GBP/USD Weekly Forecast: Dollar shows signs of exhaustion but remains the favorite

- The US Dollar remains the primary safe haven, but its rally may pause.

- Crucial employment data will be released in the US next week.

- The GBP/USD pair shows signs of an interim bottom, but the overall trend is downward.

The GBP/USD experienced a rebound after reaching its lowest level since March, near the 1.2100 area. After a prolonged rally, the US Dollar finally paused, leading to a rebound of the Cable. This move was aided by a retreat in US yields and an improvement in market sentiment. However, the rebound is a healthy correction at this stage. In the upcoming week, the focus will be on US data, all the reports that the US Government shutdown allows.

UK economy stronger than previously reported, but does it matter?

The United Kingdom Office for National Statistics (ONS) reported on Friday that in the three months leading up to the end of June, Gross Domestic Product (GDP) expanded by 0.2%, in line with the previous estimate, while Q1 figures were revised up to 0.3% from 0.1%.

According to the ONS, as of June, the economy was 1.8% larger than before the COVID-19 pandemic (last quarter of 2019), indicating an upward revision from the previous report, which stated it was 0.2% smaller after new estimations for 2020 and 2021. With the latest data, the performance of the UK's economy shows faster growth than Germany but well below the 6.1% expansion in the US. However, these changes reflect the past and do not alter the current outlook, as markets anticipate the UK heading into a recession in both Q3 and Q4.

The Bank of England (BoE) has initiated work on a facility to provide lending support to insurers and pension funds, aiming to avoid market turmoil similar to what occurred a year ago following the "mini-budget."

Inflation in Europe is showing signs of easing, contributing to improved market sentiment. The Eurozone Harmonized Index of Consumer Prices rate dropped to 4.3% in September, marking the lowest level in nearly two years.

In the US, consumer confidence figures and data from the housing sector weakened. Additionally, the Federal Reserve's preferred inflation gauge, the Core Personal Consumption Expenditure Price Index, rose by 0.1% in August, slightly below the market consensus of 0.2%. The annual rate declined from 4.3% to 3.9%, indicating a downward trajectory in inflation but still above the Fed's target. However, this data did not significantly impact market sentiment. Overall, the numbers reflect a robust economy, raising discussions on the compatibility of such strength with bringing inflation back to the 2% target.

The week ahead

During the weekend, China will release PMI gauges relevant to market sentiment. Positive data would likely positively impact the Pound, particularly because it would provide further positive signs from the Chinese economy.

The economic calendar for the UK shows no reports of significant importance for next week. The focus will shift to Bank of England speakers, including Monetary Policy Committee (MPC) external member Catherine Mann on Monday and Deputy Governor Ben Broadbent on Thursday. Data to be released includes home prices on Monday and the Construction PMI on Thursday. The BoE will also publish the Decision Maker Panel (DMP) survey, which gathers information from small, medium, and large UK businesses. The central bank uses this survey to monitor economic developments and track expectations.

The following top-tier report, the monthly Gross Domestic Product (GDP), will be released on October 12. The Bank of England decision is scheduled for November 2, and before that meeting, members of the MPC will receive a new inflation report, which will be crucial in the votes.

According to the interest rate market, the probability of a rate hike at the next BoE meeting is currently around 40%. However, market expectations rise to nearly 90% for a rate hike during the first quarter of next year. Decisions will be data-driven, balancing inflation, wage trends, and overall economic activity.

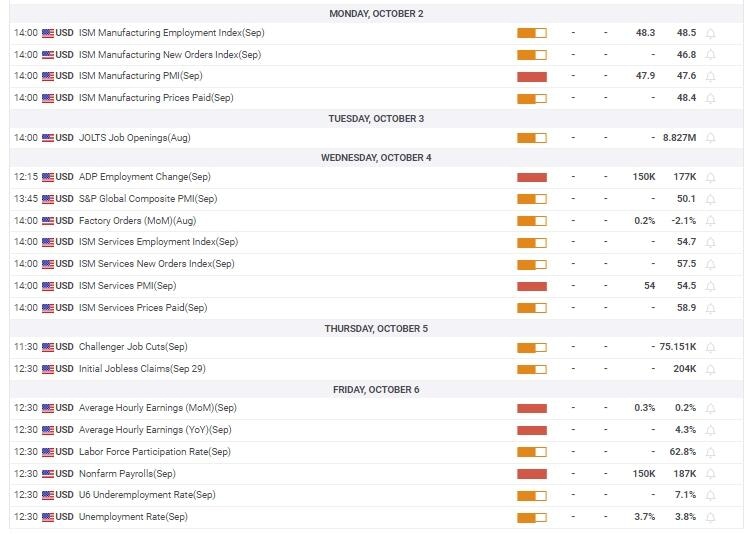

The economic calendar in the US is attractive, focusing on employment data. However, due to a potential US Government shutdown, the market may not receive all the reports. If a shutdown occurs, the publication of next week's official information, such as the August JOLTS and Nonfarm Payrolls, will not happen.

The reports that will be released regardless of the government situation include the ISM Manufacturing PMI on Monday, the ADP Employment report (with an expected increase of 150,000 in private payrolls), and the ISM Services PMI on Wednesday. If a resolution is reached and the government remains operational, the highly anticipated US jobs report on Friday is expected to show an increase of 150,000 jobs and a decline in the Unemployment Rate from 3.8% to 3.7%.

The job market numbers will be critical for Federal Reserve monetary policy expectations and could have a decisive impact on the direction of the US Dollar. Data indicating a tight labor market could increase the odds of another interest rate hike, potentially strengthening the US currency further. Conversely, evidence of a slowdown in the labor market would make another rate hike less likely, weighing on the US Dollar.

Dollar finally offers some signs of exhaustion, not reversal

Fundamentally, the US Dollar continues to be favored in the market. A robust economy, decreasing inflation, and Treasury yields remaining at multi-year highs have been driving the rally in the US Dollar Index (DXY), which has recorded eleven consecutive weekly gains. However, the rally has shown signs of exhaustion as it backed away from its highs.

The likelihood of a bearish correction for the US Dollar increases if the market sentiment improvement continues and US yields stabilize. However, if equity prices decline and Treasury yields remain around current levels, the Greenback could resume its upside momentum.

Even in the case of a correction, it doesn't necessarily mean that the uptrend for the US Dollar is over. The critical question would be how far the correction can go. If US data shows gaining momentum for the economy, GBP/USD could return to recent lows.

The decline in GBP/USD has not been characterized by panic but rather a continuation of Dollar strength. A correction in the pair may take a different form, offering rallies and sharp pullbacks. Another scenario could be consolidation, likely if the pair encounters significant technical resistance, such as the 20-day Simple Moving Average at 1.2380 or a downtrend line.

The Pound is at a point where positive news for the UK economy, such as falling inflation and improved economic activity, will benefit the currency. However, even if inflation picks up, boosting the odds of a rate hike from the Bank of England, it may only provide temporary support because tighter monetary conditions would add to the complexity of the economic outlook, affecting the Pound.

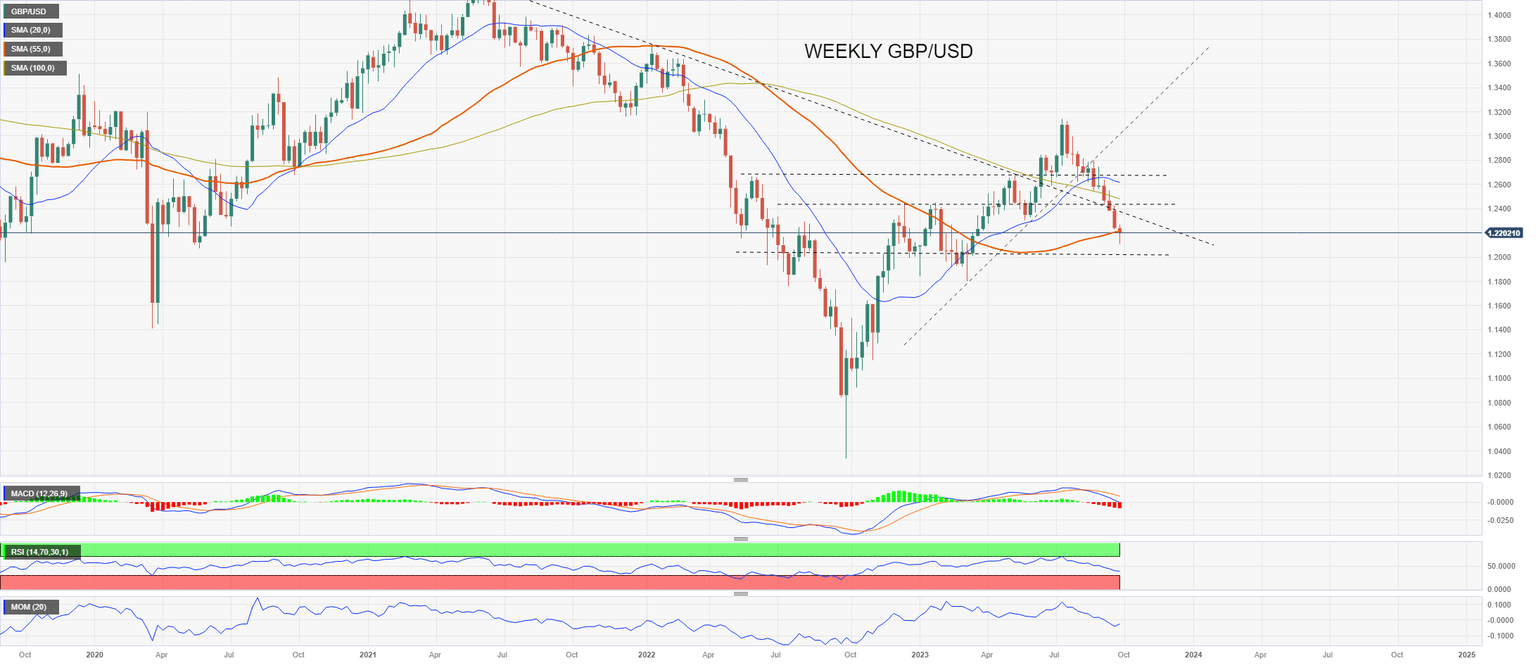

GBP/USD: Technical outlook

The weekly chart shows the GBP/USD hovering around the 55-week Simple Moving Average (SMA) in the 1.2200 area. If it remains above this level, a bullish correction seems likely, while a close below, would keep the doors open for further losses. Even if the pair surpasses 1.2350, the move will still be seen as corrective. The Pound needs to rise above the 20-day SMA at 1.2380 and a downtrend line near 1.2400 to change the short-term outlook to neutral.

Despite the recent rebound, the trend remains negative, with downside risks prevailing. A stronger support zone is seen between 1.2050 and 1.2080. A break below that area would expose 1.2000, with the next support at 1.1920. On the upside, the correction stalled at a downtrend line at 1.2275, so as long as the pair remains below that area, gains may be limited. A break higher would strengthen the Pound.

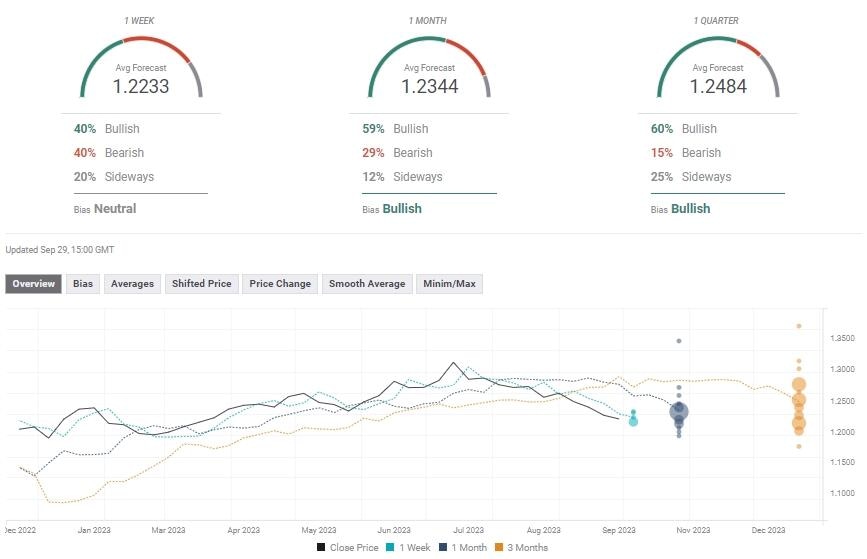

GBP/USD: Forecast poll

According to the FXStreet Forecast Poll, experts anticipate the GBP/USD pair to be near a bottom and potentially undergo a recovery in the coming weeks. The one-week average is around 1.2230. However, the recovery is expected to gather momentum, with predictions indicating that the pair may move to near 1.2350 within a one-month timeframe. Looking at the next quarter, the average forecast remains bullish, with the average at 1.2480.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.