- Pound Sterling turned south after facing rejection at 1.2700 against the US Dollar.

- US Nonfarm Payrolls and Powell’s testimony to hog the limelight in the week ahead.

- Looking ahead, GBP/USD buyers stay hopeful whilst above the 200-day SMA at 1.2576.

The Pound Sterling (GBP) returned to red against the US Dollar (USD), reversing the previous week’s rebound. GBP/USD ran into offers once again near 1.2700, as the US Dollar (USD) paused its corrective downside.

Pound Sterling eases as US Dollar stalls correction

The Pound Sterling failed to sustain the previous week’s upbeat momentum and gave into the modest rebound staged by the US Dollar, as the sentiment around the Greenback continued to be supported by the expectations of delayed interest rate cuts by the US Federal Reserve (Fed).

The US Dollar paused its correction from three-month highs, despite softening Core Personal Consumption Expenditures - Price Index (PCE), as the probability for a June Fed rate cut remained more or less the same. The Fed’s preferred inflation gauge aligned with estimates of 2.8% YoY in January but eased from December’s 2.9% increase.

The Greenback also drew support from the recent hawkish comments from several Fed policymakers, who continued to push back against bets for an early Fed policy pivot. Earlier this week, Kansas City Fed President Jeffrey Schmid, a new hawk, noted that the “Fed should be patient, wait for convincing evidence that inflation fight has been won.” Fed Governor Michelle Bowman said on Tuesday that slower-than-expected progress on inflation has left her cautious about the monetary policy stance.

Meanwhile, Atlanta Fed President Raphael Bostic said Thursday that the recent data shows the road back to the central bank’s 2% inflation goal will be “bumpy.” Chicago Fed President Austan Goolsbee, also speaking Thursday, said he expects rate cuts later this year but didn’t specify when.

Markets are currently pricing in just about a 25% chance that the Fed could begin easing rates in May, much lower than an over 90% chance a month ago, according to the CME FedWatch Tool. For the June meeting, the probability of a rate cut now stands at about 65%, up from 60% at the start of the week.

On the US data front, US Durable Goods Orders slumped by 6.1% in January while the CB Consumer Confidence index dipped to 106.7 in February. Both figures missed the market expectations. Meanwhile, US GDP was revised to an annual rate of 3.2% in the fourth quarter of 2023, from an initial estimate of 3.3% released last month.

From the UK side, there were no high-impact economic data releases, and therefore, the focus remained on the American macro news for any trading impetus on the GBP/USD pair.

The data from the US showed on Friday that the ISM Manufacturing PMI declined to 47.8 in February from 49.1 in January. This reading missed the market expectation of 49.5 and made it difficult for the USD to gather strength ahead of the weekend, allowing GBP/USD to stabilize above 1.2600.

Week ahead: US Nonfarm Payrolls and Powell in focus

GBP/USD traders gear up for another data-heavy economic calendar from the United States, with the central focus on the employment data and Fed Chair Jerome Powell’s testimony.

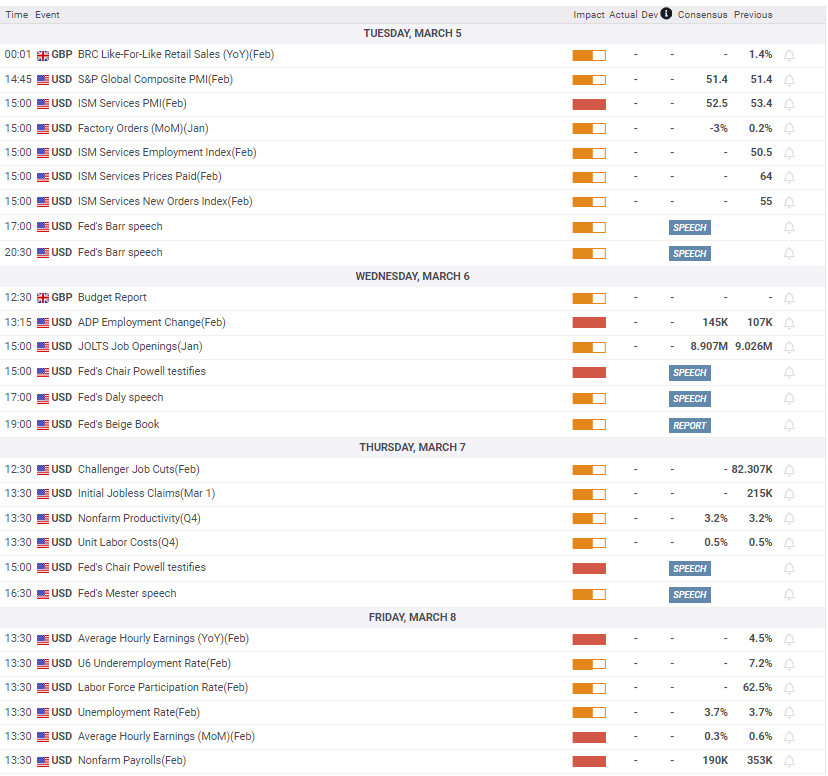

Monday is data-empty on both sides of the Atlantic, with the US ISM Services PMI and Factory Orders data likely to feature on Tuesday.

On Wednesday, the US ADP Employment Change data and JOLTS Job Openings report will be eyed by investors, alongside the first day of Powell’s testimony on the semi-annual Fed’s Monetary Policy Report (MPR) before the House Financial Services Committee, in Washington DC. Also, of note will be the UK’s Spring Budget announcement by Finance Minister Jeremy Hunt.

The European Central Bank (ECB) will announce its policy decision on Thursday. The ECB event could have a EUR/GBP-driven “rub-off” effect on the Pound Sterling. However, the US Jobless Claims and day 2 of Powell’s testimony will also impact the pair’s near-term trading direction.

Friday will feature the all-important US Nonfarm Payrolls and wage inflation data, which will be key to repricing the markets’ expectations of the timing of the Fed rate cut. Besides, speeches from the Fed policymakers will continue to play their part in the GBP/USD price dynamics before the blackout period ahead of the next FOMC meeting begins on March 9.

GBP/USD: Technical Outlook

GBP/USD appears to be a “buy-the-dips” trade in the near term, as observed on the daily chart.

The pair is clinging to the 21-day Simple Moving Average (SMA) at 1.2622 after having faced rejection at 1.2700 on multiple occasions.

The 14-day Relative Strength Index (RSI) is sitting just beneath the 50 level, suggesting that GBP/USD could see some weakness ahead before buyers jump in.

If the selling momentum gains traction, the pair could extend the weekly drop to test the 200-day SMA at 1.2576.

GBP/USD buyers are expected to emerge at that level, reviving the buying interest in the Pound Sterling. However, if the 200-day SMA fails to hold, the pair could fall further toward the 100-day SMA at 1.2553.

Further south, the 1.2450 psychological level could act as a tough nut to crack for sellers.

On the flip side, defending the 21-day SMA is critical for GBP/USD to stage a rebound toward the 50-day SMA at 1.2674.

The next upside target for buyers is seen at the 1.2750 psychological barrier, above which the static resistance near 1.2775 will be tested.

The December 28 high of 1.2828 will be the next level on the buyers’ radars.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD bounces off 1.1300, Dollar turns red

After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

GBP/USD regains pace, retargets 1.3200

The now offered stance in the Greenback lends extra support to GBP/USD and sends the pair back to the vicinity of the 1.3200 hurdle, or multi-day highs, amid a generalised better tone in the risk-linked universe on Monday.

Gold trades with marked losses near $2,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.