GBP/USD Weekly Forecast: Pound Sterling set to extend its slide

- Pound Sterling languished near two-month lows on renewed US Dollar demand.

- The UK/ US inflation data set to drive GBP/USD price action in the upcoming week.

- The daily technical setup points to more pain ahead for GBP/USD.

The Pound Sterling (GBP) extended its losing streak against the US Dollar (USD) into a fourth straight week, keeping GBP/USD undermined near two-month troughs.

Pound Sterling is not out of the woods yet

It was all about the market’s pricing of the US Federal Reserve (Fed) interest rate cut expectations following the stellar January Nonfarm Payrolls (NFP) report, which kept the US Dollar broadly elevated.

Odds for a March Fed rate cut dropped to nearly 20% this week, compared with a 68.1% probability at the start of the year. Meanwhile, the odds for a May Fed rate cut now stand at 65%. Markets now price in 115 basis points (bps) of cuts this year, compared with around 150 bps of reductions anticipated a month ago, according to CME Group’s FedWatch tool.

The dialing back of Fed rate cuts for this year received a fresh thrust after Fed Chair Jerome Powell, in an interview aired early Monday, dismissed a rate cut next month while pushing back against the timing of the rate cuts.

US ISM Services PMI came in stronger at 53.4 in January, as new orders increased and employment rebounded. US Initial Jobless Claims decreased by 9,000 to 218,000 in the week ended Feb. 3, according to Labor Department data out Thursday. Applications for US unemployment benefits fell for the first time in three weeks.

Combined with strong US economic data, hawkish Fed commentary throughout the week, convinced markets that chances of aggressive rate cuts by the Fed this year are off the table.

Minneapolis Fed President Neel Kashkari argued on Monday that a possibly higher neutral rate means that the Fed can take more time before deciding whether to cut. On Tuesday, Philadelphia Fed President Patrick Harker said that the "economy is on track for a soft landing.”

Boston Fed President Susan Collins said on Wednesday, "for the moment, policy remains well positioned, as we carefully assess the evolving data and outlook,” adding it will be "appropriate to begin easing policy restraint later this year." Richmond Fed President Thomas Barkin said Thursday that they have time to be patient on rate changes and said that he needs to see good inflation numbers being sustained and broadening.

The Greenback also capitalized on firmer US Treasury bond yields, as they remained supported by a couple of strong US government bond auctions. Ahead of the weekly close, the US Bureau of Labor Statistics (BLS) revised the monthly Consumer Price Index (CPI) increase for December lower to 0.2% from 0.3%, while November's CPI increase was revised higher to 0.2% from 0.1%, although the news had no measurable impact on GBP/USD.

On the other side, a raft of Bank of England (BoE) policymakers also took up the rostrum during the week but failed to have little to no impact on the Pound Sterling even though they retained their hawkish stance. BoE Chief Economist Huw Pill said on Monday that it's still too early to declare inflation fully suppressed – still more work to be done.

Deputy Governor Sarah Breeden said on Wednesday, "My focus has shifted to thinking about how long rates need to remain at their current level.” BoE policymaker Catherine Mann noted Thursday that she is not convinced that the near-term deceleration in headline inflation will continue. Meanwhile, on Friday, policymaker Jonathan Haskel said he is encouraged by signs that the UK’s inflation pressures might be on the wane but he would need more evidence of a cool-down before changing his stance, per Reuters.

Week ahead: It’s all about inflation

The week opens with BoE Governor Andrew Bailey’s speech on Monday, paving the way for the Pound Sterling, as traders gear up for the all-important inflation data release from both sides of the Atlantic.

The United States will report the CPI figures on Tuesday while the United Kingdom will follow it up on Wednesday. Tuesday will also see the publication of the UK’s labor market report, with a focus on the wage inflation data.

On Thursday, the preliminary first-quarter Gross Domestic Product (GDP) data from the UK will stand out amidst the releases of the country’s trade report and factory data. In American trading that day, the Retail Sales and Jobless Claims data will entertain GBP/USD traders.

Friday is also a busy one, with the UK Retail Sales dropping, followed by the US Producer Price Index (PPI), Consumer Sentiment and housing data. The bi-annual Fed Monetary Policy Report will be published later on Friday.

Apart from the data, markets will pay close attention to the speeches from the BoE and the Fed policymakers for fresh insights on the central banks’ interest rate paths.

GBP/USD: Technical Outlook

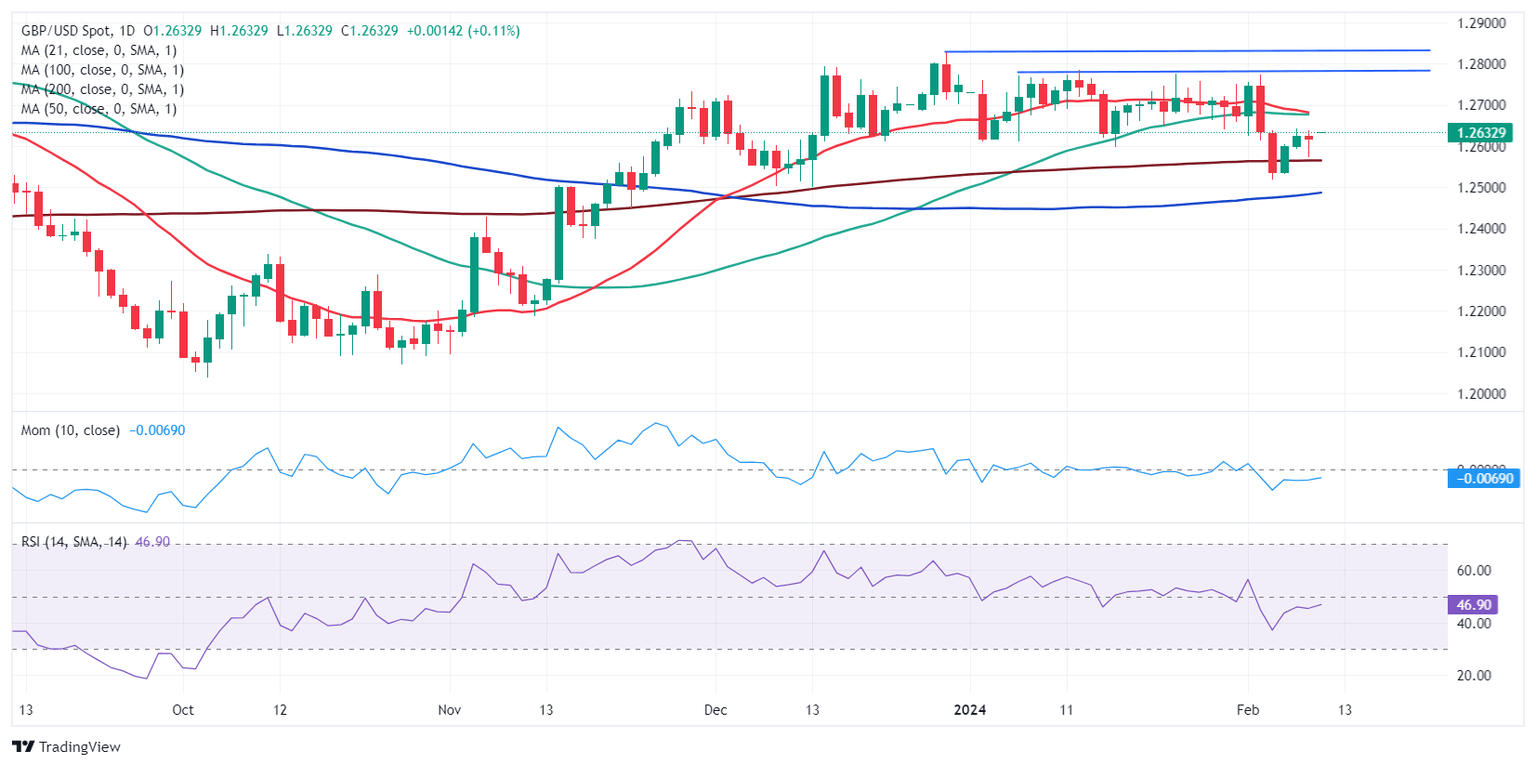

The short-term outlook for GBP/USD suggests that the ongoing downside consolidation phase indicates that a fresh leg lower could be in the offing.

Pound Sterling, however, needs a sustained move below the 200-day Simple Moving Average (SMA) of 1.2565 to extend the downtrend.

The 14-day Relative Strength Index (RSI) indicator holds below the 50 level, suggesting that the bearish potential remains intact.

Adding credence to the downside bias in the GBP/USD pair, the 21-day SMA is on the verge of crossing the 50-day SMA from above.

If the crossover occurs on a daily closing basis, a Bear Cross confirmation could accentuate the downbeat tone around the Pound Sterling.

On a breach of the 200-day SMA at 1.2565, floors will reopen toward the 100-day SMA at 1.2488. The last line of defense for buyers is seen at the mid-November lows of around 1.2375.

Meanwhile, if Pound Sterling buyers manage to defend the 200-day SMA, a test of the 1.2675 resistance cannot be ruled out. That level is the confluence of the 21-day and 50-day SMAs.

Acceptance above that level is needed to take on the next static resistance near 1.2775. Further up, the December 28 high of 1.2828 will be next on the buyers’ radars.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the strongest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.11% | -0.18% | -0.18% | -0.41% | 0.05% | -0.63% | 0.09% | |

| EUR | 0.12% | -0.06% | -0.06% | -0.30% | 0.17% | -0.52% | 0.20% | |

| GBP | 0.17% | 0.06% | 0.00% | -0.24% | 0.23% | -0.46% | 0.26% | |

| CAD | 0.17% | 0.11% | 0.00% | -0.24% | 0.22% | -0.46% | 0.26% | |

| AUD | 0.40% | 0.29% | 0.23% | 0.23% | 0.46% | -0.22% | 0.48% | |

| JPY | -0.05% | -0.17% | -0.21% | -0.26% | -0.50% | -0.65% | 0.05% | |

| NZD | 0.64% | 0.51% | 0.45% | 0.45% | 0.22% | 0.68% | 0.71% | |

| CHF | -0.09% | -0.20% | -0.26% | -0.26% | -0.51% | -0.01% | -0.72% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.