GBP/USD Weekly Forecast: Pound Sterling buyers to stay hopeful in the UK GDP week

- Pound Sterling buyers returned, pushing GBP/USD back above 1.2300.

- GBP/USD looks to the UK Q3 GDP report for a fresh directional impetus.

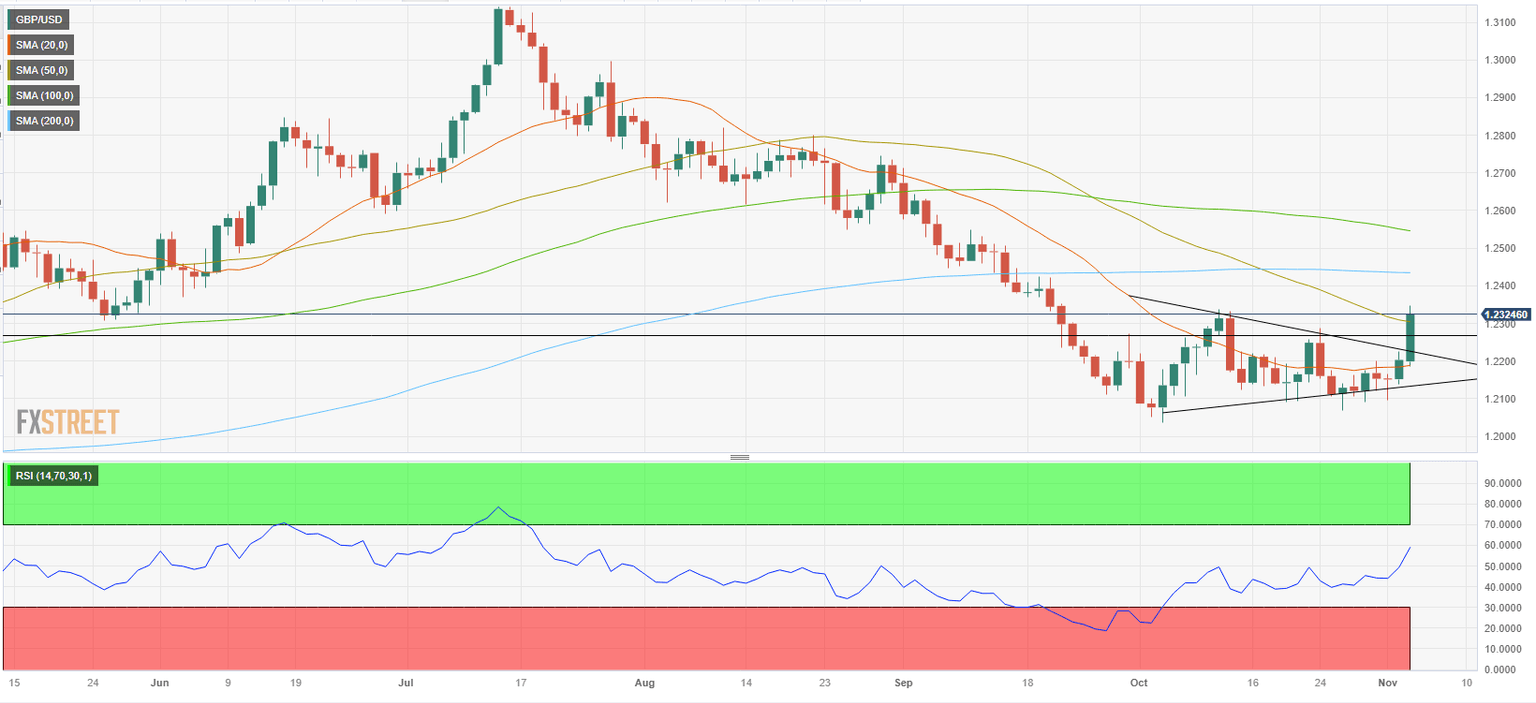

- GBP/USD stays within a symmetrical triangle, as RSI turns neutral on the daily chart.

Pound Sterling buyers regained the upper hand against the United States Dollar (USD) in the central banks’ bonanza week, reviving GBP/USD from multi-week troughs. GBP/USD managed to climb above a critical technical level, as we head toward a relatively data-light week.

GBP/USD: What happened last week?

The policy announcements from both the US Federal Reserve (Fed) and the Bank of England (BoE) served as a saving grace for the GBP/USD pair, helping it recover from a three-week low of 1.2070 set a week ago. The BoE came across as more hawkish than the Fed and this divergence enabled the Pound Sterling to reclaim the 1.2300 barrier against the US Dollar.

The Fed on Wednesday left the key rates unchanged in the range of 5.25%-5.50%, as expected. However, Fed Chair Jerome Powell’s words were perceived as not-so hawkish, prompting markets to pare back bets of a rate increase in December. Markets wagered an 80% probability of a Fed pause next month in the Fed aftermath. Meanwhile, the BoE also stood pat on the interest rate, holding it at 5.25% for the second consecutive meeting on Thursday. However, three policymakers, Catherine Mann, Megan Greene and Jonathan Haskel, voted in favor of a rate hike, suggesting that there are upside risks to future rate hikes.

Additionally, the sell-off in the US Treasury bond yields, following the Treasury’s quarterly refunding announcement and mostly downbeat US economic data releases added to the downward pressure on the US Dollar, lifting GBP/USD to fresh weekly highs. The US Treasury announced that said the government will slow increases in the size of its longer-dated auctions. The auction of 10-year Treasuries was increased by $2 billion, below the market's expectations of $3 billion. The benchmark 10-year Treasury bond yield tumbled over 20 basis points (bps) to 4.7089%, the lowest in more than two weeks on Wednesday, weakening further in the Fed aftermath on Thursday to challenge the 4.60% level.

From the US economic docket, the ADP private sector payrolls rose 113K in October, below the estimate of 150K. US ISM Manufacturing PMI slumped to 46.7 in October vs. 49.0 expected. The Job Openings and Labor Turnover Summary (JOLTS) report showed that the number of job openings on the last business day of September stood at 9.55M, slightly up from a revised 9.50M in August and ahead of the 9.25M forecast. Initial Jobless Claims increased by 5,000 in the week ending October 27, its highest level in seven weeks.

In the early part of the week, expectations surrounding a hawkish Fed policy outlook supported the US Dollar alongside the persistent strength in the US Treasury bond yields, leaving GBP/USD languishing near the 1.2100 region. Lingering geopolitical concerns surrounding the Hamas-Israel conflict also continued to weigh on the higher-yielding Pound Sterling. Israeli Prime Minister Benjamin Netanyahu said on Monday that he will not agree to a cease-fire, threatening further escalation in the region.

On Friday, GBP/USD gathered bullish momentum and climbed above 1.2300 for the first time since late September. The data from the US showed that Nonfarm Payrolls (NFP) rose by 150,000 in October. This reading came in below the market expectation of 180,000 and triggered a USD selloff ahead of the weekend. Other details of the jobs report revealed that September’s 336,000 rise in NFP got revised lower to 297,000 and the Unemployment Rate edged higher to 3.9% from 3.8%.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -1.36% | -1.73% | -1.30% | -2.38% | -0.04% | -2.76% | -0.22% | |

| EUR | 1.33% | -0.38% | 0.07% | -1.00% | 1.30% | -1.40% | 1.11% | |

| GBP | 1.72% | 0.38% | 0.42% | -0.63% | 1.68% | -1.01% | 1.51% | |

| CAD | 1.32% | -0.07% | -0.42% | -1.07% | 1.23% | -1.44% | 1.07% | |

| AUD | 2.31% | 0.99% | 0.64% | 1.02% | 2.28% | -0.39% | 2.11% | |

| JPY | 0.05% | -1.31% | -1.59% | -1.27% | -2.34% | -2.72% | -0.17% | |

| NZD | 2.70% | 1.36% | 1.01% | 1.42% | 0.37% | 2.65% | 2.47% | |

| CHF | 0.24% | -1.12% | -1.48% | -1.04% | -2.13% | 0.19% | -2.51% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Week ahead: UK GDP takes center stage

Following the central banks’ bonanza week, Pound Sterling traders are likely to catch a breather amid a relatively quiet week ahead.

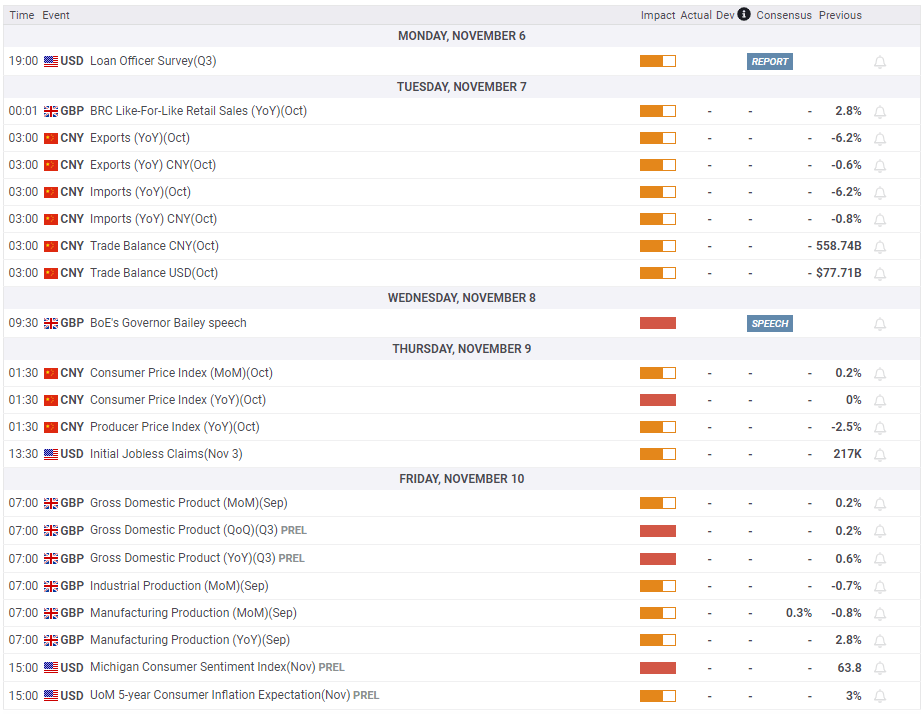

There are no high-impact economic data releases from both sides of the Atlantic in the first half of the week. The low-tier UK Construction PMI will be published on Monday while Tuesday and Wednesday lack any relevant data releases.

On Thursday, however, the focus will be on China’s Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data, which could play a pivot point in driving the market sentiment. Later that day, the US Jobless Claims data will be of note from the United States.

Friday will feature the preliminary third-quarter Gross Domestic Product (GDP) from the United Kingdom alongside the monthly GDP, Manufacturing and Industrial Production data. From the US docket, the preliminary University of Michigan (UoM) Consumer Sentiment and Inflation Expectations data will be reported.

Apart from the scheduled economic data publication, Federal Reserve policymakers will return to the rostrum while the Middle East geopolitical tensions will be also closely followed by market participants.

GBP/USD: Technical outlook

From a short-term technical perspective, the GBP/USD outlook appears to be shifting in favor of Pound Sterling buyers. The 14-day Relative Strength Indicator (RSI) climbed to 60 and the pair broke above the symmetric triangle and the 50-day Simple Moving Average (SMA), reflecting a buildup of bullish momentum.

As long as GBP/USD holds above 1.2300 (50-day SMA), buyers could remain interested. In this scenario, the 200-day SMA could be seen as the next resistance at 1.2430 ahead of 1.2500 (psychological level).

On the downside, key support is located in the 1.2190-1.2200 area, where the ceiling of the broken triangle meets the 20-day SMA. If GBP/USD returns below that level, the ascending trend line could act as interim support at 1.2130 before the seven-month low of 1.2037.

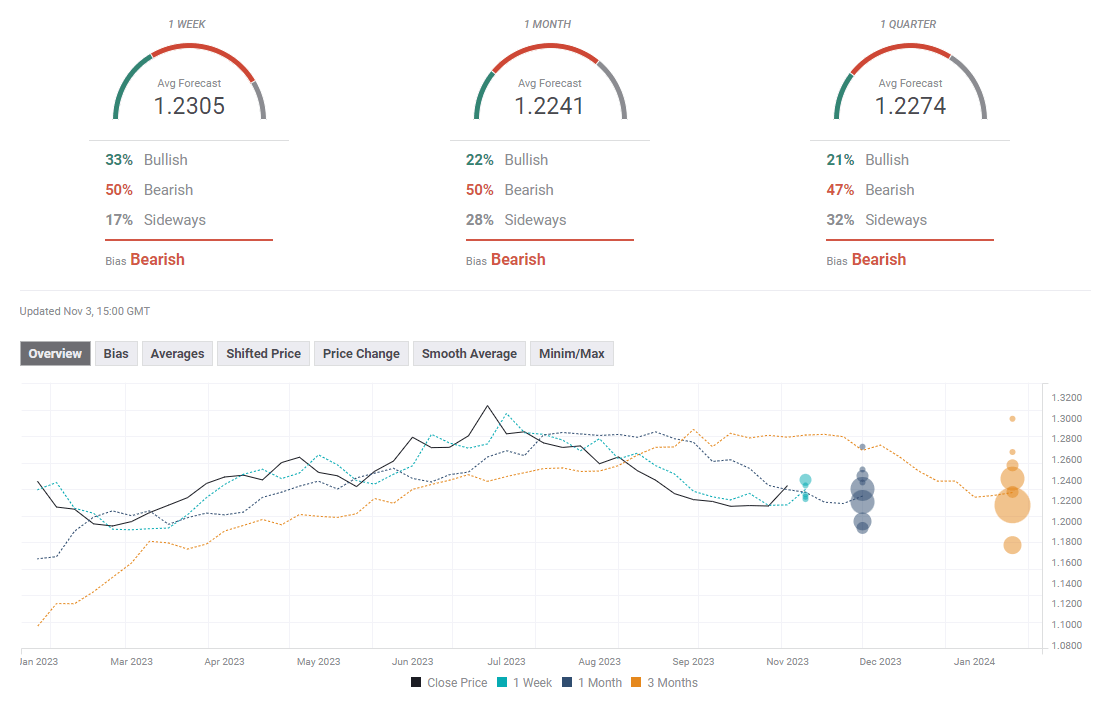

GBP/USD: Forecast poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.