GBP/USD Weekly Forecast: Correction to extend before next set of key UK, US data

- GBP/USD snapped a three-week uptrend after Bank of England’s cautious stance.

- US Dollar bulls rescued by banking sector and debt ceiling woes.

- GBP/USD eyes deeper correction ahead of US Retail Sales, UK jobs data.

Pound Sterling buyers threw in the towel as the US Dollar grabbed the upper hand amidst mounting fears of a US default and a looming banking sector crisis. GBP/USD also suffered from a cautious Bank of England (BoE) policy stance. Markets repriced the US Federal Reserve (Fed) interest rates outlook following the United States Consumer Price Index (CPI) data, now awaiting the Retail Sales numbers for fresh trading impetus.

GBP/USD: What happened last week?

It was all about US CPI inflation data, which influenced the US Dollar valuations in the first half of the week. In the lead-up to the main event, the Greenback remained on the back foot, allowing GBP/USD to briefly recapture the 1.2600 barrier. Markets fully priced in a US Federal Reserve (Fed) rate hike pause in June and a rate cut as early as July ahead of the key inflation data release.

On Wednesday, the United States Consumer Price Index rose by 4.9% YoY in April, but it was lower than expectations of a 5.0% increase. Month-over-month, April's CPI rose 0.4% after gaining 0.1% in March. However, the monthly US Core CPI increased 0.4% in April, at the same pace as in March. Even the annualized Core CPI rose by 5.5% in April. The core figures remained quite sticky, which pushed back on market expectations of any Federal Reserve rate cuts this year. This helped the US Dollar stage a comeback while investors looked for safety in the Greenback amidst looming banking sector risks and US default fears.

Attention then turned toward the Bank of England’s ‘Super Thursday’ event, as GBP/USD regained the upside traction and hit the highest level in a year at 1.2680 before correcting swiftly toward 1.2600. The BoE raised rates by the expected 25 basis points, maintaining the 7-2 voting pattern in favor of the rate hike. The bank upwardly revised its inflation and GDP forecasts, which initially propelled GBP/USD above 1.2600 but only to change course at Governor Andrew Bailey’s press conference.

Bailey’s words spoilt the party for the Pound Sterling buyers, as he turned dovish, citing that “past rate hikes will weigh more economy in coming quarters.” He also added that all the Monetary Policy Committee (MPC) forecasts are “conditional” and that "GDP growth is still weak despite upward revision." GBP/USD's renewed bullish momentum faded, sending the pair back below 1.2600. Markets are now expecting the BoE terminal rate at 5%, little changed from the pre-BoE announcement.

Adding to the Greenback demand, downbeat United States Jobless Claims and Producer Price Index (PPI) data rekindled economic concerns, which were amplified by the persisting risks over the US banking sector crisis and potential default, ramping up risk-off flows. US Initial Jobless Claims increased by 22,000 to 264,000 in the week ended May 6, hitting the highest level since October 2021. Meanwhile, the annualized Producer Price Index rose by 2.3%, following a 2.7% gain in March, registering the lowest rate since January 2021. The currency pair shed over one big figure in the aftermath of the BoE policy announcements and amidst risk-aversion.

On the final trading day of the week, the major is licking its wounds near 1.2500 even though the UK first quarter Gross Domestic Product (GDP) met estimates growing 0.1% on a quarterly basis. However, the UK GDP monthly release showed that the economy unexpectedly contracted 0.3% in March vs. 0% expected and 0% previous. Meanwhile, British manufacturing output jumped 0.7% MoM in March versus -0.1% expected and -0.1% seen in February while total industrial output came in at 0.7% MoM vs. 0% expected and -0.1% last.

The University of Michigan (UoM) reported ahead of the weekend that the Consumer Confidence Index declined to 57.7 (preliminary) in May from 63.5 in April. "While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff," the UoM explained in its publication. With this data weighing on risk mood in the American session, the USD preserved its strength and forced GBP/USD to stay on the back foot.

All eyes on United States Retail Sales data

With the critical United States Consumer Price Index and Bank of England policy announcements out of the way, investors now look for calm in the week ahead. But not yet?

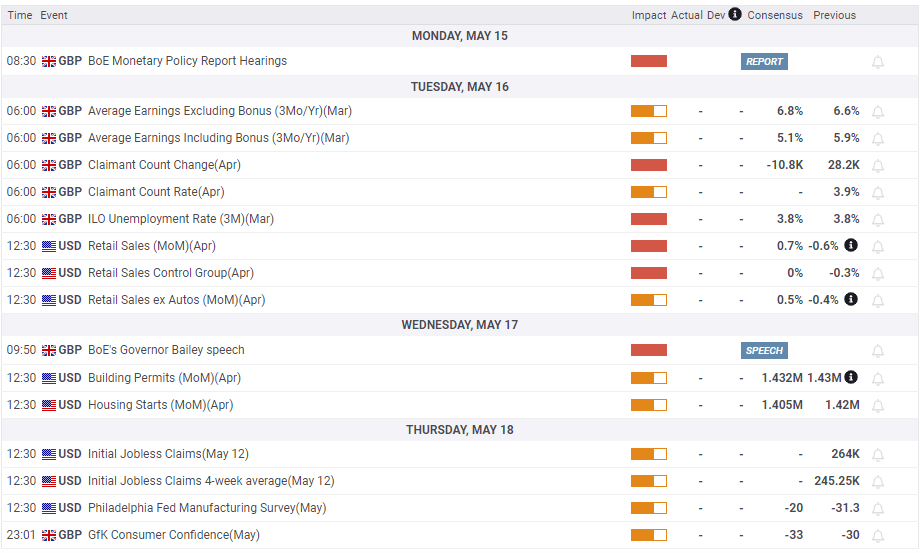

The week kicks off with the BoE Monetary Policy Hearings scheduled for Monday, as Governor Andrew Bailey and his colleagues will testify on inflation and the economic outlook before Parliament's Treasury Select Committee (TSC).

Data-wise, there are no first-tier economic releases from any side of the Atlantic on Monday, diverting attention to Tuesday’s employment data from the United Kingdom. Next on the radar will be the Retail Sales report from the United States, which will be critical data to watch out for in an otherwise relatively quiet week.

On Wednesday, the US docket will feature the Housing Starts and Building Permits data while Thursday will see the releases of the BoE Quarterly Bulletin, US weekly Jobless Claims and Existing Home Sales.

Nothing of note is due for release on Friday and, therefore, the UK CBI Industrial Order Expectations and the end-of-the-week flows could entertain traders.

Apart from the data publication, all eyes will also remain on the developments surrounding the US banking sector crisis and debt ceiling stand-off. Speech from the BoE and Fed policymakers will also garner attention for fresh policy cues.

GBP/USD: Technical outlook

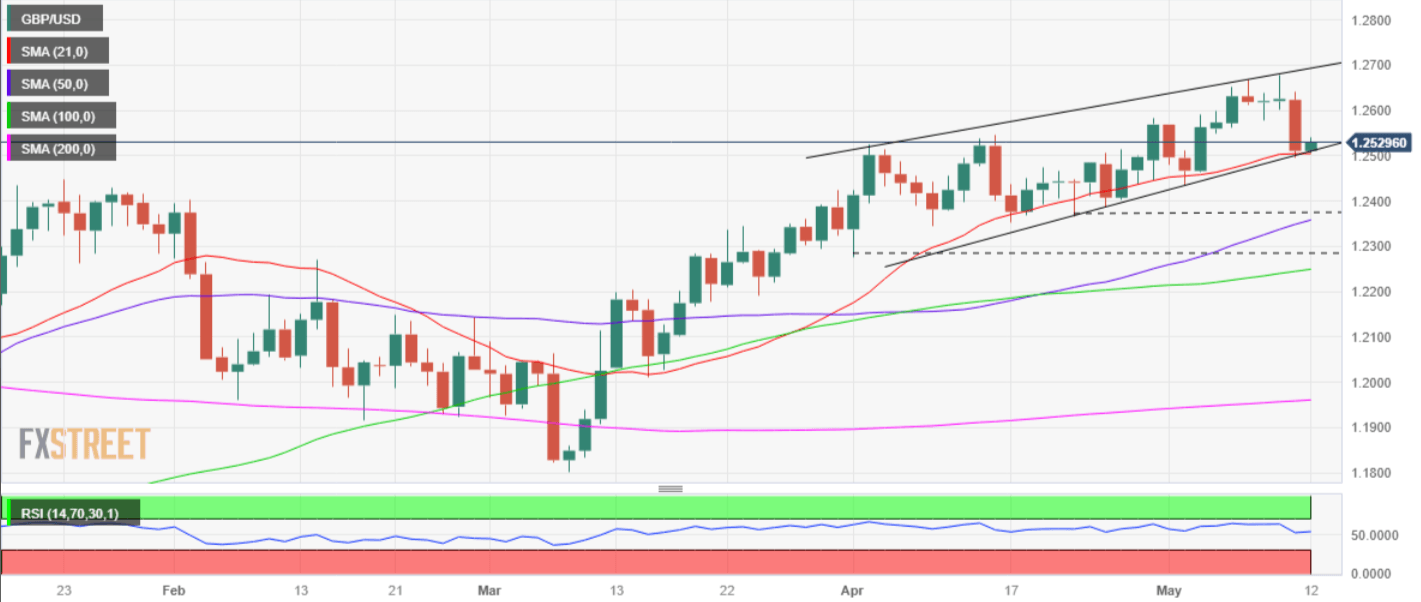

As observed on the daily chart, GBP/USD is challenging the critical daily support line at 1.2510, having erased entire weekly gains on Thursday.

A weekly close below the latter will validate a downside break from a six-week-old rising wedge formation, setting the stage for a deeper correction in the GBP/USD pair.

If GBP/USD confirms a bearish wedge, the next critical support is seen at 1.2400, below which the April 21 low at 1.2367 will be put to test.

Further south, the April month low at 1.2277 will test the bullish commitments.

With the 14-day Relative Strength Index (RSI) still holding above the midline, Pound Sterling buyers could try their luck to initiate a recovery if it defends the abovementioned critical support at 1.2510, which is the confluence of the wedge support and the bullish 21-Day Moving Average (DMA).

On the road to recovery, GBP/USD could run into strong offers at Tuesday’s low of 1.2578. Acceptance above the latter could fuel a meaningful upswing toward the yearly high of 1.2680. The next relevant upside target is aligned at 1.2750, the psychological level.

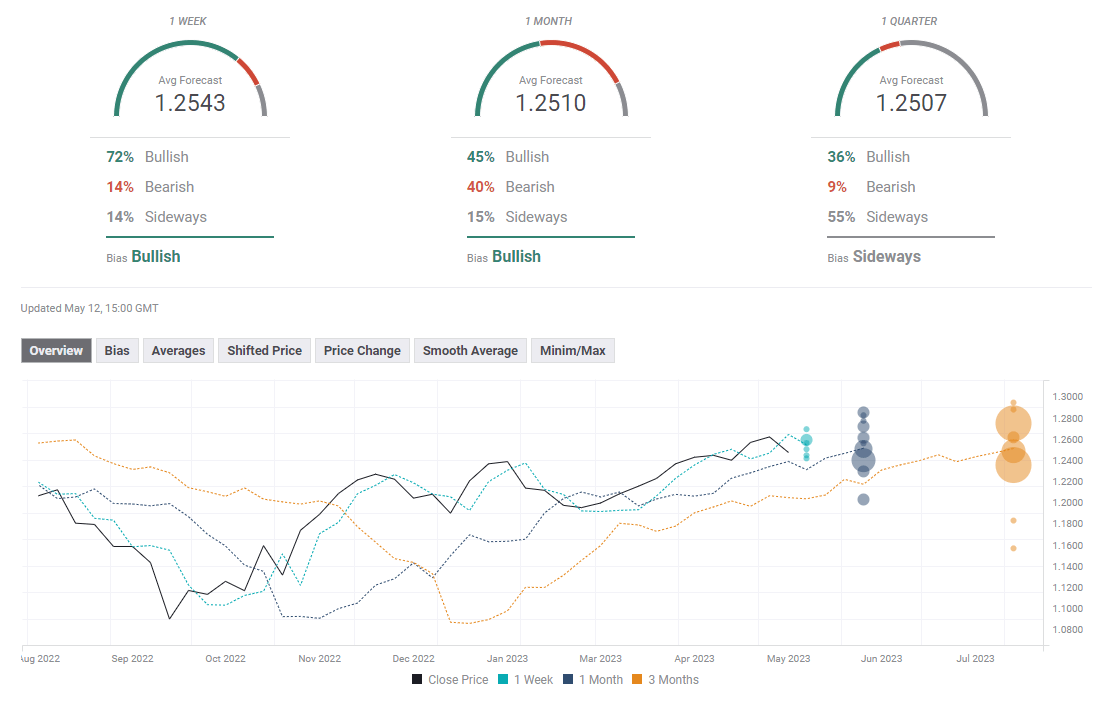

GBP/USD: Forecast poll

Despite GBP/USD's pullback this week, the FXStreet Forecast Poll points to a bullish bias in the short term. The one-month outlook paints a mixed picture.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.