GBP/USD Weekly Forecast: Pound Sterling looks to recover recent losses as focus shifts to US inflation

- The Pound Sterling rebounded from seven-week lows against the US Dollar.

- GBP/USD recovery set to fade heading into the US inflation week.

- The Pound Sterling still targets 1.2400, as the daily RSI remains below 50.00.

The Pound Sterling (GBP) failed to sustain the bounce against the US Dollar (USD), as the GBP/USD pair lost upside momentum once again when it tried to reach 1.2700.

Pound Sterling tries another recovery attempt

GBP/USD broke its previous week’s consolidation to the downside and reached the lowest level in seven weeks near 1.2540 on Tuesday. The pair staged a rebound to hit a fresh two-week high shy of 1.2700 but buyers failed to sustain this momentum, pushing GBP/USD lower in the latter part of the week.

GBP/USD’s up and down price action was mainly driven by the sentiment surrounding the market’s pricing of a US Federal Reserve (Fed) dovish policy pivot as early as June. There was no significant fundamental catalyst from the United Kingdom (UK), and hence, the pair remained at the mercy of the US Dollar dynamics.

Earlier in the week, strong US ISM Manufacturing PMI, JOLTS Job Openings and ADP Employment Change data sponsored the rally in the US Dollar and the Treasury bond yields, anticipating that the Fed could delay its dovish policy pivot on the back of the US economic resilience.

“The ISM said on Monday that its manufacturing PMI increased to 50.3 last month, the highest and first reading above 50 since September 2022, from 47.8 in February. The rebound ended 16 straight months of contraction in manufacturing,” per Reuters. US job openings rose by 8,000 to 8.756 million on the last day of February, the Labor Department's Bureau of Labor Statistics said on Tuesday. Meanwhile, the US private sector added 184,000 jobs in March, a decent increase from the upwardly revised 155,000 print in February, the ADP reported on Wednesday.

Despite strong data, markets continued to price in a 64% probability of a June Fed rate cut, according to the CME Group’s FedWatch Tool. This could be attributed to the recent commentaries from Fed officials.

Cleveland Fed President Loretta Mester said on Tuesday that she still expects interest rate cuts this year but ruled out the next policy meeting in May. San Francisco Fed President Mary Daly noted that three reductions this year is a “very reasonable baseline” though she said nothing is promised. Fed Chairman Jerome Powell on Wednesday reassured markets of the likelihood of interest rate cuts this year.

The Fedspeak likely triggered a sharp pullback in the US Treasury bond yields, prompting the US Dollar to turn south. However, a fresh bunch of Fed speakers on Thursday tempered Fed rate cut bets with their hawkish commentaries and propelled the Greenback while triggering a correction in the GBP/USD pair from two-week highs.

Chicago Fed President Austan Goolsbee said on Thursday that “if housing inflation does not come down, would be very difficult to return inflation to 2%”. Minneapolis Federal Reserve Bank President Neel Kashkari noted that “if inflation continues to move sideways, makes me wonder if we should cut rates at all this year”. Finally, Richmond Fed President Thomas Barkin said that "disinflation is likely to continue, but the speed of that remains unclear”. He added: "I think it is smart for the Fed to take our time.”

On Friday, the pair remained on the back foot amid broad risk-aversion, fuelled by intensifying geopolitical tensions between Israel and Iran. Later in the day, the Bureau of Labor Statistics reported that Nonfarm Payrolls (NFP) increased 303,000 in March, beating the market expectation of 200,000. Additionally, the Unemployment Rate edged lower to 3.8% from 3.9% in February. The USD gathered strength on the upbeat jobs report and caused GBP/USD to retreat below 1.2600 ahead of the weekend.

Week ahead: US CPI to hog the limelight

The US inflation data, the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday, are likely to stand in a relatively quiet week ahead.

Besides, the Minutes of the March Fed meeting, the UK monthly Gross Domestic Product (GDP) report for February and the US preliminary Michigan Consumer Sentiment and Inflation Expectations data will provide fresh trading impetus to GBP/USD.

Also of note will remain the speeches from Fed policymakers for gauging the timing and scope of the Fed interest rate cuts this year.

GBP/USD: Technical Outlook

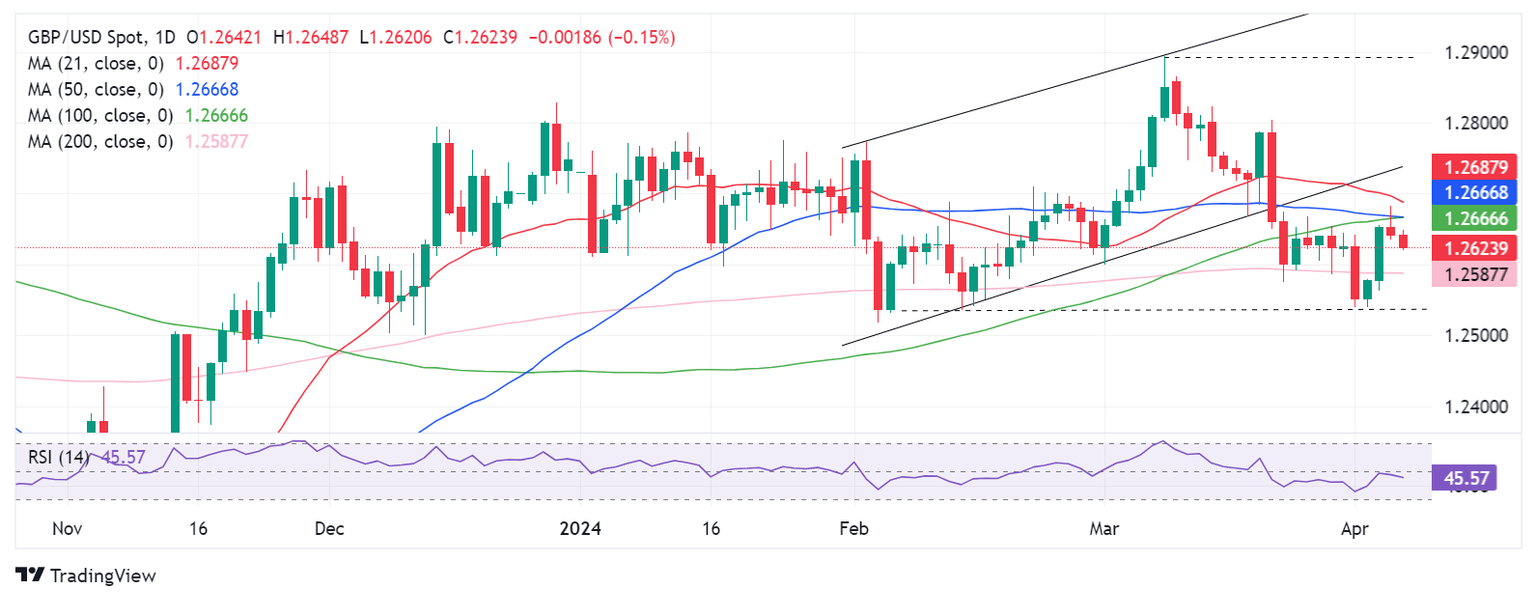

From a short-term technical perspective, GBP/USD remains on track to extend the downside break from the rising channel seen a couple of weeks ago.

The bearish outlook could be based on the 14-day Relative Strength Index (RSI) indicator, which continues to stay below the midline near 46.00.

However, Pound Sterling sellers must settle the week below the horizontal 200-day Simple Moving Average (SMA) at 1.2587 for a sustained downtrend.

Sellers will then target the April low near 1.2540, followed by the 1.2500 round figure. Further south, the 1.2400 threshold could come to the rescue of buyers.

If buyers defend the 200-day SMA at 1.2587, it could alleviate the near-term selling pressure, allowing GBP/USD to attempt a comeback toward the static resistance shy of the 1.2700 level.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.