GBP/USD Weekly Forecast: More pain for the pound? Delta, data and future Fed moves all eyed

- GBP/USD has suffered as covid, mixed UK data and US tapering fears weigh on the pair.

- Fed Chair Powell's critical speech, top-tier US data and virus figures stand out.

- Late August´s daily chart is painting a mixed picture.

- The FX Poll is pointing to gains on all timeframes.

Flight to safety – that has been the main theme boosting the dollar as coronavirus cases have continued rising, and data has been mediocre at best. Will the Federal Reserve come to the rescue by pushing back against tapering its bond-buying scheme? That is the main question for investors who are also watching covid figures on both sides of the pond.

This week in GBP/USD: Fear grips markets

Tilting toward tapering – the Federal Reserve's meeting minutes from the July meeting shows a growing trend toward reducing the bank's bond-buying scheme already in 2021. The minutes came after media reports about an upcoming announcement in September, sending the dollar higher.

There were reasons to doubt the urge at which the Fed would act – the protocols are from a decision taken before the tumbledown and included support for separating tapering from raising rates. Nevertheless, investors saw the glass half empty and found other reasons to worry.

See Dollar selling opportunity? Three reasons (and charts) explaining why the King may crash

US data disappointed, adding to the misery. After August´s consumer sentiment tumbled to below the worst of the pandemic levels, hard data also fell short of estimates. Retail Sales fell by 1.1% in July, worse than 0.2% expected and on top of only meager upward revisions. Core figures also slipped.

Soaring coronavirus cases gained importance after America reported some 250,000 in one day, accelerating the increase in average daily infections that topped 140,000. While most outbreaks are in undervaccinated areas, the relentless spread all over the country is becoming a growing concern.

Covid cases in the UK also remain stubbornly high, clearly ending the rapid decrease recorded in mid-July. The mix of safe-haven flows to the dollar and worries about the UK economy weighing on sterling has been a dominating factor in depressing GBP/USD.

COVID-19 infections in the US and UK are also off their lows

Source: FT

British data was mixed, but the most significant figures weighed on sentiment. While the Unemployment Rate dropped to 4.7% and wage growth leaped by 8.8% YoY in June, the more recent jobless claims statistic showed only a modest 7,800 drop in July.

Moreover, the headline UK Consumer Price Index slipped to 2% in July, below projections and easing the pressure on the Bank of England to tighten its policy.

UK events: Delta watch and business sentiment

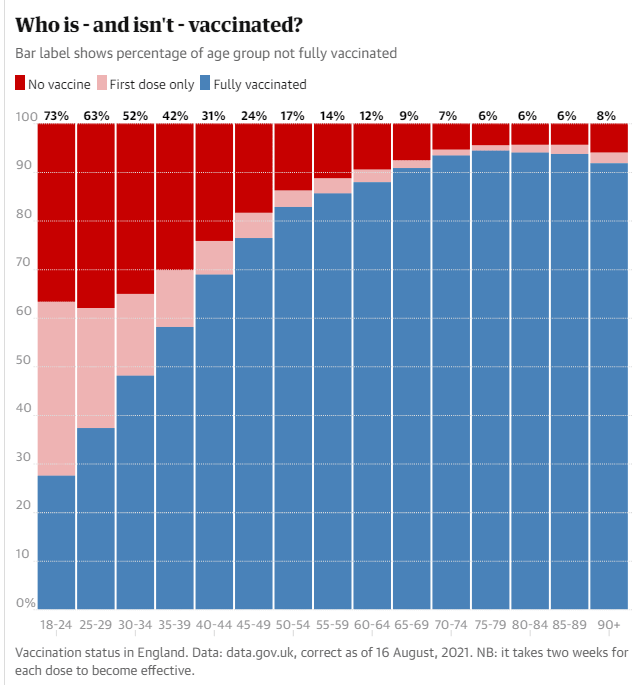

Will Britain bend the covid curve once again? After cases related to Euro 2021 dropped, infections crept up again while the vaccination campaign slowed down. The key to winning the virus and restoring consumer confidence lies with immunization, especially of the young.

Higher blue lines on the left-hand part of the chart below would encourage investors:

Source: The Guardian

The economic calendar is relatively light toward the end of the summer, but Markit's preliminary Purchasing Managers' Indexes for August stand out. The downgrade of the Services PMI in July caused sterling to dip, and another slip in sentiment in the UK's largest sector would also be worrisome. Nevertheless, any score above 50 represents expansion, and it would provide hopes for ongoing growth.

Here is the list of UK events from the FXStreet calendar:

US events: Spending, covid and a GDP update

Congress is set to return after a summer recess, with two large spending programs high on its agenda. Democrats are struggling to balance between passing the bipartisan $1 trillion hard infrastructure – that moderates back – and the more ambitious $3.5 trillion expenditure program backed by progressives.

The ruling party has been hit by the collapse of Afghanistan's government and only has a razor-thin majority in both chambers. Any delay in passing the programs could further dim growth prospects and weigh on sentiment. Passing both would cheer markets.

Rising coronavirus cases, hospitalizations and deaths weigh on sentiment, but there is also a silver lining – the pace of vaccinations has increased. Any additional uptick in the chart below could improve the mood, alongside a flattening of the covid curves in the worst-hit areas.

Vaccine progress in the US:

Source: NYT

On the economic calendar, the best awaits for last – Federal Reserve Chair Jerome Powell's speech at Jackson Hole. Investors are eager to hear if the world's most powerful central bank is about to announce tapering down its bond-buying scheme. It currently creates $120 billion every month.

The recent spread of the Delta variant, weak consumption and signs of "cresting" in core inflation – only 0.3% MoM in July – are all reasons to push back against hawks calling for the bank to announce a reduction in September. On the other hand, broader price rises remain high at 5.4%, and hiring has been outstanding in the past two months. America created nearly a million jobs last month.

Powell is a dove, meaning he would likely refrain from signaling a withdrawal of stimulus – at least until August's Nonfarm Payrolls are released in the following week. That could send the dollar down.

Ahead of Friday's speech, several economic indicators are set to move markets. Markit's preliminary PMIs for August could show a decline in business sentiment following the decline in consumer confidence. Durable Goods Orders statistics for July will provide the first view on investment in the third quarter, with mixed figures projected.

Economists expect updated Gross Domestic Product figures for the second quarter to be upgraded from the initial read of 6.5% annualized. That first read fell significantly short of market expectations.

Just before Powell takes the stage, the Fed's preferred gauge of inflation – Core PCE – is forecast to show that price rises remained above 3% once again. An update from the University of Michigan on its shocking read for August may also move markets. Revisions to this indicator are rarely of interest, but this publication is different.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar has dropped below the 200-day Simple Moving Average, and momentum has flipped to the downside. Moreover, the Relative Strength Index has held above 30, thus above oversold levels. Overall, the picture is bearish – yet there is hope for bulls while it holds above critical support.

The make-or-break point for cable is 1.3560, which was July's bottom and the lowest since February when it also bounced off that area. Holding above that level could open the door to a bounce within the broad range, moving as far up as 1.40, the summer's high point.

On the way up, 1.3660 separated ranges in July, 1.3740 provided support in mid-August, 1.38 held cable up earlier this month and 1.3880 was a stubborn cap in recent weeks.

Looking down below 1.3560, the psychologically significant 1.35 level is of interest and it is followed by 1.3450, which played a role early in the spring.

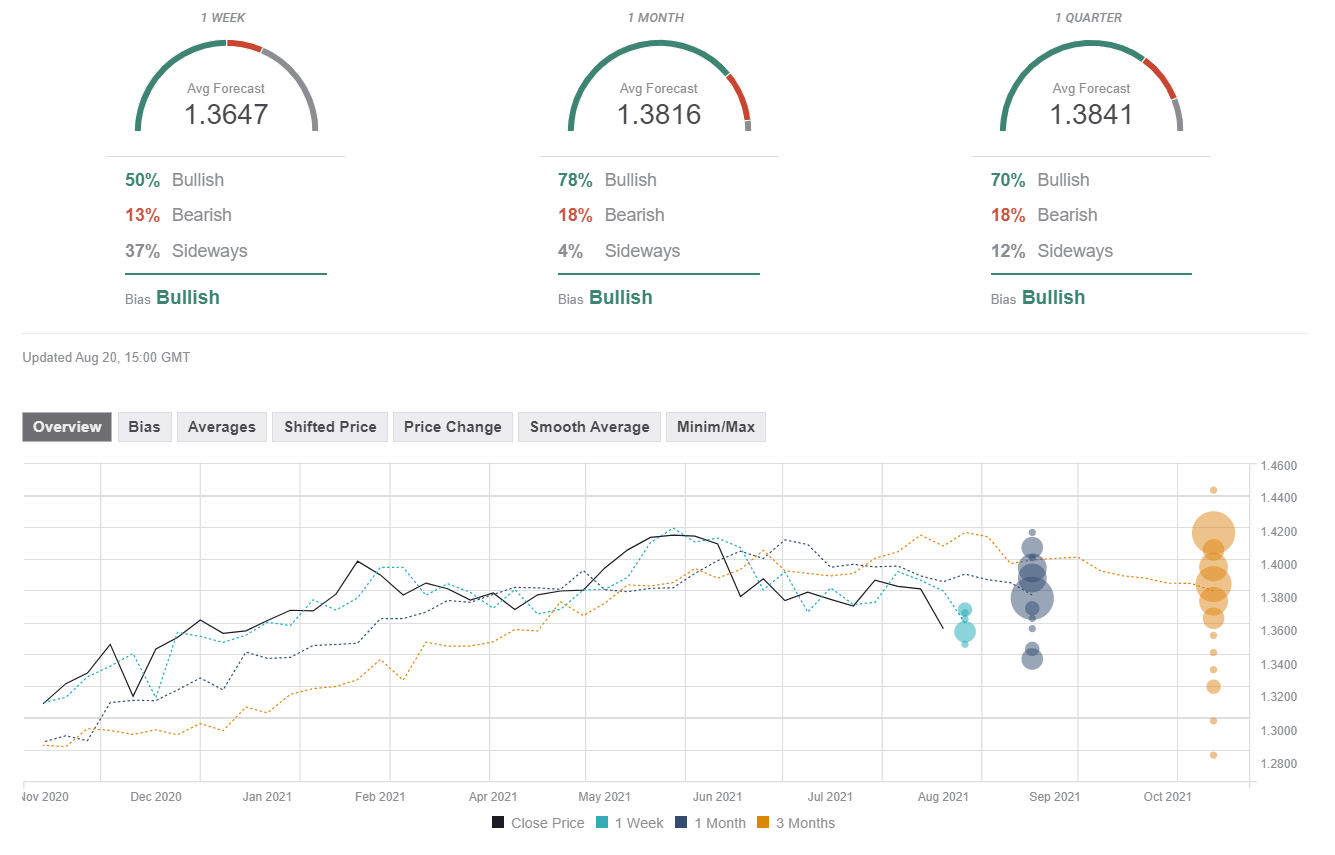

GBP/USD sentiment

Powell's Jackson Hole speech could mark a turnaround in dollar strength by showing the Fed is there to support markets. Moreover, fear of covid may peak as cases fall in the worst-hit areas.

The FXStreet Forecast Poll is showing that experts are bullish on cable's prospects moving forward, seeing a small short-term bounce before significant upward moves later on. While the target for the upcoming week has been substantially downgraded, the others remain firmer.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.