- The GBP/USD rose some 280 pips during the final week of February on the back of increasing Brexit delay market euphoria.

- The UK Prime Minister Theresa May wants a second vote on Brexit deal in the House of Commons on March 12 before moving to Brexit delay vote.

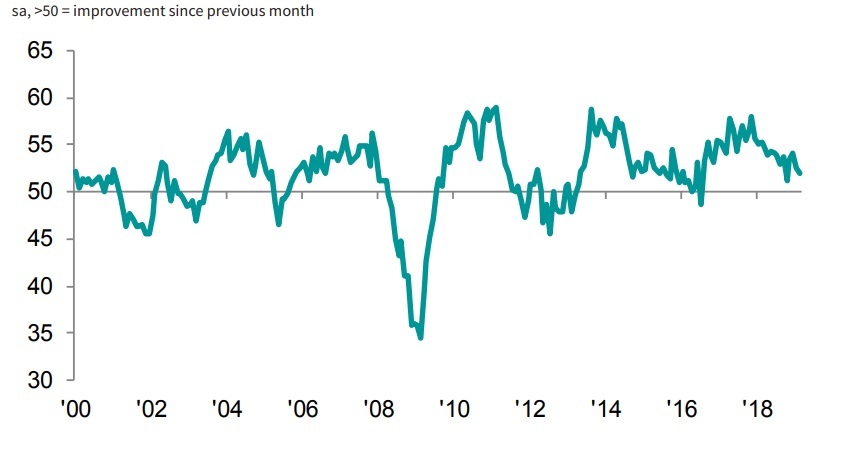

- The UK manufacturing PMI fell further to 52.0 in February with the uncertain outlook impacting the business optimism.

- Brexit uncertainty weighed on the manufacturing activity and employment, with confidence at a series-record low and the rate of job losses hitting a six-year high.

The GBP/USD rose some 1.7% over the final week of February ending the week at around 1.3280 as the foreign exchange market priced in the increased probability of a delayed Brexit.

The UK Prime Minister Theresa May presented her plan of the lower chamber of the British parliament voting on her upgraded Brexit deal for the second time on March 12 with the option of parliament voting in favor of either no-deal Brexit or delayed Brexit.

The GBP/USD rose in the first half of the fourth week of February from 1.3059 to 1.3350 retreating to mid 1.3200s by the end of the week as market booked profits from long Sterling positions and the US economy run series of positive macro data.

At the same time, the UK macro data were scarce and rather negative, with the UK manufacturing PMI falling to 52.0 in February as Brexit uncertainty weighed on the manufacturing activity and employment, with confidence at a series-record low and the

rate of job losses hitting a six-year high.

In the US the set of the Federal Reserve Bank officials was out in news with the Federal Reserve Chairman Jerome Powell Congressional testimony highlighting the agenda.

Powell confirmed during the Congressional testimony that the patience is an official stance in term of monetary policy outlook and the Fed expecting some signs of stronger wage growth and the US inflation to run close to its 2% target after transitory effects of recent energy price decline abate. The Fed is now in a position to evaluate "appropriate timing and approach" for the end of its balance sheet runoff, according to Jerome Powell.

UK manufacturing PMI

Source: IHS Markit

On the Brexit front, the UK House of Commons will be able to have a second vote on a Brexit deal on Tuesday, March 12. If the members of parliament will reject the Brexit deal again, they will be asked to vote on whether they would like to leave the EU without a deal instead. While parliament is almost certain to say no to such option, The UK Prime Minister Theresa May will ask members of parliament to vote on whether the leaving date of the 29 March should be pushed back. Delaying Brexit alternative would be a one-off move with the deadline likely to be pushed to June.

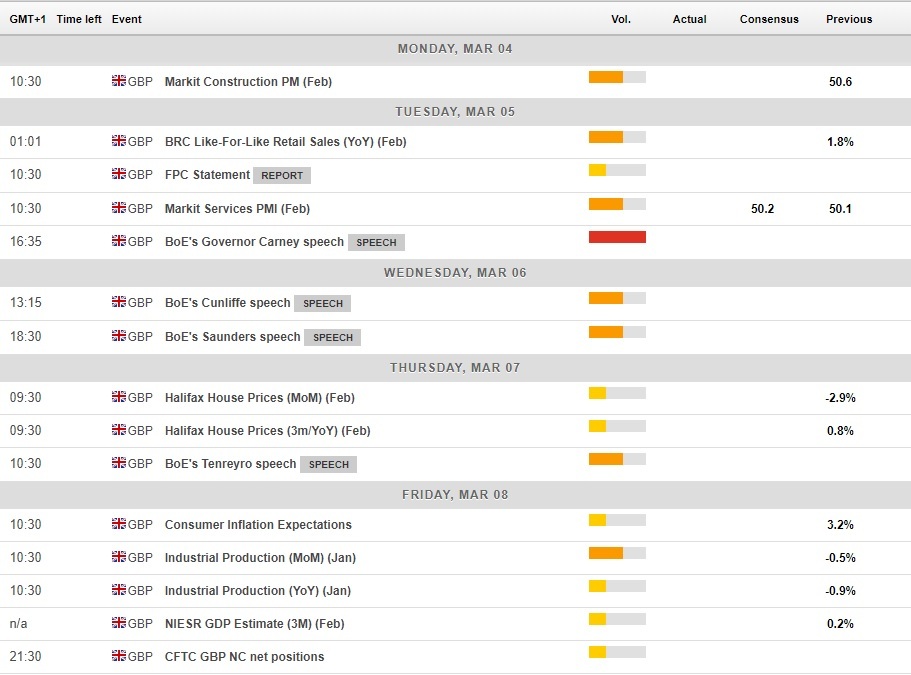

With the Bank of England Governor Mark Carney testifying in the House of Lords headlining the calendar next week and no major move on Brexit front, the major Brexit-related event is scheduled for March 12 with the UK parliament voting on renewed Brexit deal proposal from the UK Prime Minister Theresa May that increases the chances of delayed Brexit until June.

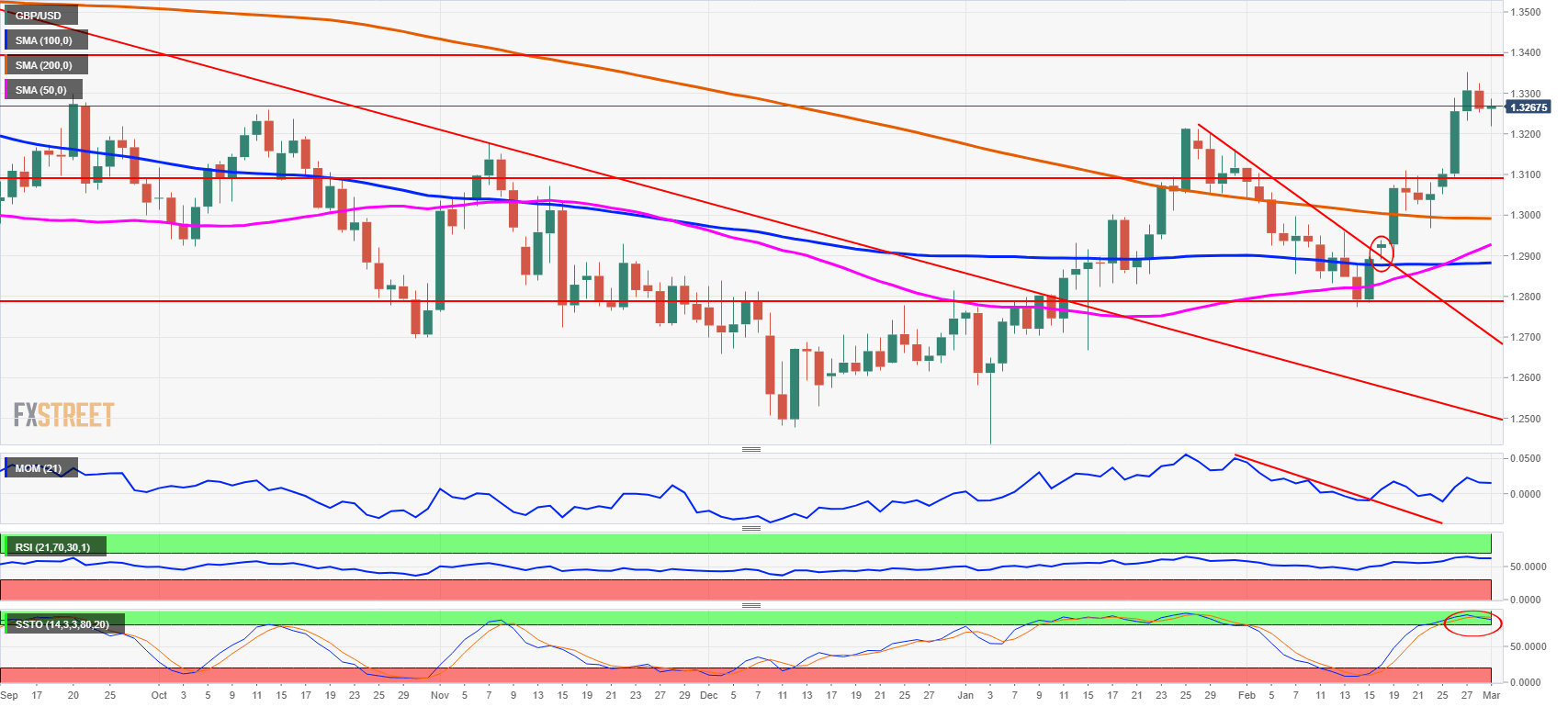

While GBP/USD is elevated and the golden cross representing the crossover of the 50-day moving average (DMA) and 100-DMA favor the GBP/USD upside, the lack of important macroeconomic data in the UK is more likely to see GBP/USD correct lower in the upcoming week.

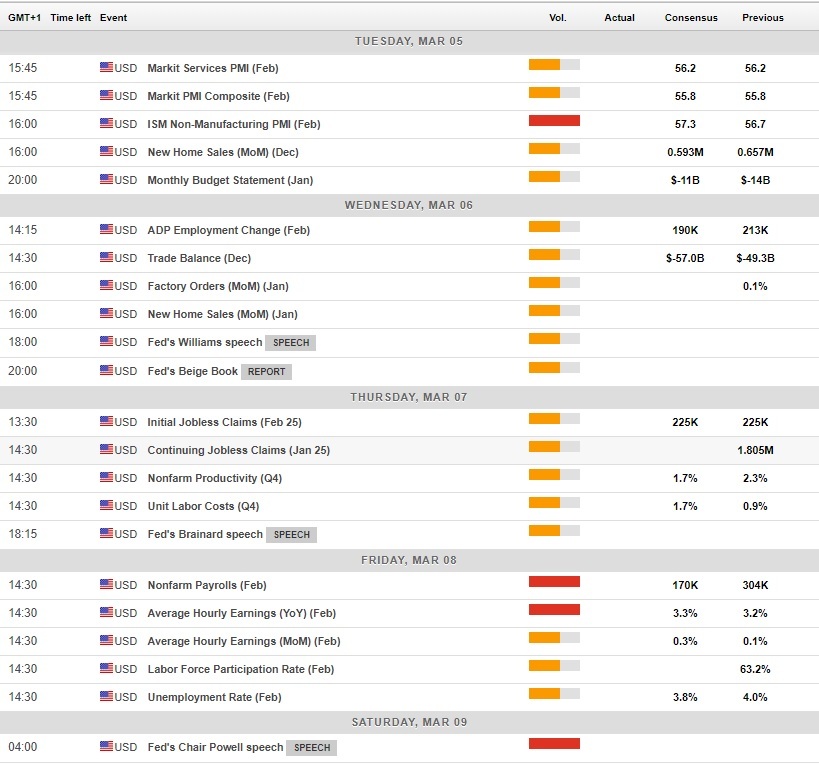

This forecast is also supplemented by the plethora of important macro data scheduled for the US in the upcoming week that will include the all-important February labor market report.

In terms of the data last week, the fourth-quarter US GDP came out stronger than expected with a 2.6% quarterly annualized rise while the

In the UK, the set of construction and services PMIs are scheduled for the next week together with the Bank of England Governor Mark Carney’ s testimony in the House of Lords. The Bank of England officials including the Monetary Policy Committee (MPC) members Saunders, Tenreyro, and Cunliffe are also scheduled to speak publically next week.

Technically the GBP/USD is set to correct lower next week with the scheduled data set expected to confirm the growth differential favoring the US Dollar. This is particularly true regarding the labor market that is expected to create a strong 170K new jobs in the US economy in February with wages rising 3.3% over the year and the unemployment rate falling to 3.8%.

Technical analysis

GBP/USD daily chart

The technical correction off a 33-week high is supported by the swing of the technical oscillators as a 280-pips strong move higher on GBP/USD is temporarily exhausted even with the prospects of delayed Brexit.

The technical oscillators including Momentum and the Relative strength index are turning lower from their elevated positions pointing downwards and Slow Stochastics made a bearish crossover within the Overbought territory. The most important technical feature though is the golden cross of the 50-day moving average crossing over the 100-day moving average (DMA). The golden cross is a strongly bullish technical signal that is expected to push Sterling higher long-term. In the short-term, the GBP/USD though is in corrective mode around mid 1.3200s before testing 1.3215, previous cyclical high. On the upside, the immediate target is at 1.3390 representing 61.8% Fibonacci retracement of post-Brexit recovery from 1.1800 to 1.4374.

Fed officials speaking in the final week of February

The Federal Reserve Chairman Jerome Powell said in Congressional testimony on February 26:

- The US economy is healthy and outlook favorable, Fed has seen in the past few months some "crosscurrents and conflicting signals."

- Recent economic data has "softened," but 2019 US GDP growth expected to be "solid" though slower than 2018.

- Recent US government shutdown expected to have had only "fairly modest" impact on the economy and that would "largely unwind" in next several months.

- The Fed sees some signs of stronger wage growth, expects inflation to run close to its 2% target after transitory effects of recent energy price decline abate.

- The Fed is now in a position to evaluate "appropriate timing and approach" for the end of its balance sheet runoff.

- The demand for reserves will not go back to pre-crisis levels.

The Federal Reserve Vice Chairman Richard Clarida said on February 28:

- Fed is entering the era when it is "especially" dependent on incoming data.

- Inflation expectations at the "lower end" of range consistent with Fed meeting its 2% inflation target.

- Policymakers need to see their economic models as "not infallible" and avoid any rush to judgement on basis of model-based predictions.

- 2019 growth expected to be "slower but still solid".

- Financial conditions are more supportive of outlook today than they were in December.

- Leveraged loan market does not present systemic risk to the economy.

- Wage gains in line with underlying inflation trends and productivity; "no real evidence" of cost-push pressures.

- No "slam dunk" decision on the composition of securities to be held in the balance sheet; decision after the size of the balance sheet is determined.

The Federal Reserve Chairman Jerome Powell said at the 87th Awards dinner on February 28:

- Signs of upward pressure on inflation are "muted".

- Powell repeats the economy in a "good place" as Fed remains patient, watches risks.

- Urges policies to boost labor force participation, productivity.

- The recent rise in productivity leaves room for wages to increase without raising inflation concerns.

The economic calendar in the week ahead

UK economic calendar March 4-8

US economic calendar March 4-8

FXStreet Forecast Poll

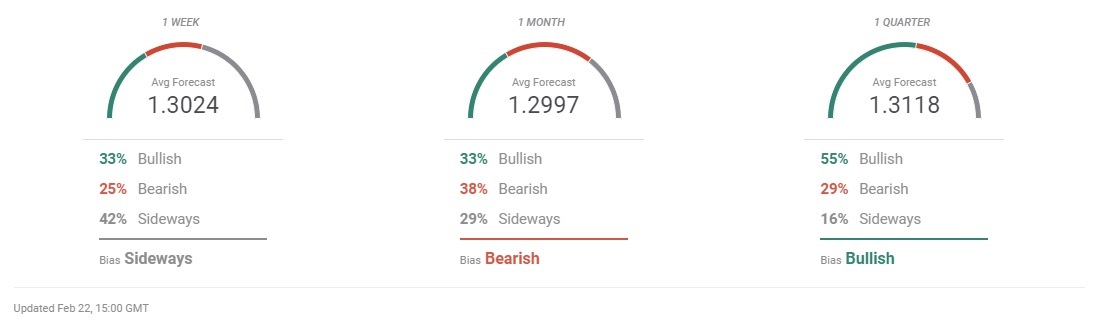

The herd effect proved right with FXStreet Forecast Poll short-term FX forecast for GBP/USD completely missing the reality of 1.3280 spot rate this Friday as the spot rate rose on the back of market re-pricing the chances for delayed Brexit. For the week ahead the FXStreet Forecast Poll is expecting Sterling to move sideways to 1.3268, up from 1.3024 last week and 1.2766 two weeks ago. The forecast remains highly uncertain with the bullish-to-bearish ratio at 36%-43%, 21% predicting sideways trend.

For 1-month ahead, the forecast is bearish predicting 1.3150, up from 1.2997 last week and from 1.2864 FX rate predicted two weeks ago. Bullish-to-bearish forecast is 30%-48 and 22% of sideways predictions.

The vast majority of the forecasters in the FXStreet Forecast Poll is bullish over the 3-months horizon with GBP/USD prediction moving further up to 1.3256 from last week's at 1.3118 and with 51%-42% of bullish-to bearish forecasts, down from 55%-29% last week and 72%-20% two weeks ago.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD remains directionless near 1.0400

EUR/USD continues to fluctuate in a tight channel at around 1.0400 in the European session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to find direction.

GBP/USD extends sideways grind above 1.2500

GBP/USD moves up and down in a narrow band above 1.2500 on Friday after posting small losses on Thursday. The cautious market mood doesn't allow the pair to gain traction, while trading volumes remain low following the Christmas break.

Gold struggles to build on weekly gains, holds above $2,630

Gold enters a consolidation phase slightly above $2,630 on Friday after closing in positive territory on Thursday. The risk-averse market atmosphere helps XAU/USD hold its ground as investors refrain from taking large positions heading into the end of the holiday-shortened week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.