-

GBP/USD entered a consolidative phase in a holiday-shortened week.

-

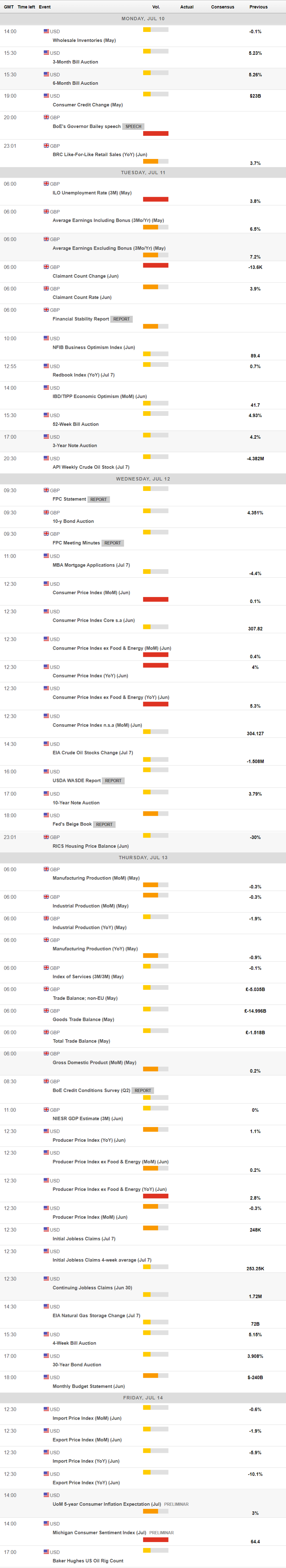

Eyes on United States inflation data, UK jobs report and BoE’s Bailey in the week ahead.

-

Risks remain skewed to the upside whilst above 1.2600, with a bullish RSI.

The Pound Sterling held onto recovery gains against the United States Dollar (USD) this week following a brief correction from 14-month highs. GBP/USD, however, traded in a narrow range, with the upside capped by resurgent US Dollar demand on hawkish US Federal Reserve (Fed) signals and growing recession fears. Traders repositioned ahead of next week’s top-tier United States (US) Consumer Price Index (CPI) and the United Kingdom’s employment data.

GBP/USD: What happened last week?

Market expectations signaling more tightening by the Federal Reserve later this year drove the US Dollar valuations, while the Pound Sterling drew support from the hawkish pricing of the Bank of England (BoE) terminal rate beyond 6.0%. Against this backdrop, the GBP/USD pair witnessed a tug-of-war, but Pound Sterling bulls eventually held the upper hand following a mixed set of United States economic data in the second half of the week.

At the start of the week, the top-tier US ISM Manufacturing PMI data unexpectedly showed that contraction in the manufacturing sector deepened further. The US Dollar came under renewed selling pressure in an immediate reaction to the downbeat data but quickly regained its footing as the data also rekindled recession fears. Renewed US-China trade tensions also underpinned the safe-haven demand for the Greenback, keeping the upside attempts in check for GBP/USD near the 1.2740 region.

Hawkish signals from the Minutes of the Fed meeting in June also kept the buoyant tone intact around the American Dollar. The Minutes showed that almost all Fed officials indicated that further tightening is likely. US Treasury bond yields extended their upsurge on the hawkish Fed outlook, with the benchmark 10-year Treasury bond yields hitting their highest level in four months above the key 4.0%.

In the latter part of the week, US Dollar sellers returned on mixed US JOLTS Job Openings data and the ISM Services PMI. Job Openings fell to 9.82 million at the end of May, dropping from an upwardly revised 10.3 million in April, according to the BLS’ latest Job Openings and Labor Turnover Survey report. Markets had expected openings to fall to 9.935 million in May. The June US ISM Services purchasing managers' index (PMI) came in at 53.9, which was above the 51.0 forecast. Despite the upbeat headline number, the ISM Services components were mixed, which failed to impress US Dollar bulls.

GBP/USD briefly took a flight to 1.2800 but lost the bullish momentum as Pound Sterling traders turned on the sidelines ahead of Friday’s highly-anticipated US NFP data release. The pair resumed its advance and flirts with the 1.28 figure, as the US added just 209K new jobs in June, missing expectations, while the Unemployment Rate declined to 3.6% as expected. The USD initially fell, although higher-than-anticipated wages limited optimism. Average Hourly Earnings rose 0.4% MoM and 4.4% YoY, reflecting remaining pressures in the inflation front and therefore, leaving the door open for additional monetary tightening.

Eyes on United States CPI, UK jobs data and Bailey’s speeches

After a relatively light week of economic data from the United Kingdom, Pound Sterling traders gear up for some high-impact events in the week ahead. The United States economic calendar is also an eventful one, with the all-important CPI inflation data on the cards.

At the beginning of the week, investors will digest Sunday’s speech by the Bank of England Governor Andrew Bailey, as he is due to participate in a panel discussion titled "Central banks as lightning rods for crises" at the Economic Meetings of Aix-En-Provence, in France.

Monday will feature China’s CPI and Producer Price Index (PPI) data for June, which are likely to influence risk trades should the statistics add to the signs of an economic slowdown in the world’s second-largest economy. Later in the day, Bailey’s speech at the Financial and Professional Services Dinner, in London, will be awaited.

Thereafter, attention will turn toward Tuesday’s British labor market report. The UK Unemployment Rate and the Average Hourly Earnings will be closely scrutinized for the BoE’s next interest-rates path. Average Hourly Earnings data will likely provide a decent picture of the country’s wage inflation. The US docket lacks any relevant economic releases on Tuesday.

Wednesday will once again witness Governor Bailey’s appearance, this time, holding a press conference about the Financial Stability Report (FSR). His words on the country’s banking sector and the overall financial market conditions will be closely followed. All eyes, however, will be on the US CPI report for fresh insights on the Fed’s rate hike outlook. The Fed’s Beige Book will be published later in American trading on Wednesday.

The UK’s monthly Gross Domestic Product (GDP) and Industrial Production data will be reported on Thursday ahead of the US PPI inflation data and the weekly Jobless Claims. Meanwhile, the only significant economic data due on Friday will be the preliminary US University of Michigan (UoM) Consumer Sentiment and Inflation Expectations for July.

GBP/USD: Technical outlook

GBP/USD has managed to defend the upward-sloping critical 21-Daily Moving Average (DMA) at 1.2700, courtesy of the bullish momentum indicator, the 14-day Relative Strength Index (RSI), on the daily timeframe.

The pair has carved out a descending triangle formation over the last three weeks, but given that it is breaking the figure to the upside, the risk titles in favor of Pound Sterling buyers. The natural tendency of the descending triangle is to yield an upside break, defining it as a bullish continuation pattern.

As the pair develops above the trendline resistance at 1.2780, chances now skew for a test of the 1.2900 mark. However, the strong resistance near 1.2850 will have to be cracked first.

On the flip side, a sustained break below the 21-DMA support at 1.2700 is likely to initiate a corrective pullback in the GBP/USD pair toward the double-bottom low near 1.2600. The bullish 50-DMA at 1.2572 will provide immediate support on a breach of the latter. The June 12 low of 1.2483 will be next on sellers’ radars.

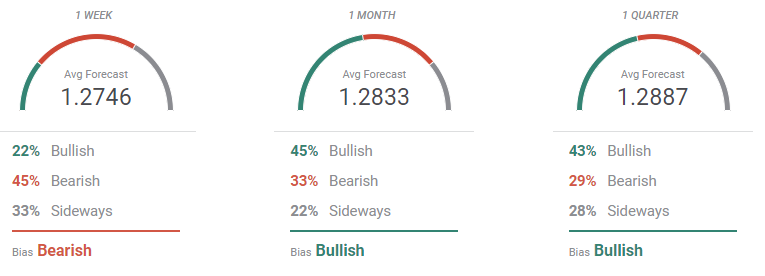

GBP/USD sentiment poll

The FXStreet Forecast Poll shows that GBP/USD is set to continue advancing. Despite bears dominating the short term, bulls are all over the place with the pair seen firming beyond the 1.2800 threshold in the longer run. Bulls are a majority in the monthly and quarterly perspectives.

The Overview chart confirms the positive momentum, as the three moving averages accelerated their advances to fresh multi-month highs. In the monthly and quarterly views, most targets accumulate just below the 1.3000 level, suggesting market players are willing to challenge it in the foreseeable future.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds gains above 0.6350 after mixed Chinese data

AUD/USD holds the bounce above 0.6350 in the Asian session on Monday, following the mixed Chinese data releases. The pair remains underpinned by the US Dollar pullback. Traders will keep an eye preliminary US PMI due later on Monday ahead of the Wednesday's Fed interest rate decision.

USD/JPY bulls regain poise and test 154.00 despite upbeat Japanese data

USD/JPY looks to extend the five-day winning streak and tests 154.00 early Monday. Traders resort to cash in on their Yen longs, ignoring the upbeat Japanese data, ahead of the Fed and BoJ policy decisions later this week. The pair stands resilient to broad US Dollar weakness. US PMIs eyed.

Gold price consolidates as traders seem reluctant ahead of Fed meeting

The Gold price oscillates around the $2,650 area as traders keenly await the outcome of the crucial FOMC meeting for cues about the future rate-cut path and before placing fresh directional bets. In the meantime, geopolitical risks and trade war fears could support the safe-haven precious metal, though bets for a less dovish Fed should cap the upside.

Fed’s interest rate decision in focus

As the week is about to come to an end, we open a window at what next week has instore for the markets. On Monday, we get the preliminary PMI figures for December of Australia, Japan, France, Germany, the Euro Zone as a whole, the UK and the US.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.