GBP/USD Weekly Forecast: Pound Sterling looks at 1.2800 in US data-packed week

- The Pound Sterling tested 1.2800 against the US Dollar but failed to resist at higher levels.

- GBP/USD buyers hold the reins marching into the US Nonfarm Payrolls week.

- The Pound Sterling needs acceptance above 1.2800 to sustain the bullish momentum.

The Pound Sterling (GBP) tested 1.2800 against the US Dollar (USD) this week, as the GBP/USD pair hit a new two-month high before sellers jumped back into the game.

Pound Sterling enjoyed a two-way business

GBP/USD set off the week on a bullish note, extending the previous week’s rebound amid US and UK market holidays on Monday. Thin trading helped the pair stay afloat as the Pound Sterling continued to capitalize on the hot UK inflation data, which revived expectations about a delay in the Bank of England's (BoE) policy pivot.

Meanwhile, the US Dollar lost ground on a positive shift in risk sentiment from Friday. The Greenback bore the brunt of the renewed optimism in the Chinese economy after China announced several measures to prop up its property sector and the semiconductor industry.

Improved risk appetite and broad US Dollar weakness drove GBP/USD to a new two-month high of 1.2800 on Tuesday. But Pound Sterling sellers quickly fought back control amid resurgent demand for the US Dollar. Increased safe-haven flows combined with the hawkish commentary from Minneapolis Federal Reserve President Neel Kashkari saved the day for the US Dollar buyers.

Lingering geopolitical tensions between Israel and Gaza spooked investors’ sentiment, boosting the safe-haven demand for the Greenback. Israeli forces shelled a tent camp in a designated “safe zone” west of Rafah and killed at least 21 people, including 13 women and girls, in the latest mass killing of Palestinian civilians. The UN Security Council convened an emergency meeting over Israel’s ground invasion of Rafah as Spain, Ireland, and Norway formally recognized the state of Palestine.

Meanwhile, Kashkari said in a CNBC interview on Tuesday that the Fed should wait for significant progress on inflation before lowering the policy rate. Additionally, upbeat US Conference Board's (CB) Consumer Confidence data also helped put a floor under the US Dollar. The US CB Consumer Confidence Index rose to 102.00 from 97.5 in April.

However, in the second half of the week, the US Dollar once again lost the upside impetus, following Thursday’s downward revision to the annualized first-quarter US Gross Domestic Product (GDP) data to 1.3% from 1.6% in the first estimate and a modest increase in the Initial Jobless Claims. Weak data raised concerns over a potential ‘soft-landing’ for the US economy this year, reviving expectations of a September Fed rate cut.

According to the CME FedWatch Tool, markets price in 49% odds that the Fed will hold rates in September, down from 53% seen earlier in the week. The probability of a November rate cut increased to 64% from about 60% previously. The revival in the dovish Fed expectations thrashed the US Treasury bond yields alongside the US Dollar on Thursday, allowing GBP/USD to stage a decent comeback to near 1.2750, having briefly fallen below the 1.2700 threshold on Wednesday.

GBP/USD, however, stalled its recovery momentum as buyers turned cautious early Friday, anticipating the high-impact US core Personal Consumption Expenditure (PCE) Price Index. The Federal Reserve’s preferred inflation measure could offer cues on the timing of the Fed rate cut, significantly impacting the US Dollar’s performance against its six major currency counterparts, including the British Pound.

The USD came under modest bearish pressure in the American session on Friday and allowed GBP/USD to recover above 1.2750 after the data showed that inflation, as measured by the change in the PCE Price Index, held steady at 2.7% on a yearly basis in April. This reading matched March's increase and came in line with the market expectation. The core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% on a yearly basis, also meeting analysts' estimates.

Eyes on US payrolls as the ‘blackout’ period kicks in

Another week, dominated by US economic data, awaits the Pound Sterling markets amid a data-sparse UK docket.

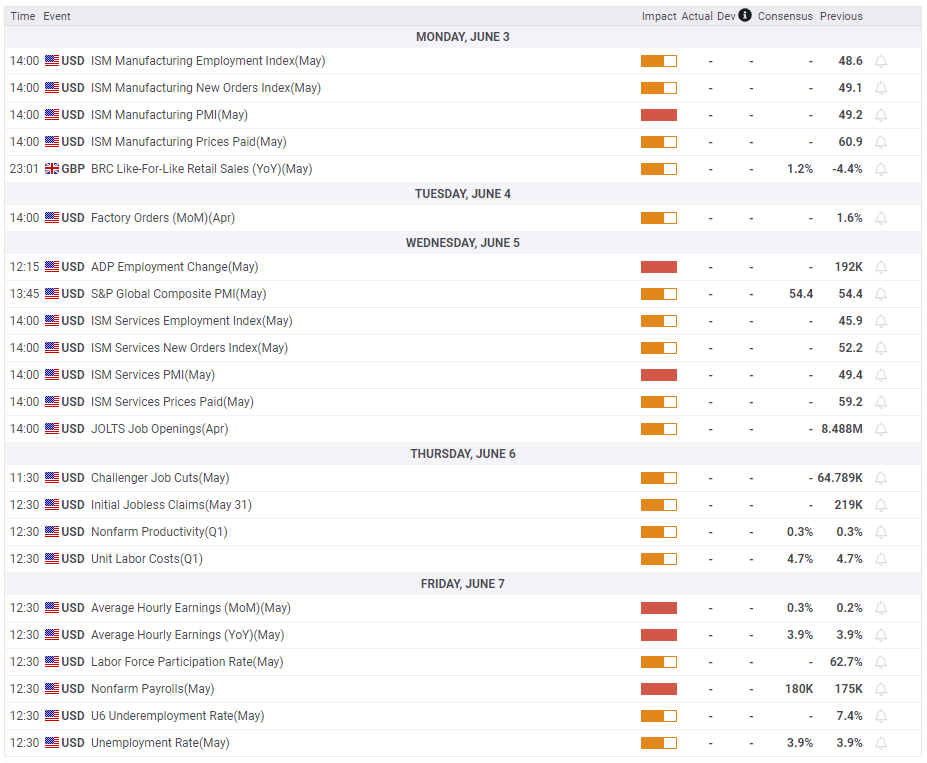

US ISM Manufacturing PMI will hog the limelight on Monday ahead of Tuesday’s JOLTS Job Openings survey. Wednesday will feature the key US ADP Employment Change data, followed by the ISM Services PMI.

The weekly US Jobless Claims will drop on Thursday after the European Central Bank’s (ECB) policy announcements, which could have a EUR/GBP cross-driven ‘rub-off’ effect on the Pound Sterling.

Later on Friday, the US Nonfarm Payrolls and the Wage inflation data will stand out as the labor market report will be published.

There will be no communication from the BoE policymakers until the July 4 UK general election while the Fed enters its ‘blackout’ period on June 1 ahead of the June 11-12 monetary policy meeting.

GBP/USD: Technical Outlook

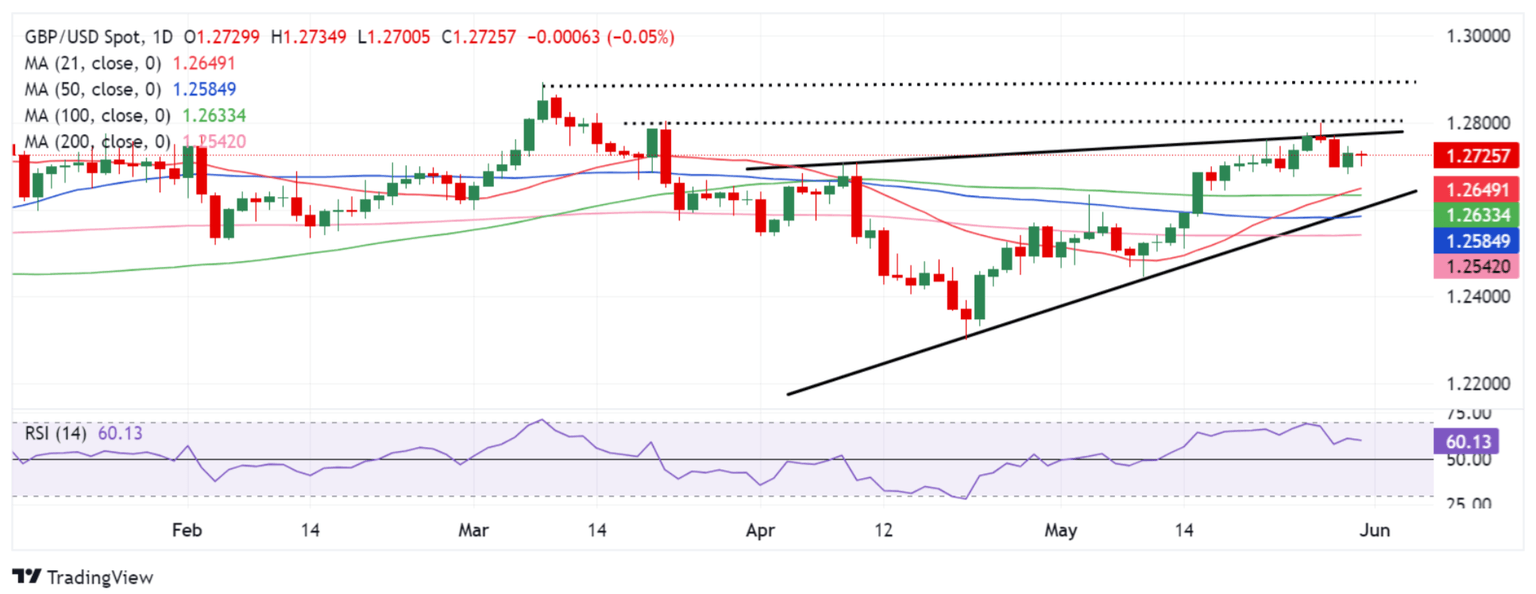

As observed on the daily chart, GBP/USD continues to range within a two-month-long rising wedge formation.

The pair briefly breached the upper boundary of the pattern, then at 1.2765, to challenge 1.2800 but failed to yield a daily closing above the latter.

The 14-day Relative Strength Index (RSI) has turned lower but holds well above the 50 level, currently near 60, suggesting that there is more room to the upside for the Pound Sterling.

Adding credence to the bullish potential, the 21-day Simple Moving Average (SMA) crossed the 100-day SMA for the upside on Wednesday, confirming a Bull Cross.

GBP/USD, however, needs to secure a daily close above the upper boundary of the pattern, now at 1.2775 to take out the March 21 high of 1.2804.

Acceptance above the latter would negate any near-term bearish bias, fueling a fresh uptrend toward the March 8 high of 1.2894. The next relevant resistance is seen at the 1.2950 psychological level.

However, if buyers face rejection at the upside hurdle of the potential rising wedge once again, the initial support could be seen near 1.2640, where the 21-day SMA and the 100-day SMA hang around.

Further south, the confluence zone of the lower boundary of the wedge and the 50-day SMA at around 1.2590 will also test the bullish commitments.

The last line of defense for buyers is seen at the critical support near 1.2540, the 200-day SMA.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.