Moving Average (SMA). Also, the weekly chart warns of the potential for some consolidation ahead and an extension of the move downwards. A relevant support level is 1.2650. The crucial support for the bullish perspective is seen at 1.2360 and 1.2420: the 20-week SMA and an uptrend line. A break below that area would change the outlook to neutral/bearish.

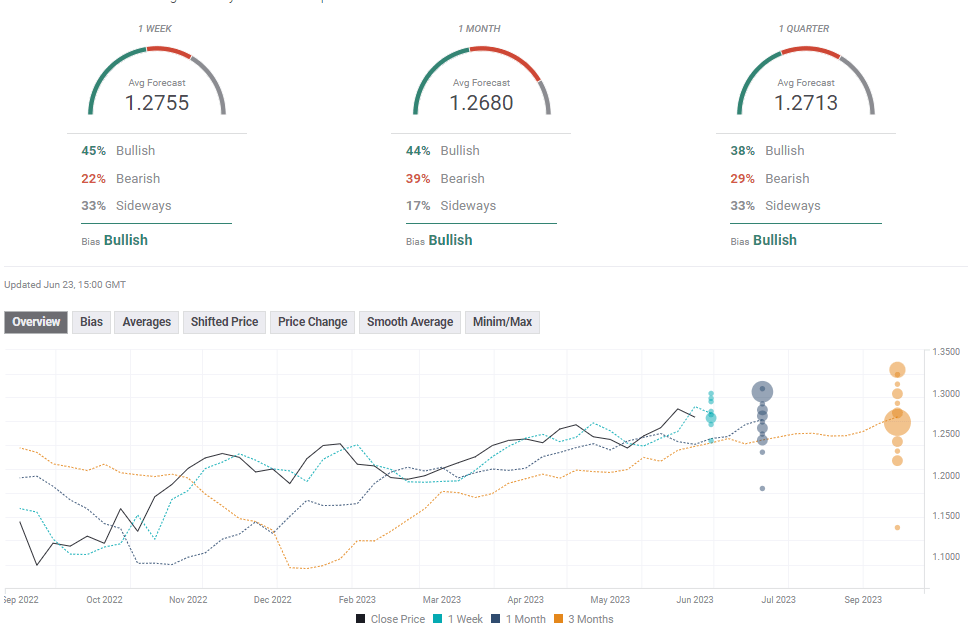

GBP/USD: Forecast poll

The FXStreet Forecast Poll highlights a slightly bullish bias in the near term, with the one-week average target aligning near the mid-1.2700s. The one-month outlook has improved relative to last week, probably after the BoE surprise. The one-quarter average forecast is slightly above 1.2700, around current levels

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638231313524806526.png&w=1536&q=95)