GBP/USD Weekly Forecast: Nonfarm Payrolls and the virus curve set to stir sterling

- GBP/USD has been unable to take advantage of dollar weakness due to rising UK covid cases.

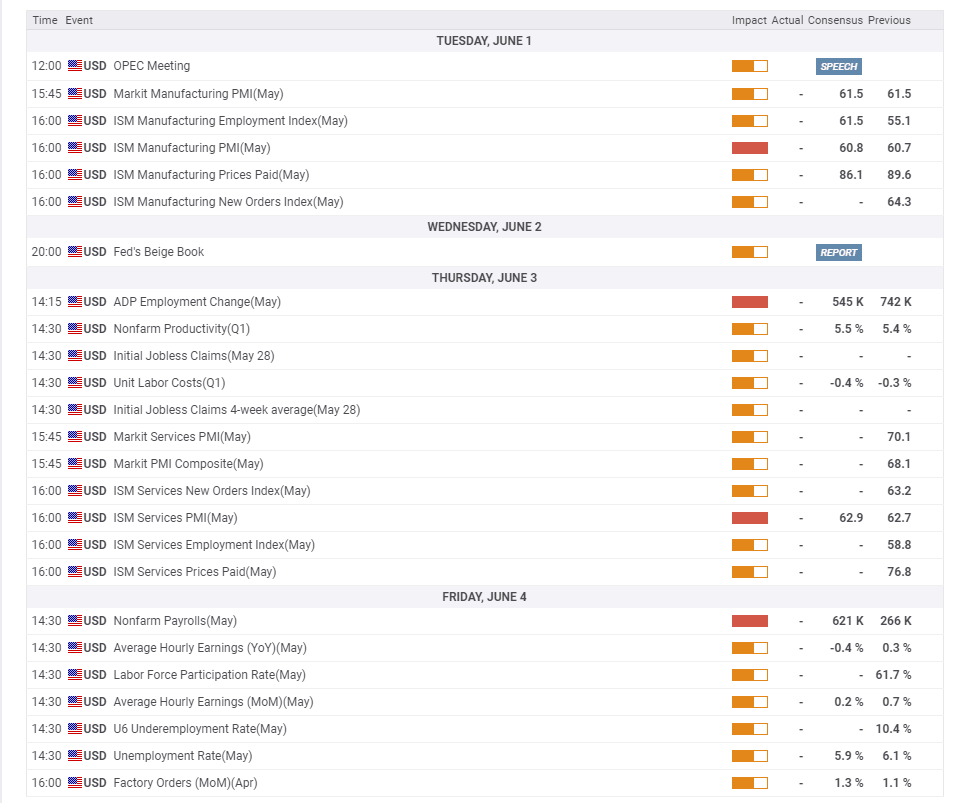

- A full buildup to US Nonfarm Payrolls and virus developments are set to dominate trading.

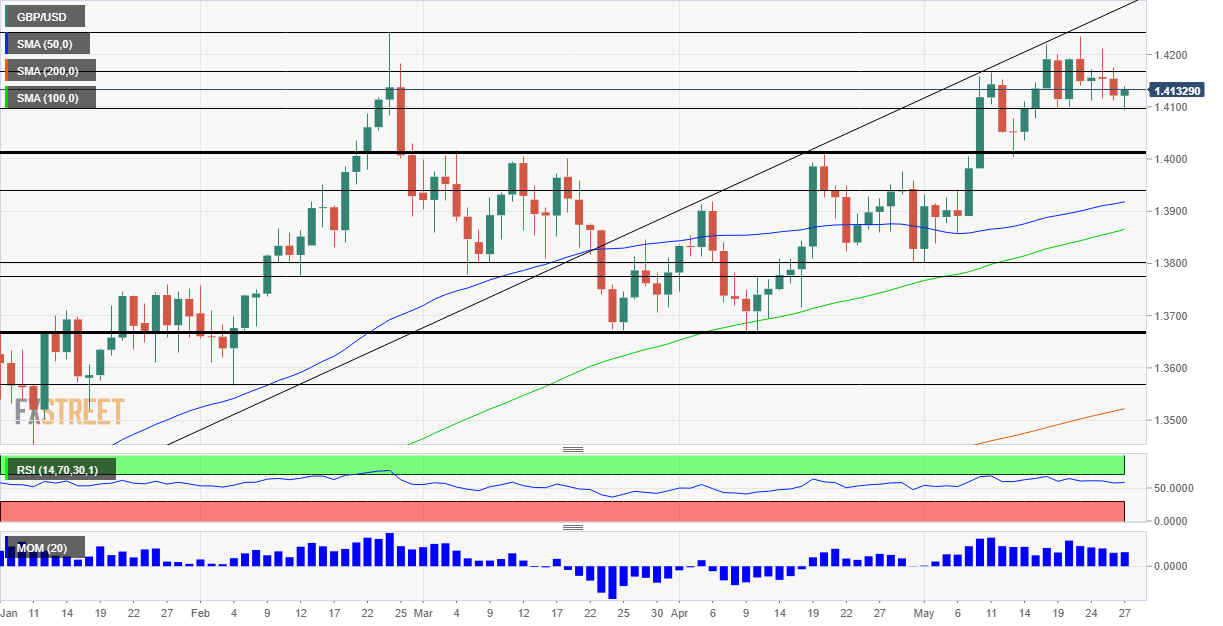

- Early June's daily chart is painting a mixed picture for the currency pair.

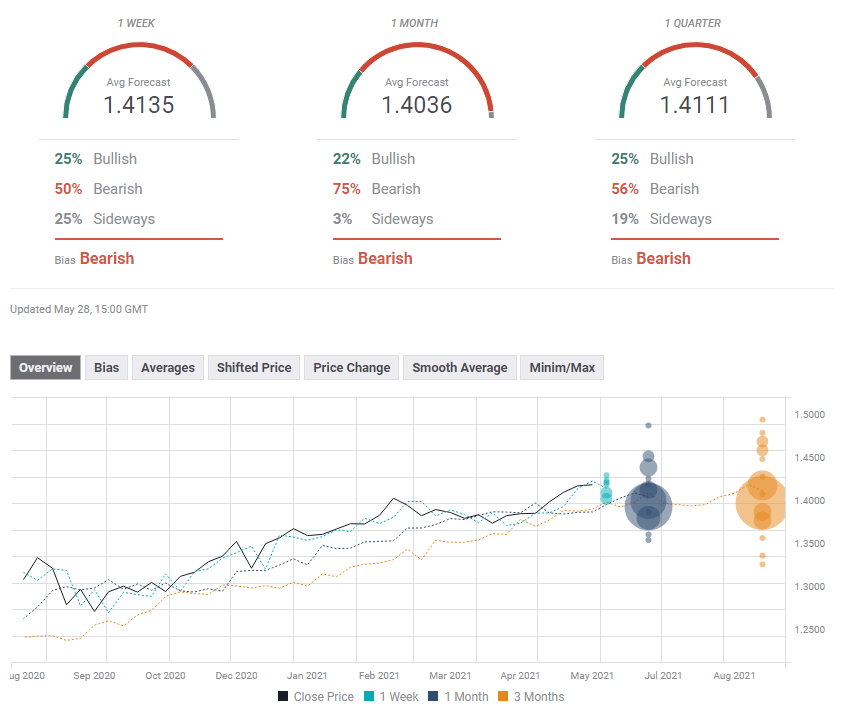

- The FX Poll is pointing to losses on all timeframes.

The Fed has downed the dollar – but sterling has also suffered from its own issues. As the page turns on June, cable is at a crossroads, and the all-important US jobs reports may serve as a tiebreaker. UK covid developments and other events are also in play.

This week in GBP/USD: Ugly contest between dollar and pound

Sticking to the script: A long list of Federal Reserve officials have taken to the stage, repeating the same message – the rise in inflation is transitory, and the economy has a long way to go. Heavyweight Fed Governors Lael Brainard and Randal Quarles were joined by Esther George. Usually, a hawk, the latter concurred with the other members that the bank is set to continue buying bonds at the current $120 billion/month pace, rejecting talk of tapering it down. This stance has been depressing the dollar.

Fresh economic figures have vindicated the Fed's stance with several misses. The Conference Board's Consumer Confidence came out at 117.2 in May, below expectations. The housing sector – which seemed to be steaming hot – showed signs of a cool down as seen by New Home Sales and other data.

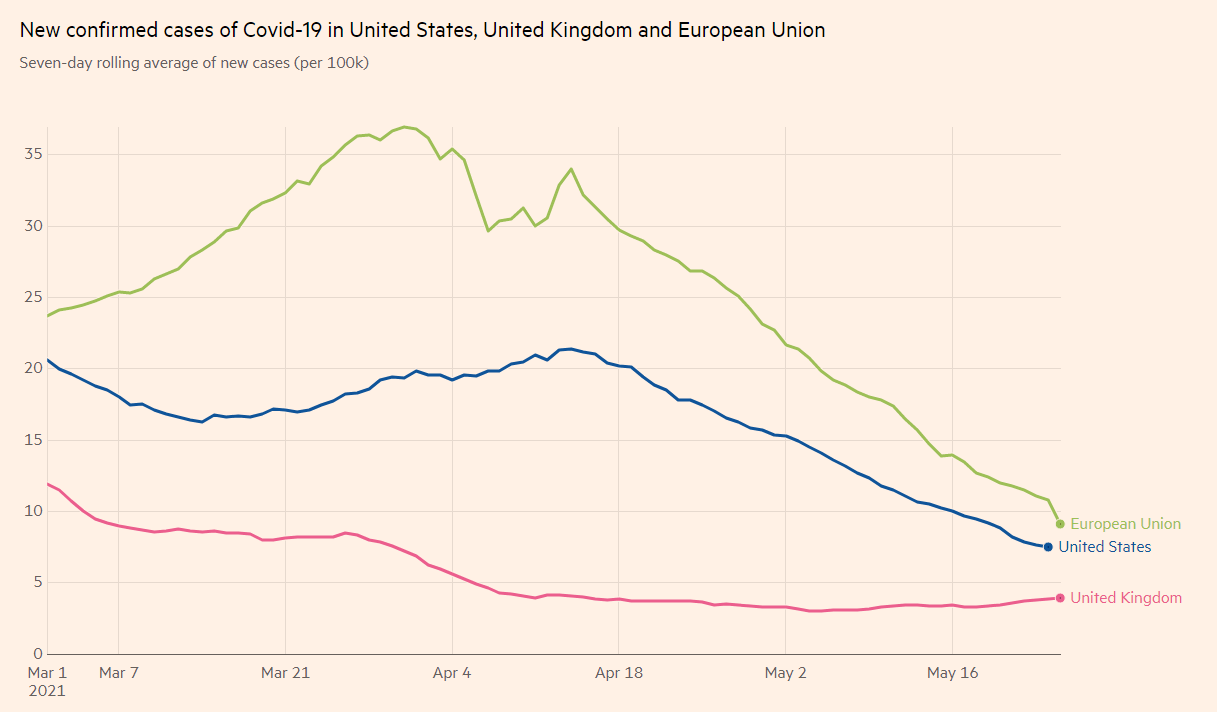

However, while EUR/USD hit the highest since January, GBP/USD struggled to advance due to the rapid spread of the COVID-19 variant first detected in India. While studies proved that existing vaccines are effective against these strains, and numbers remain small, the creeping increase in cases is worrying.

UK Prime Minister Boris Johnson said there is a continuing concern about the variant, and Germany announced restrictions for travelers coming from Britain. The virus graph is edging higher once again.

COVID-19 cases in the US, the EU and the UK

Source: FT

Brexit: The UK and the EU remain at odds about the Northern Irish protocol, a component of Britain's exit from the bloc that remains a point of contention. London and Brussels have yet to resolve other issues such as regulation of the services sector – and that also weighed on the pound.

One event that grabbed the headlines but failed to stir sterling was Dominic Cummings' explosive evidence in parliament. The former senior adviser to the PM spilled the beans on alleged government incompetence in handling the pandemic. Nevertheless, Johnson's Conservatives seem stable as the public focuses on the exit from the crisis rather than its worst days.

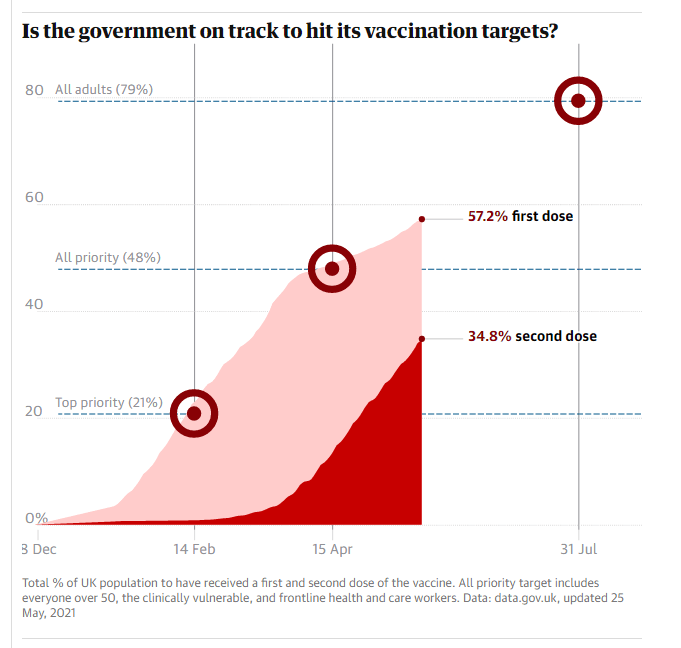

UK events: Vaccine vs. variant once again

Will the B.1.167.2 variant halt Britain's reopening? That is the critical question for the British economy. While UK activity is already much increased compared to the winter, fears about the final stage of returning to normal have risen alongside COVID-19 cases.

Vaccines have proven efficient against this strain first identified in India, but reaching as many people with both doses has become more important. Investors want these charts to rise even faster:

Source: The Guardian

PM Johnson will likely weather the recent political storm around Cummings' testimony, despite the explosive revelations. However, optimism about the recovery may be undermined by lingering Brexit issues. The EU and the UK remain at loggerheads around the NI protocol and other issues. If the topic remains on the backburner, sterling would have room to rise, but any resurfacing of acrimony could weigh on the pound.

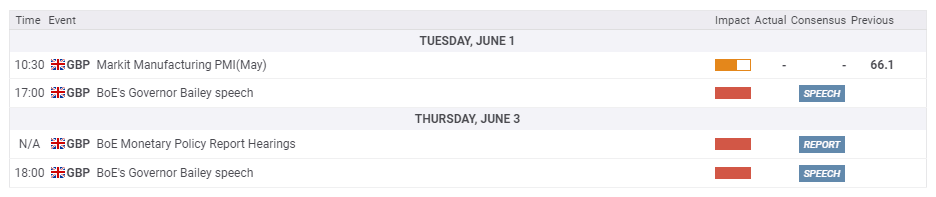

Markit's final Purchasing Managers' Indexes (PMIs) for May are of interest, but Bank of England Governor Andrew Bailey's public appearances are of higher importance. Bailey is set to provide an updated view on the local and global economies and potentially hint at the bank's next moves. While inflation is off the lows, it remains tame.

Here is the list of UK events from the FXStreet calendar:

US events: Full buildup to Nonfarm Payrolls

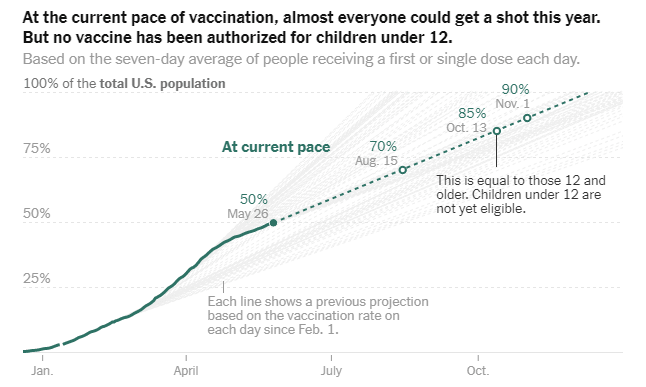

Half of the US population has received at least one vaccine dose, and 40% are fully immunized against COVID-19. Is it enough? The campaign depressed coronavirus cases, hospitalizations and deaths, yet the recent slowdown means that the elusive "herd immunity" has been pushed back.

Any uptick in cases or additional slowdown in inoculations could weigh on sentiment.

Vaccine progress in the US:

Source: NYT

Will the new month bring Democrats and Republicans closer to a deal on infrastructure spending? President Joe Biden and his team have been working with the GOP to reach a deal, but he may still go it alone if the gaps remain substantial.

The focus is set to be on the busy economic calendar, culminating in the Nonfarm Payrolls figures. The ISM Manufacturing PMI kicks off the week and is expected to remain at the high ground above 60 points – reflecting rapid expansion.

Its employment component serves as a hint toward the jobs report. Special attention will also be dedicated to the PMI's inflation figure, which is set to cool from the highs.

ADP's private-sector labor figures are forecast to show slower job growth in May. Any significant surprise could shape expectations for the official employment report, despite diminishing correlation between the two figures. The ISM Services PMI is the last hint, and also here, the employment component will be closely watched.

Was April's disappointing increase of 266,000 positions a one-off? Economists expect May's NFP to show over 600,000 jobs gained, reflecting a rapid return to normal. Revisions to the previous figures are also of interest.

Roughly eight million Americans have yet to return to their pre-pandemic positions, and an acceleration in returning to work would raise expectations of tightening and boost the dollar. Changes to the Unemployment Rate heavily depend on the Participation Rate and are shrugged off by investors.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar remains in an uptrend despite failing to break above the yearly high of 1.4240. The currency pair has never looked back at 1.4010 after breaking that line in early May, and it trades above the 50-day, 100-day and 200-day Simple Moving Averages (SMAs). Momentum remains to the upside, and the Relative Strength Index (RSI) is below 70 – outside overbought conditions. All in all, bulls are in control.

Some resistance is found at 1.4160, which was a swing high in early May, and then by 1.4220, a level it reached later in the month. Above 1.4240 mentioned earlier, the upside target is 1.4350, which was last seen in 2018.

Some support is at 1.41, which provided some support in late May. It is followed by 1.4010, a separator of ranges, and then by 1.3930 and 1.38.

GBP/USD sentiment

The US economy is steaming hot and May's Nonfarm Payrolls will likely clear any doubts – paving the way for the Fed to increase its taper talk. With ongoing fears of virus variants, the pound could suffer. All in all, there is room for falls.

The FXStreet Forecast Poll is showing that experts are bearish on all timeframes. However, the target for the long-term is above the goal for the medium-term. Moreover, the average objectives are not very far from each other.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.