- GBP/USD continued to find demand amid divergent Fed-BoE rate outlooks.

- Top-tier US economic data will determine GBP/USD’s next directional move.

- GBP/USD could range within a potential rising wedge, with RSI still bullish.

The GBP/USD bull-bear tug-of-war extended for the second week in a row amid signs of bullish exhaustion and as the United States Dollar (USD) found its feet following a series of weekly declines. The focus will remain on the macroeconomic and policy divergence between the United States and the United Kingdom in the week ahead, as the preliminary Q1 US Gross Domestic Product (GDP) data release will take center stage.

GBP/USD: What happened last week?

Last week’s struggle extended, as choppy trading remained the name of the game, leaving GBP/USD gyrating in a familiar range around the 1.2400 level throughout the week. The US Dollar struggled for a clear directional bias amid a relatively data-light week while investors assessed the Federal Reserve interest rate outlook alongside key US corporate earnings reports. Poor Netflix results were followed by a revenue miss in Tesla’s earnings, which spooked markets further and kept the US Dollar bulls motivated.

Meanwhile, United Kingdom’s annualized Consumer Price Index (CPI) softened less than expected in March, arriving at 10.1% vs. 9.8% expected. This fanned expectations that the Bank of England (BoE) will need to stay committed to its rate hike trajectory to tame stubbornly high inflation. Earlier in the week, higher UK pay growth data also backed the hawkish BoE narrative. Markets fully priced in a 25 bps rate hike by the Bank of England next month following the upbeat UK top-tier statistics.

The pair, therefore, received a fresh lift in the first half of the week but the upside lost traction as the US Dollar bulls found their footingamid a tepid risk sentiment and hawkish commentary from Federal Reserve policymakers throughout the week. New York Fed President, John Williams, emphasized that “inflation is still too high, and we will use our monetary policy tools to restore price stability.” Cleveland Federal Reserve President, Loretta Mester, reiterated that the Fed has more work to do with inflation in the US staying too high. Meanwhile, the European Central Bank (ECB) policymakers contemplated between a 25 bps or 50 bps rate hike at the upcoming meeting.

Concerns resurfaced that central banks may have to keep rates higher for longer, in the wake of elevated inflation level, which could tip the global economy into recession. The US Dollar continued to find support from a cautious market environment, further reinforced by the latest weak economic data from the United States. Initial claims for state unemployment benefits rose 5,000 to a seasonally adjusted 245,000 for the week ended April 15, the United States Labor Department said on Thursday. The Fed's "Beige Book" report on Wednesday described job gains as having "moderated somewhat" in early April "as several districts reported a slower pace of growth" than in recent reports.

Friday’s downbeat UK Retail Sales added to the weight on the GBP/USD pair. The UK Retail Sales dropped 0.9% over the month in March vs. -0.5% expected and 1.1% previous. The Core Retail Sales, stripping the auto motor fuel sales, declined by 1.0% MoM vs. -0.7% expected and 1.4% previous. Mixed UK S&P Global Manufacturing and Services preliminary PMI reports also kept Cable bulls at bay. S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) fell to 46.6 in April versus 48.5 expected while the Preliminary UK Services Business Activity Index for April jumped to 54.9 as against 52.9 expected.

Ahead of the weekend, the data from the US showed that the business activity in the US private sector expanded at a stronger pace than expected in early April with S&P Global Composite PMI improving to 53.5 from 52.3 in April. With this upbeat data helping the USD hold its ground in the American session on Friday, GBP/USD found it difficult to stage a rebound.

Week ahead: All eyes on top-tier United States data

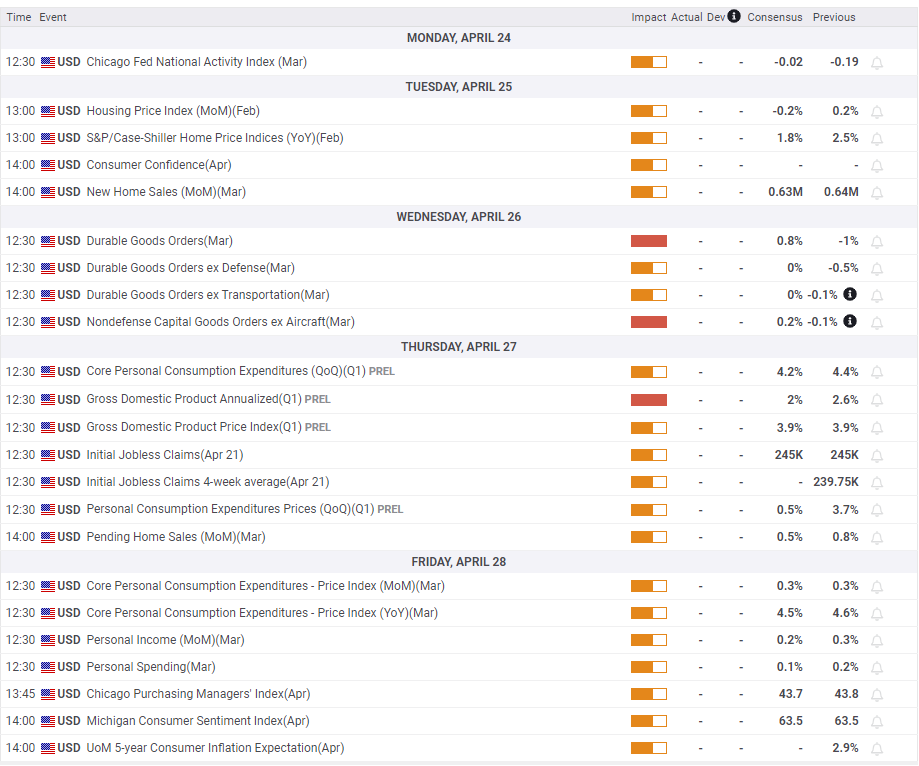

After a data-packed week for the United Kingdom, American traders gear up for a busy economic calendar from the United States. However, there will be no speeches lined up from the Federal Reserve policymakers, as the Fed enters its ‘blackout period’ from April 22 ahead of the May 2-3 policy meeting. Meanwhile, the British docket is devoid of any top-tier economic releases in the week ahead.

Tuesday will feature the UK Public Sector Net Borrowing data, which has little to no impact on the Pound Sterling. Across the pound, the Conference Board Consumer Confidence and New Home Sales data will hold relevance for US Dollar valuations.

Moving on, the UK CBI Realized Sales will drop on Wednesday, followed by the Durable Goods Orders and Goods Trade Balance data from the United States. Markets are unlikely to pay much attention to the latter ahead of Thursday’s preliminary Gross Domestic Product (GDP) data publication from the United States, which is foreseen at 2.7% YoY in the first quarter of 2023. Encouraging US growth numbers could douse concerns over the economy tipping into a recession and also about Fed rate cuts. Thus, the US Dollar could benefit from a strong US Q1 GDP report, keeping GBP/USD’s upside attempts in check.

The US Personal Consumption Expenditures Prices for Q1 and the weekly Jobless Claims data will be reported alongside the GDP release. The US Pending Home Sales data will be also eyed later in the American session on Thursday.

On Friday, all eyes will be on the Fed’s preferred inflation gauge, the annualized Core Personal Consumption Expenditures - Price Index, which is seen rising to 4.8% in March, compared with a 4.6% growth reported in February. The Q1 Employment Cost Index from the United States and the Personal Spending data will be also published ahead of the revised University of Michigan’s (UoM) Consumer Sentiment and Inflation Expectations data.

GBP/USD: Technical outlook

GBP/USD defied the bullish trend and struggled during most part of the week, as Pound Sterling sellers raised their ugly heads after the pair confirmed a three-week-long rising wedge breakdown on Monday.

Ever since, the wedge support-turned-resistance at 1.2471 continued to cap any upside attempts. However, buyers had the bullish 21-Day Moving Average (DMA) at 1.2400 to rely on.

In the week ahead, if the 21 DMA support holds, the major could revisit the 1.2500 hurdle, above which the ten-month top of 1.2545 will be put to test. Near that level, the wedge resistance aligns, making it a powerful upside barrier.

Further up, the May 2022 high at 1.2616 could challenge bullish commitments. The 50 and 100 DMAs bullish crossover could offer a hand to the potential upside in the pair, as the 14-day Relative Strength Index (RSI) continues to hold the fort above the 50.00 level.

On the flip side, a sustained break below the 21 DMA support could revive the selling interest in the GBP/USD pair, threatening the next critical support near 1.2350.

Pound Sterling sellers will then seek to find a foothold below the latter, initiating a fresh downtrend toward the 1.2200 level, where the 50 and 100 DMAs merge.

Ahead of that, the April 3 low at 1.2275 could come to the rescue of the GBP/USD optimists.

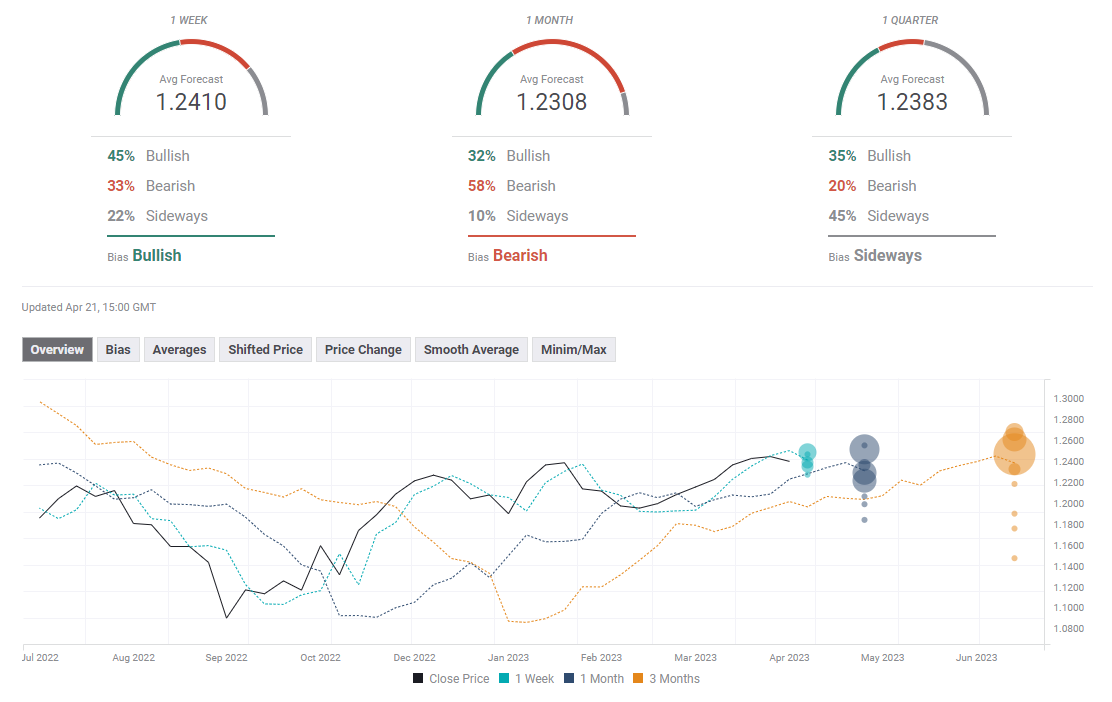

GBP/USD: Forecast poll

FXStreet Forecast Poll paints a mixed picture for GBP/USD in the near term. The average target on the one-week outlook is located slightly above 1.2400. The bearish bias stays intact for the one-month view.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.