- GBP/USD has been marching higher in hopes of a Brexit deal.

- Coronavirus headlines and several data points compete with EU-UK talks for attention.

- Late November's daily chart is painting a bullish picture.

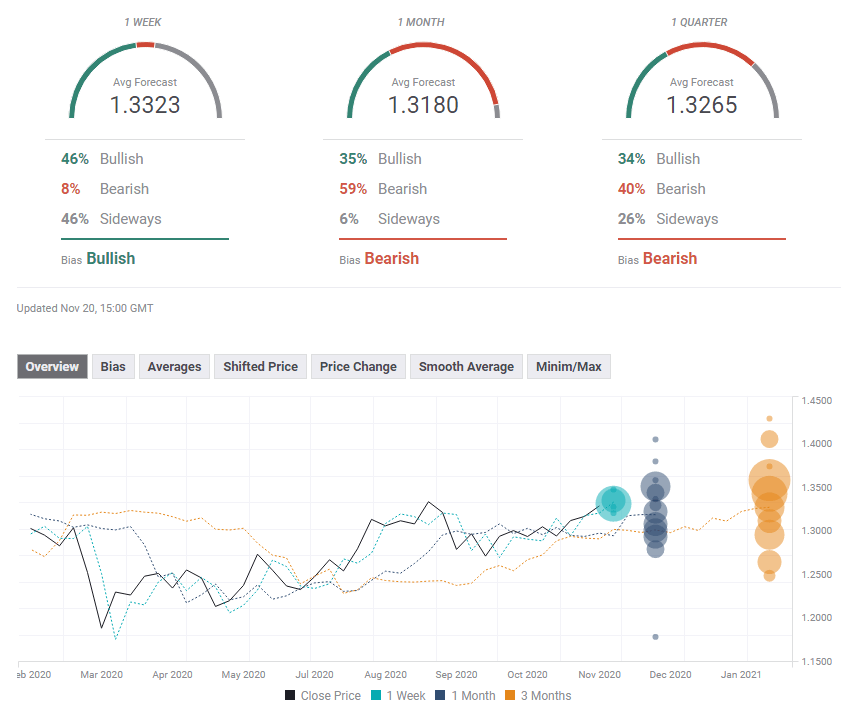

- The FX Poll is pointing to short-term gains.

Far away, so close? Brexit headlines have continued whipsawing GBP/USD – and so have changing market mood swings. Vaccine news is set to continue competing with covid statistics once again. The Federal Reserve's minutes, updated US growth figures and forward-looking UK surveys are eyed.

This week in GBP/USD: Brexit dominates the scene

GBP/USD's temporary dip in response to a pause in Brexit talks – the result of a team member's positive COVID-19 test – may sum up the week. Coronavirus and talks about future EU-UK relations have been intertwined, and most falls usually triggered a bounce.

Brexit headlines have often been contradictory. Prime Minister Boris Johnson signaled the UK would prosper without a deal, and EU officials indicated talks could collapse. On the other hand, the British press talked about a French compromise on fisheries – a minuscule industry that politically punches above its weight – and that a deal is imminent.

Markets tended to see the glass as half full, sending sterling higher on positive developments and losing interest in adverse headlines.

Vaccine: After Pfizer caused markets to cheer on the previous Monday, it was Moderna's turn to inject optimism into markets. The American firm reported 94.5% efficacy in its covid vaccine candidate and also lower storage temperatures. The market reaction was not as significant, as Moderna had already implied results were imminent.

Immunization optimism continued with Pfizer's announcement that it would shortly seek regulatory approval for its inoculation and continued with AstraZeneca's upbeat news. While the British pharmaceutical firm's statistics were only from its Phase 2 trial, they showed high tolerance and raised hopes that the broader test would also yield upbeat results.

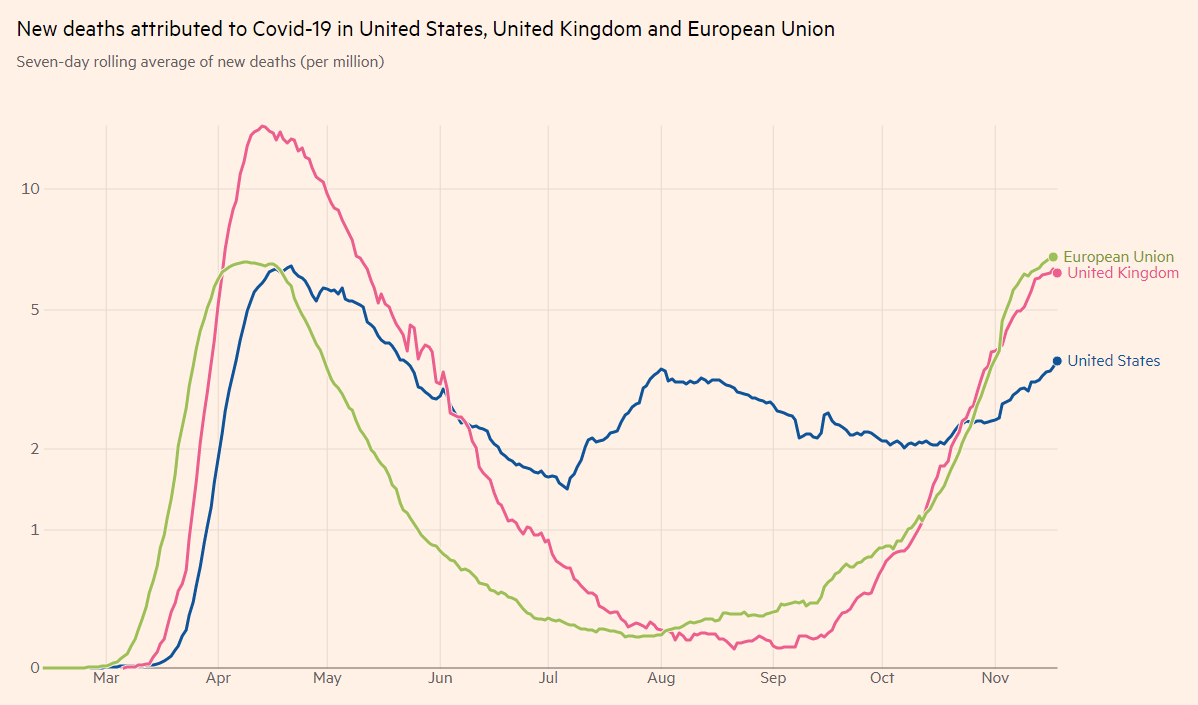

High hopes for an exit from the coronavirus crisis were countered by grim reality. Britain's death toll from coronavirus topped 50,000, and the infections curve remains stubbornly elevated. Expectations for a rapid tapering of measures on December 2 – when the current nationwide lockdown expires – have diminished. Even if the UK returns to a regional approach, restrictions may remain relatively tight.

America's covid crisis is worse. Hospitalizations have been hitting new peaks almost daily, and other metrics are going in the wrong direction as well. Several state governors announced measures from mask mandates to school closures, potentially adding to the economic damage caused by consumers shying away from streets. The safe-haven dollar found limited bids in response.

Covid mortalities in the US, the EU and the UK

Source: FT

Economic data was mostly positive for pound/dollar. UK Retail Sales jumped by 1.2% in October, beating estimates. Britain's headline Consumer Price Index exceeded expectations with 0.7% yearly in October, lessening the case for additional stimulus from the Bank of England.

US Retail Sales disappointed with a meager rise of 0.3% in October, and Unemployment Claims also missed expectations by increasing to 742,000 in the week ending on November 13. On the other hand, housing sector statistics remain robust.

UK events: Mostly Brexit and the virus again

Brexit: Mid-November has come and gone – but so have many other deadlines in the EU. While there is still time until the end of the transition period on December 31, there is an urge on both sides to "get Brexit done," as Johnson said. Reports on "bending red lines" may turn into black ink on a deal.

How would sterling react? While the talks' collapse would undoubtedly send sterling down, will investors "buy the rumor, sell the fact" in response to a deal? The recent market sensitivity shows that an agreement is far from being priced, leaving room for the pound to rally.

Another date next month is also on traders' minds – December 2, when the current shuttering expires. The PM is likely to postpone any decision to the last minute, and coronavirus statistics could guide markets ahead of the next moves. If infections begin declining more substantially, there is room for easing and a rise in the pound. If Britain continues struggling to contain the disease, the pound could suffer.

AstraZeneca might publish its Phase 3 trial results late in the week, but there are higher chances for the data to come out only later on. While the UK's struggle against the virus is arguably having modest success, it is well-positioned when it comes to an exit strategy. Apart from having a homegrown immunization scheme, the government signed agreements with five other pharmaceutical companies. Once vaccines are authorized, Britain could quickly emerge from the crisis.

See Three reasons to expect a sustained Santa rally for sterling.

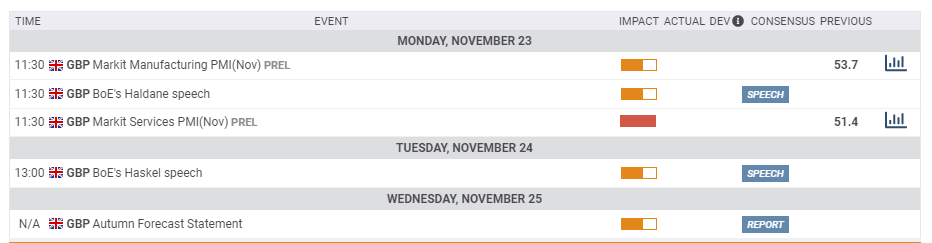

Markit's preliminary Purchasing Managers' Indexes for November will likely show a decrease in expectations. The large services sector's PMI stood at 51.4 points in October, pointing to modest growth. A decline below 50 would represent a return to economic contraction and fears of a double-dip recession.

A speech from Andy Haldane, the BOE's Chief Economist, and an economic update from the government may also move markets. However, the bank and Westminster already delivered the coordinated boost early in the month – announcing additional bond-buying and an extension of the furlough scheme, respectively. Both institutions will probably wait until making new steps.

Here is the list of UK events from the FXStreet calendar:

US events: Coronavirus fears and vaccine Thanksgiving

How many Americans will see their families this Thanksgiving? A personal question for many could turn into an influential macroeconomic one for markets. On the one hand, travel triggers spending, especially on gifts. On the other hand, it could contribute to spreading covid.

Coronavirus statistics, and ensuing restrictions, will likely stand out in America's short trading week. After surpassing the 250,000 mortality mark, investors could focus on daily deaths, with the grim prospects surpass the peak in the spring.

Full lockdowns are also on the cards. Governors' decisions in the four largest states: California, Texas, Florida and New York, are set to have the most significant impact on markets.

The political front has been relatively quiet, but markets would applaud any Republican move toward accepting President-elect Joe Biden's victory. Outgoing President Donald Trump is set to continue fighting for his political future. Still, any acknowledgment from Senate Majority Leader Mitch McConnel or other senior figures could weigh on the safe-haven dollar.

Democrats and Republicans are gearing up toward Georgia's runoff elections in January, critical for the upper chamber's control. Therefore, they are unlikely to compromise on a relief package – a move that would disappoint activists. The covid situation would probably have to worsen before both sides sign off on a stimulus deal further.

More American Politics and the Pandemic: What are the markets thinking?

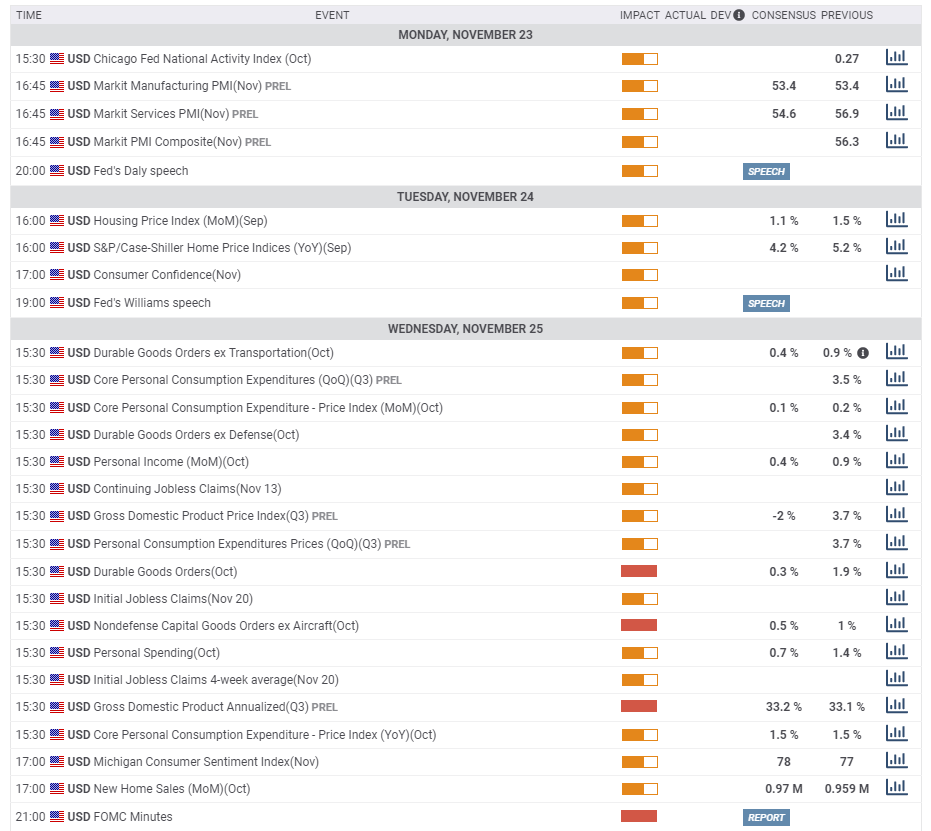

Economic releases kick off in earnest on Tuesday. The Conference Board's Consumer Confidence gauge for November is set to decline amid the increase in coronavirus cases' immense political polarization.

Thursday's Thanksgiving holiday packs in several events on Wednesday. An update on third-quarter growth is set to confirm a robust expansion after a devastating second quarter. Investors will likely look to the more up-to-date Durable Goods Orders statistic for October, which carries expectations of more modest increases in investment.

Markets will want to see if the recent increase in jobless claims was a one-off event or an ugly turn to rising unemployment. Personal Income and Personal Spending are also of interest.

Last but not least, the Federal Reserve's Meeting Minutes from the early November decision could shed light on the bank's bond-buying intentions. Jerome Powell, Chairman of the Federal Reserve, opened the door to expanding the Quantitative Easing program, but investors are unsure if a move is imminent.

If most members seem concerned and ready to act, the dollar could fall. Otherwise, the safe-haven greenback could attract buyers. The bank has been urging lawmakers to act, yet to no avail.

Here the upcoming top US events this week:

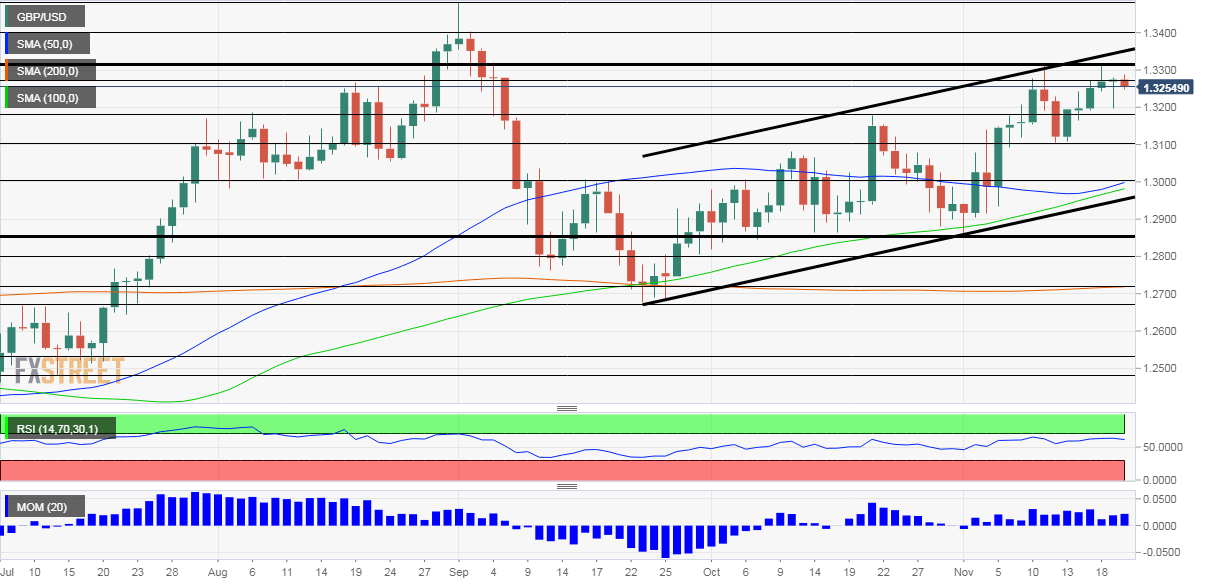

GBP/USD technical analysis

Pound/dollar has been extending its gains in the uptrend channel accompanying it since late September. The currency pair is trading above the 50-day, 100-day and 200-day Simple Moving Averages and benefits from upside momentum on the daily chart. Moreover, the Relative Strength Index is below 70, thus outside overbought conditions.

Overall, the bulls are in the lead.

Some resistance awaits at 1.3275, which capped GBP/USD back in August. November's peak of 1.3310 is a critical hurdle. The uptrend resistance line hits the price at around 1.3360, and it is followed by 1.34 and 1,3510, which played a role in the past.

Significant support awaits at 1.3180, which held cable down in mid-October. Further down, 1.31 was a low point in mid-November, and the psychologically significant 1.30 level is also where the 50-day SMA hits the price. The next cushion is at 1.2860.

GBP/USD sentiment

Even without an imminent Brexit deal, the prospects of further easing from the Fed and Britain's pole position on vaccines imply further upside for the currency pair.

The FXStreet Forecast Poll is pointing to short-term gains before falls coming later on. Experts have upgraded their average forecast for the upcoming week but seem skeptical about its longevity.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.