GBP/USD Weekly Forecast: Seeing dead cat bounces everywhere, time for another fall

- GBP/USD has hit new lows before bouncing amid a mix of virus news and other developments.

- Brexit talks, US COVID-19 statistics, and several other indicators are in play.

- Early July's daily chart is showing that bears have a minor advantage over bulls.

- The FX Poll is pointing to a short-term fall before a recovery later on.

Super Saturday – Brits can go to the pub for the first time since March and may also celebrate the pound's minor recovery. While markets cheered the Non-Farm Payrolls, America's coronavirus situation and Brexit talks will likely continue weighing on cable and could turn into another "dead cat bounce."

This week in GBP/USD: Upbeat old data keeps it from crashing

Only residents of Leicester – where an outbreak of COVID-19 has triggered reimposing of restrictions – the English tradition of going to the pub resumes on July 4. The easing of restrictions comes as the disease is coming under better control, supporting the pound.

Prime Minister Boris Johnson is also able to get his haircut and perhaps tourists will return as the UK opens its borders to some 50 countries – yet it is unclear if the gesture will be reciprocated.

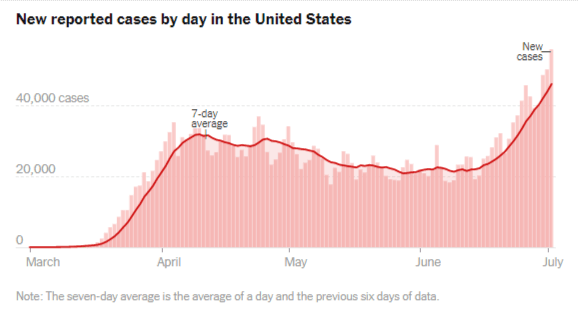

On the other side of the pond, Dr. Anthony Fauci, America's top epidemiologist, said that the US reopened before it had coronavirus under control. His words came as the number of daily infections is hitting new records, reaching 55,000 on Thursday.

Source: New York Times

The elevated number of cases is due to more testing but also a higher positive test rate. Hospitalizations and even deaths – which were on a constant decline – are now on the rise as well. States continue reimposing restrictions or halting the reopening – including those that have successfully flattened the curve, like New Jersey and New York.

Consumers began shunning away from restaurants and bars – and also reduced their gasoline purchases – according to high-frequency data. Weekly jobless claims also remain elevated near 1.5 million as for the week ending June 26.

While weekly figures already capture the downturn, Non-Farm Payrolls figures for June – compiled in the week ending on June 12 – showed an impressive restoration of 4.8 million jobs, beating estimates.

The increase in jobs does not look like recovery but only a bounce – a dead cat bounce.

President Donald Trump was quick to claim responsibility for the job recovery but continues dismissing coronavirus. He says it will "just disappear" and refuses to lead.

Four months ahead of the elections, opinion polls are showing that Trump is trailing rival Joe Biden by over nine points nationally and also in battleground states – even giving Democrats a shot at the Senate. Investors may begin fearing a clean sweep by Democrats.

While Trump was trailing Clinton at this stage of the race, Biden's lead is far more significant.

See 2020 US Elections: Three reasons why Biden's lead over Trump is far greater than Clinton's in 2016

The other major political earthquake of 2016 was Brexit. Talks between the EU and the UK remain deadlocked and top negotiators postponed a face-to-face meeting to next week. That news somewhat weighed on the sterling.

The pound was also pounded by the downgrade of the UK's Gross Domestic Product figures in the first quarter – from a contraction of 2% to 2.2%.

UK events: Brexit and the reopening are eyed

Brexit: Chief EU Negotiator Michel Barnier and his British counterpart David Frost will meet and try to iron out differences on the EU's demand for a "level playing field" – keeping EU regulations after the Brexit transition period expires in 2021. In return, Brussels will grant easy access to its single market. London refuses and says the point of Brexit was to make its own laws.

Will both sides square this circle? Many expect talks to heat up only after the summer and closer to the deadline, so that may have to wait for another week.

Investors will also examine UK coronavirus cases, which are going in the right direction – down. If infections increase due to the current opening, it may take time to see it in the chart. Nevertheless, as long as it falls, sterling will receive support.

Source: World Info Meter

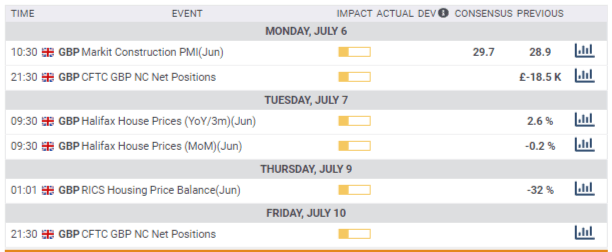

Markit's Construction Purchasing Managers' Index is set to edge up from the lows as the economy opens up, and several house price indexes are also of interest. However, Brexit and coronavirus stand out.

Here is the list of UK events from the FXStreet calendar:

US events: All about the virus

Americans are celebrating 244 years to the founding of the country in a less-than-festive atmosphere as COVID-19 rages. Daily figures from Florida, California, Texas, and also smaller states will likely move markets.

High-frequency data is also of interest, and that includes gasoline consumption and restaurant visits. More importantly, weekly jobless claims figures will be watched for any change – continued gradual decline or a potential increase.

The ISM Non-Manufacturing PMI is set to extend its recovery in June, following the footsteps of the manufacturing sector. The publication tends to have greater weight when it is published ahead of the Non-Farm Payrolls but is of interest also now.

With coronavirus being right, left, and center, campaigning is limited and markets are not focusing on the elections. After advancing significantly, Biden's lead over Trump has stabilized. A comeback by Trump lowers the chances of a clean sweep for Democrats, boosting markets and weighing on the safe-haven dollar. However, if the current gap is not the former VP's high watermark, investors may fear significant changes by the left-wing of the party to American capitalism.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar is battling the 100-day Simple Moving Average and struggles to hold onto it. It is also trading below the 200-day SMA and suffers from downside momentum. On the other hand, this momentum is weak and cable is still above the 50-day SMA.

All in all, bears are in the lead.

Initial support awaits at 1.2420, which is where the 50-day SMA hits the price. The next line to watch is 1.2340, a swing low in mid-June, followed by 1.2250, the low point in late June, and also a support line earlier in the year. Further below, 1.2155 and 1.2065 await the currency pair.

Resistance is at 1.2550, which held GBP/USD down in late June. It if followed by 1.27, a swing high and where the 200-day SMA hit the price. June's peak of 1.2815 is the next level to watch.

GBP/USD Sentiment

A Brexit breakthrough is unlikely at this juncture while US coronavirus cases are set to continue rising. The new measures imposed will take time to turn the ship. The safe-haven dollar has room to rise and GBP/USD to fall.

The FXStreet Forecast Poll is showing a bearish trend in the short and medium terms, yet it is essential to note that targets have been revised to the upside and are trending higher. Are experts sensing that the bottom is near?

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637293651532125546.png&w=1536&q=95)