GBP/USD Weekly Forecast: Can Pound Sterling stage a steady rebound?

- Pound Sterling hit fresh weekly low on sustained US Dollar demand.

- GBP/USD traders look to S&P Global US and UK PMI data in the week ahead.

- Looking ahead, GBP/USD seems poised for a rebound but bearish potential remains intact.

The Pound Sterling (GBP) continued to remain in the back seat against the US Dollar (USD), as GBP/USD extended its bearish momentum into the fifth week in a row.

UK economic data fail to lift the Pound Sterling

The price action around the GBP/USD pair was mainly driven by a host of top-tier economic data releases from the United States (US) and the United Kingdom (UK), which helped reprice the markets’ expectations of a dovish policy pivot by the US Federal Reserve (Fed) and the Bank of England (BoE).

The pair traded directionless at the start of the week on Monday, as traders moved on the sidelines and refrained from placing any fresh positional bets, in anticipation of the all-important US Consumer Price Index (CPI) data due on Tuesday.

The UK labor market report was also published on Tuesday, which put a fresh bid under the Pound Sterling. Data released by the Office for National Statistics (ONS) showed on Tuesday, employment rose by 72K in the final three months of 2023 and the Unemployment Rate fell to 3.8% in the same period. Resilient pay growth and strong hiring backed the narrative of “higher interest rate for longer” by the BoE.

However, hawkish commentary from the Fed officials combined with hotter-than-expected US inflation data reinforced the selling interest around GBP/USD. The annual CPI inflation in the US fell to 3.1% in January following a brief increase to 3.4% in December but outpaced forecasts of 2.9%. The US CPI edged up 0.3% MoM, the most in four months, and above forecasts of 0.2%.

Hot US inflation report justified the Fed’s pushback against early and aggressive interest rate cut expectations, triggering a fresh rally in the US Treasury bond yields and the US Dollar. In light of this, GBP/USD reversed sharply from the weekly high of 1.2688 to as low as 1.2575.

The correction in the currency pair gained momentum on Wednesday after the annual CPI inflation in the UK remained unchanged at 4.0% in January, against the market forecast of an increase to 4.2%. Core CPI arrived at 5.1% YoY in the reported month, missing estimates of 5.2%.

Softer UK inflation data dialed down odds of BoE interest rate cuts for this year. Markets now price about 70 basis points (bps) of BoE easing this year, down from about 100 bps seen a week ago.

On the contrary, hot US CPI numbers made markets push back their expectations of a Fed policy pivot until June. Markets have almost priced out a March Fed rate cut while a lower than 50% chance of easing is seen for the May meeting.

Downbeat US Retail Sales data capped the US Dollar upside, offering relief for the Pound Sterling on Thursday. This came after the Pound was heavily impacted by the confirmation of a technical recession in the UK. US Retail Sales declined by 0.8% in January, the US Census Bureau reported on Thursday, worse than the market expectations for -0.1%.

Meanwhile, UK Gross Domestic Product (GDP) contracted by 0.3% in the three months to December, having shrunk by 0.1% between July and September. Despite a weak UK economic outlook, BoE policymakers remained quite optimistic and maintained the central bank’s hawkish bias, offering legs to the tepid recovery in GBP/USD on Thursday.

Pound Sterling buyers gave into the US Dollar resurgence, in anticipation of hot US Producer Price Index (PPI) inflation data and an improvement in the UoM Consumer Sentiment.

GBP/USD failed to capitalize on strong UK Retail Sales data on Friday. The UK Retail Sales rebounded 3.4% over the month in January vs. 1.5% expected and -3.3% reported in December, the latest data released by the ONS showed on Friday. Later in the day, the US Bureau of Labor Statistics announced that the Producer Price Index rose 0.9% on a yearly basis in January, compared to the market expectation for an increase of 0.6%. The Core PPI increased 2% in the same period to surpass analysts' estimate of 1.6%. The USD held resilient against its peers after these data releases and made it difficult for GBP/USD to stage a rebound ahead of the weekend.

Week ahead: PMIs take center stage

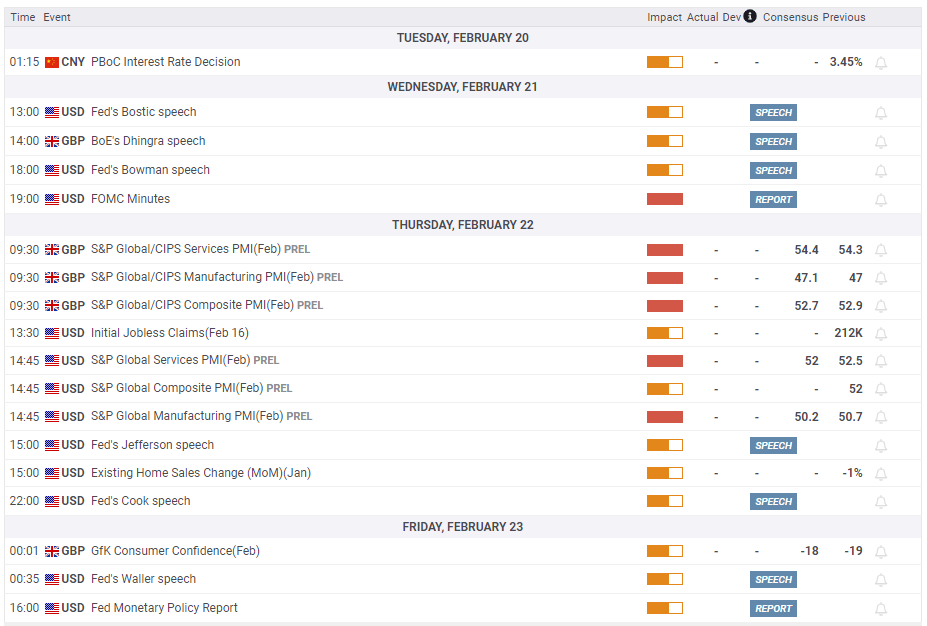

It’s a relatively data-light week after a busy one, as the S&P Global PMI data from both sides of the Atlantic will draw attention. Also, it is a US holiday on Monday, in observance of Presidents' Day.

The first half of the week is devoid of any high-impact macro data releases, and hence, Pound Sterling traders will eagerly await Thursday’s PMI data. Bank of England's Monetary Policy Committee (MPC) member Megan Greene will also speak on Thursday.

On the US docket, besides the preliminary PMI reports, the weekly Jobless Claims and housing data will also be closely eyed. Fed Vice Chair Philip Jefferson is scheduled to make an appearance on Thursday.

On Friday, BoE official Greene will speak again this week while the Fed Monetary Policy Report is likely to stand out that day.

GBP/USD: Technical Outlook

The short-term outlook for GBP/USD points to a brief corrective bounce before the downtrend resumes.

Pound Sterling needs a convincing break below the 200-day Simple Moving Average (SMA) of 1.2565 to initiate a fresh descent.

The 14-day Relative Strength Index (RSI) indicator holds below the 50 level, suggesting that any rebound in GBP/USD is likely to be sold off.

Adding credence to the negative outlook for the GBP/USD pair, the previous week’s 21-day SMA and 50-day SMA Bear Cross remains in play.

On the downside, a breach of the 200-day SMA at 1.2565 will reopen floors toward the 100-day SMA at 1.2507. Further south, the 1.2450 psychological level could test bullish commitments. The last line of defense for buyers is seen at the mid-November lows of around 1.2375.

However, if Pound Sterling buyers manage to close the week above the 200-day SMA, the 21-day SMA at 1.2650 will be put to the test. The next topside barrier for the pair is seen at the 50-day SMA of 1.2680.

Acceptance above that level is needed to take on the next static resistance near 1.2775. The December 28 high of 1.2828 will be next on the buyers’ radars.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.