Pound Sterling and US Dollar battle to be defined by central banks’ decisions

- Pound Sterling gave up control against the US Dollar, as GBP/USD corrected to a two-week low.

- A blockbuster week, with central banks’ 2023 finale set to rock the Pound Sterling.

- Downside appears limited for GBP/USD, as strong support aligns near 1.2450.

The Pound Sterling snapped a three-week uptrend against the United States Dollar (USD), fuelling a GBP/USD correction to two-week lows below 1.2600. Traders gear up for a central bank bonanza week, which could lead to a spike in volatility for the pair.

Pound Sterling gives into the US Dollar comeback

GBP/USD reversed the previous week’s gains and lost almost 150 pips, as the US Dollar staged a solid comeback against its major counterparts. Weak US JOLTS Job Openings and ADP Employment Change data suggested loosening labor market conditions and affirmed increased expectations of the Federal Reserve (Fed) interest rate cut in March weighing heavily on the US Treasury bond yields. However, this failed to deter US Dollar bulls, as Australian, UK and the euro area peripheral bond yields fell relatively rapidly after traders ramped up rate-cut bets for other central banks.

Markets priced in around an 85% chance that the European Central Bank (ECB) will cut interest rates at the March meeting while the odds of the Reserve Bank of Australia (RBA) being done with its hiking cycle also rose after this week’s dovish pause. Meanwhile, a quarter-point Bank of England (BoE) rate cut in June next year and a second reduction in September was fully baked in. For the Fed, the probability of a March rate cut stood at roughly 60%.

On the data front, the Institute for Supply Management (ISM) showed on Tuesday that the Services PMI registered 52.7 in November, firming up from October's reading of 51.8. However, US JOLTS Job Openings slid to more than a 2-1/2-year low of 8.733 million in October. The US Private payrolls rose by 103,000 jobs last month, the ADP Employment Change data showed on Wednesday, with the previous figure revised lower to show 106,000 jobs added instead of 113,000. The market consensus was for a 130K increase.

Meanwhile, there was nothing of note from the UK economic docket, except for the S&P Global final Services PMI, which showed an upward revision to 50.9 from the 50.5 preliminary readout. The UK service providers moved back into expansion mode during November but failed to inspire the Pound Sterling.

In the second half of the week, however, British Pound found some support amid a pause in the US Dollar upswing, as traders weighed the prospects of Fed rate cuts ahead of next week’s Federal Open Market Committee (FOMC) policy decision.

The US Dollar accelerated north on Friday following a stronger-than-anticipated Nonfarm Payrolls (NFP) report. Not only the country added 199K new jobs in November, but the unemployment rate declined to 3.7%. The figures spurred concerns, as they still indicate a tight labor market, which means the Federal Reserve has more to do to maintain inflation under control. Odds for rate cuts in 2024 decreased ahead of the central banks' meetings next week and the US CPI release.

Key events to watch out for Pound Sterling traders

Pound Sterling traders will be bracing themselves for one of the most eventful weeks of this year, studded with major global central bank final monetary policy announcements.

The Fed is set to announce a rate on-hold decision on Wednesday, followed by the BoE’s steady policy announcement on Thursday. This time around, it’s not just the interest rate decision, the former will publish the Statement of Economic Projections (SEP) – the so-called Dot Plot chart, which will be key to gauging the central bank’s interest rates outlook next year.

Meanwhile, the BoE’s communication in the policy statement will be closely scrutinized, as both, the Fed and the BoE, are expected to embark on the rate cuts trajectory in 2024. The next direction of the GBP/USD pair hinges on the Fed-BoE policy outlooks but volatility is set to remain intense.

Ahead of these events, the top-tier Consumer Price Index (CPI) inflation data from the US and the employment report from the UK are likely to provide some trading impetus on Tuesday, as Monday offers a quiet docket on both sides of the Atlantic. On Wednesday, the UK monthly Gross Domestic Product (GDP) data could entertain Pound Sterling markets in the lead-up to the Fed showdown.

Meanwhile, the Retail Sales and weekly Jobless Claims will fill up the US docket on Thursday, following the BoE policy outcome. The European Central Bank (ECB) is also due to announce its interest rate decision that day, and hence, could have the EUR/GBP cross-driven ‘rub-off’ effect on the Pound Sterling on any surprises.

Friday will feature the S&P Global preliminary Manufacturing and Services PMI data from the US and the UK. Also, the mid-tier US Industrial Production data will be released before the US PMIs. BoE Deputy Governor Dave Ramsden will speak during European hours on Friday but his speech is unlikely to be on monetary policy.

GBP/USD: Technical outlook

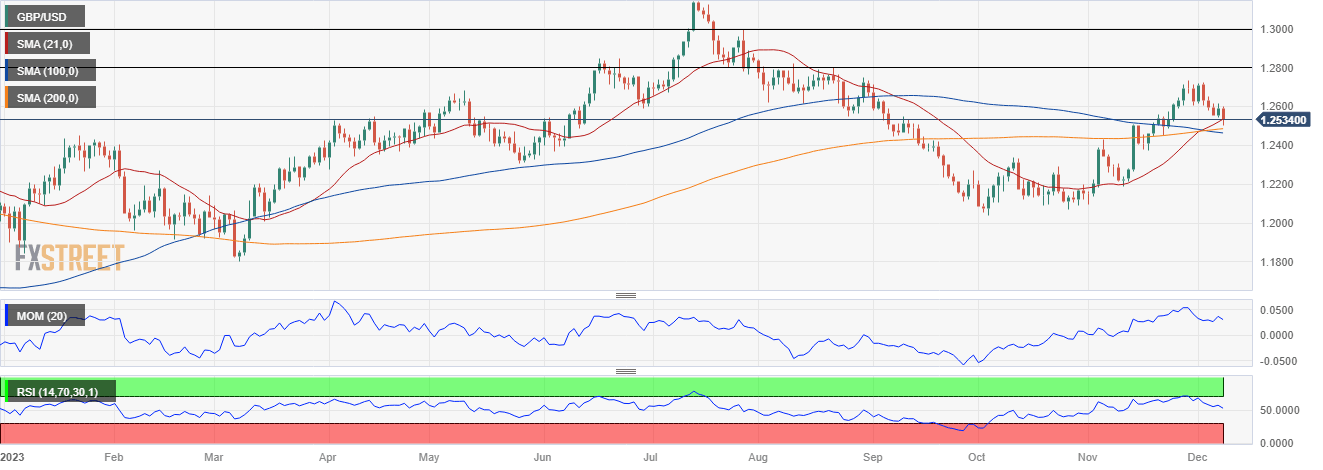

GBP/USD trades near the 1.2500 figure and aims to end the week at fresh lows, suggesting the path of least resistance is to the downside. Nevertheless, the 14-day Relative Strength Indicator (RSI) is holding above the 50 level, suggesting that additional declines are yet to be confirmed.

Adding credence to the negative outlook, the pair trades below the 21 Simple Moving Averages (SMA) on the daily timeframe, although still holding above the 100 and 200 SMAs.

Pound Sterling buyers will regain some ground if GBP/USD settles above the 21-day SMA at 1.2535.

A daily closing below the latter will expose the strong demand area around the 1.2470 level. The November 17 low of 1.2374 will be next on sellers’ radars. Additional declines could challenge the ascending 50-day SMA at 1.2339.

On the flip side, the August 30 high of 1.2746 remains a tough nut to crack for buyers, a break above which could expose the static resistance near 1.2820 en route to the 1.2900 round figure.

Economic Indicator

United Kingdom BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.