- GBP/USD broke its consolidation to the downside amid relentless US Dollar demand.

- US jobs data to stand out in a holiday-shortened week for the Pound Sterling.

- GBP/USD remains poised to test the 200-day Simple Moving Average at 1.2400.

The Pound Sterling finally ended its 200 pips range trade against the United States Dollar (USD), sending GBP/USD back under the 1.2600 level this week. Attention turns toward the all-important United States (US) Nonfarm Payrolls data release in the holiday-shortened week ahead for GBP/USD traders.

GBP/USD: What happened last week?

The GBP/USD pair reversed a temporary rebound and resumed its downtrend in the past week, as the love for the US Dollar was unmatchable in the critical US Federal Reserve’s (Fed) Jackson Hole Symposium week.

Resurfacing worries over the health of the global economy amid elevated inflation levels and higher interest rates continued to underpin the sentiment around the US Dollar. After Chinese embattled property giant, Evergrande, filed for US bankruptcy protection on Friday, reports hit the wires on Monday that another real estate company Country Garden Holdings is set to be removed from Hong Kong’s Hang Seng Index. Meanwhile, the People’s Bank of China (PBOC) poured cold water on the stimulus optimism after it cut its one-year benchmark lending rate by 10 basis points (bps) and left its five-year rate unchanged, against market expectations for 15 bp cuts to both.

The latest US banking concerns were accentuated after S&P Global on Monday cut credit ratings and revised its outlook for multiple US banks, citing large deposit outflows and prevailing higher interest rates. Amidst these worrying factors, markets found some support from the upbeat earnings report from the US artificial intelligence (AI) chip maker Nvidia.

However, risk-off flows soon returned, as investors weighed stagflation risks after the Eurozone, the UK and the US business PMI reports showed a downturn in the services sector while the manufacturing sector remained in contraction. S&P Global said its preliminary US Composite PMI index, which tracks manufacturing and service sectors, dropped to 50.4 in August from 52 in July, registering the biggest drop since November 2022.

Following the downbeat S&P Global UK Services PMI data, bets for more tightening from the Bank of England (BoE) dropped. UK interest rate swaps showed more than a 50% chance of rates reaching 6.0%. Risk-aversion combined with dovish BoE expectations weighed heavily on the Pound Sterling against the US Dollar.

The pain in the GBP/USD pair was exacerbated after the US Dollar extended its rally to renew two-month highs above 104.00 across its main competitors, in the face of encouraging US Initial Jobless Claims data and in anticipation of Fed Chair Jerome Powell’s Jackson Hole speech on Friday. Markets expected Powell to reiterate his rhetoric of a ‘higher for longer’ narrative, sparking a fresh rally in the US Treasury bond yields, which lifted the US Dollar broadly.

The US Treasury bond yields rallied to 16-year highs due to multiple factors, including an increase in the US Treasury issuance, Fitch's credit downgrade, concerns China will dump Treasuries to support the Yuan and the hawkish Fed expectations.

GBP/USD jumped to 1.2653 as an immediate reaction to Fed Chairman Jerome Powell’s words. However, the pair quickly changed course and sank roughly 70 pips, on Powell's hawkish surprise. He said that they are prepared to raise rates further if appropriate in his opening remarks at the annual Jackson Hole Economic Symposium, while adding the Fed is attentive to signs the economy is not cooling as expected. Furthermore, he added that inflation remains too high, and bringing it down is a long lasting process. Finally, he said that "there is substantial further ground to cover to get back to price stability."

It’s all about the US employment data

With the Jackson Hole Symposium out of the week, GBP/USD traders look forward to another high-impact event from the United States, the labor market data.

Liquidity is expected to be thin at the start of the week on Monday, as the United Kingdom markets will be closed in observance of the Summer Bank Holiday. The absence of any relevant US economic data releases will also leave the pair exposed to minimal volatility.

Tuesday will feature the US Conference Board Consumer Confidence and JOLTS Job Openings data while the UK docket lacks top-tier economic data publication.

The JOLTS Job Openings data will be the first of the key US employment data releases in the week ahead and could likely trigger a big market reaction in case of any major deviations from the forecasts.

It will be an intense US economic calendar again on Wednesday, as the ADP Employment Change data will be reported ahead of the second estimate of the second-quarter Gross Domestic Product (GDP) report and the Pending Home Sales data.

Early Thursday, China’s National Bureau of Statistics (NBS) will report the official Manufacturing and Non-Manufacturing PMI reports, which could have a significant impact on risk sentiment. The data could underscore the economic concerns in the world’s second-largest economy. Later that day, the US Personal Consumption Expenditures (PCE) - Price Index will be released alongside the Personal Spending and Income data. The weekly US Jobless Claims data will also entertain Pound Sterling traders.

China’s Caixin Manufacturing PMI for August will be published on Friday, followed by the final reading of the UK S&P Global Manufacturing PMI. The main event risk on Friday, however, remains the US employment data, including the headline Nonfarm Payrolls and the Average Hourly Earnings. The US labor market data will shape up the Fed interest rate expectations and set the tone for markets in the coming weeks.

Additionally, speeches from the Fed and BoE policymakers will also have a strong bearing on the central banks’ policy outlooks, impacting the GBP/USD pair.

GBP/USD: Technical outlook

Having faced stiff resistance at the critical 50-day Simple Moving Average (SMA) at around 1.2785 on multiple occasions over the past two weeks, GBP/USD sellers fought back control and hammered the pair through a couple of key support levels at 1.2725 and 1.2640, the downward-sloping 21-day SMA and flattish 100-day SMA, respectively.

Meanwhile, the 14-day Relative Strength Index (RSI) indicator continues to keep its range just beneath the midline, pointing to more downside in the near term.

If the selling momentum intensifies in the upcoming week, Pound Sterling sellers could attack the 200-day SMA at 1.2400. Further down, the May low of 1.2308 could be exposed.

Alternatively, if the pair gains acceptance above the 50-day SMA resistance at 1.2785, it will likely confirm a bullish reversal and open doors toward the July 27 high of 1.2995. Pound Sterling buyers, however, need a daily closing above the 1.2850 static resistance, at first.

GBP/USD sentiment poll

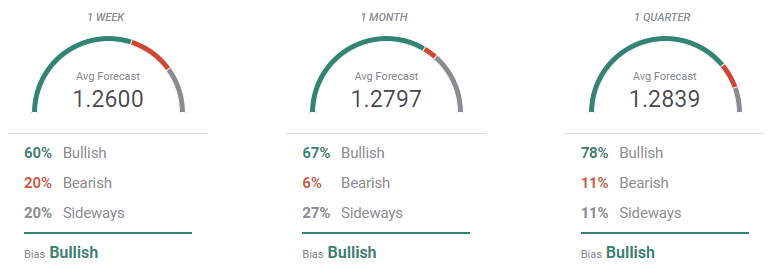

According to the FXStreet Forecast Poll, GBP/USD still has room to recover. The pair is seen bullish in all the time frames under study. The pair is seen at 1.2600 on average in the weekly view and up to an average of 1.2830 in the quarterly perspective. In all cases, bulls stand above 60% of the polled experts.

In the Overview chart, the shorter moving average is bearish, with an even spread of potential targets. In the monthly view, most targets accumulate between 1.2500 and 1.2800, but the range increases to 1.2700/1.3100 in the quarterly one. Chances of a slide below 1.2500 seems unlikely at the time being, but the picture may change next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0400 as trading conditions thin out

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD consolidates below 1.2550 on stronger US Dollar

GBP/USD consolidates in a range below 1.2550 on Tuesday, within striking distance of its lowest level since May touched last week. The sustained US Dollar rebound and the technical setup suggest that the pair remains exposed to downside risks.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.