- GBP/USD recovered after hitting the lowest since March 2020 at 1.1717.

- The US dollar rally garnered strength amid recession fears and hawkish Fed bets.

- With Jackson Hole over, focus shifts to US NFP, impending bear flag on the daily chart.

Having lost roughly 300 pips in the previous week, GBP/USD ended the week marginally lower, below the 1.1800 mark. The US dollar recovery and hawkish Fed rate hike expectations were the key catalysts that smashed the currency pair to the lowest level in two months at 1.1717. Looking ahead, GBP bulls brace for more pain as US Nonfarm Payrolls (NFP) grab attention in a holiday-shortened week.

GBP/USD: What happened last week?

GBP/USD accelerated its downward spiral at the start of the week, as the recovery in the US dollar picked up strength, as investors ramped up bets for aggressive Fed tightening in anticipation of the Kansas City Fed's Jackson Hole Economic Symposium held on August 25-27. Resurfacing China's growth concerns also helped the safe-haven dollar to extend the upside.

The sell-off extended on Tuesday, and cable hit fresh two-year lows at 1.1717, as the greenback touched the highest level in 19 years against its major peers amid renewed fears over a potential recession in the euro area and the UK. However, the Preliminary S&P Global business PMI reports from across the euro area economies, and the UK eased recessionary concerns and snapped the dollar's rally as risk flows returned. Weak US Preliminary S&P Global Services and Composite PMIs combined with a sharp drop in New Home Sales accentuated the buck's retreat. That offered a much-needed respite to GBP bulls, as the currency pair rebounded sharply to near the 1.1880 region, staging a staggering recovery.

GBP/USD sellers, however, returned on Wednesday, as dollar bulls regained control amid a negative shift in risk sentiment. Investors reassessed the risks of an imminent global recession after the business PMIs pointed to an extended downturn in economic activity. Additionally, traders refrained from placing any directional bets on the higher-yielding sterling, progressing towards the Jackson Hole Symposium. US Treasury yields extended their weekly run up, as the benchmark 10-year rates hit the highest in two months near 3.125%, driven by expectations of an outsized Fed rate increase in September despite the headline miss in the US Durable Goods and discouraging Pending Home Sales data.

Heading into the three-day Fed symposium on Thursday, investors resorted to profit-taking on their US dollar long positions. The yields on the US government bonds also tumbled while Wall Street indices recovered firmly, lending some additional support to the pair. GBP/USD, however, failed to sustain the rebound once again above 1.1850, as the downside in the dollar remained cushioned by the upward revision to the US Q2 GDP and somewhat hawkish Fed commentary. The US GDP shrank 0.6% in Q2, annualized, less than the 0.9% contraction the Commerce Department reported in the preliminary reading last month. Meanwhile, St. Louis Fed President James Bullard and Kansas City Fed President Esther George sounded hawkish, offsetting dovish remarks from Philadelphia Fed President Patrick Harker.

On Friday, the major witnessed good two-way businesses before the critical US PCE inflation data and Powell's opening remarks on day two of the Jackson Hole Symposium. Cable tumbled below 1.1800 again after the dollar regained the upside traction while the pound suffered after the British energy regulator, Ofgem, announced that the average annual household energy bills will rise by 80% from October to 3,549 pounds. The tide turned against GBP bears in the European session, as the dollar came under pressure in spite of a decent comeback in the yields.

Softer US PCE inflation failed to offer any respite to USD bulls but Powell's prepared remarks rescued them, smashing the pair back around the 1.1800 demand area. The Fed Chief said that "decision on September rate hike will depend on totality of data since July meeting." According to the CME FedWatch Tool, odds of a 75 bps rate hike now stand at 55%, down from 65% seen on Thursday.

Week ahead: What to watch out for

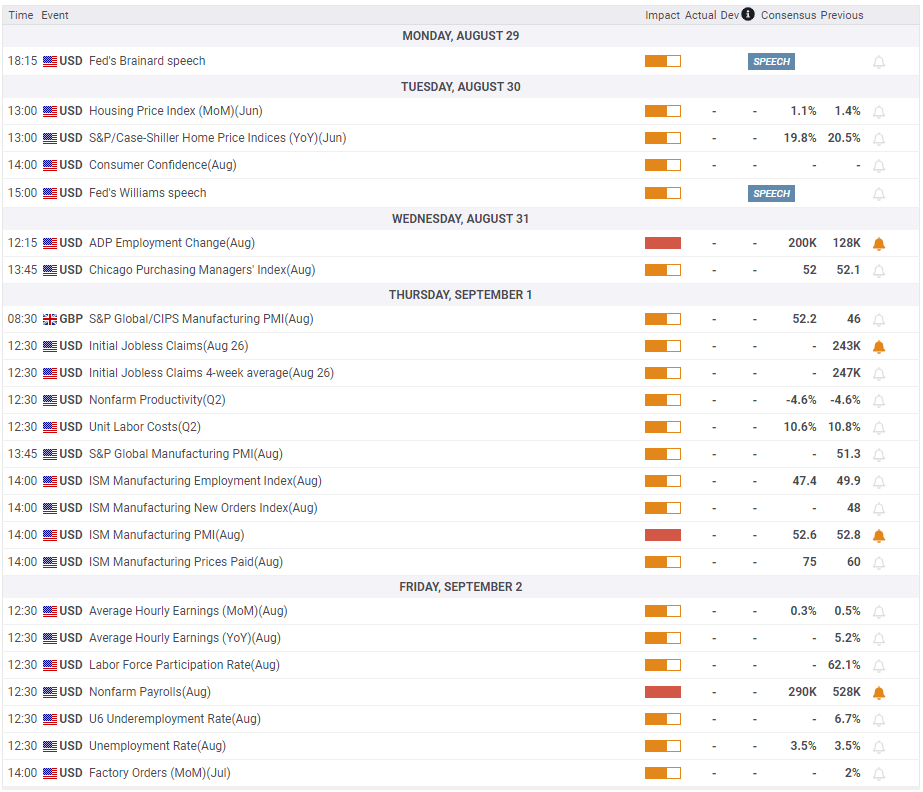

With the Jackson Hole symposium out of the way, GBP/USD traders gear up for a quiet start to the critical US labor market data week. There are no top-tier UK economic news releases slated for this week, therefore, the American macro data and the Fed tightening expectations will be closely eyed for fresh trading impetus on GBP/USD.

Monday will be data-empty on the US docket while the UK observes the Summer bank holiday. Low volumes and minimal volatility could exaggerate the moves in the pair, as the dust settles over Powell's aftermath. The focus then turns towards Tuesday's US Conference Board (CB) Consumer Confidence data and JOLTS Job Openings while New York Fed President John William's speech will also likely be hotely followed.

Markets will eagerly await the US ADP Nonfarm Employment Change on Wednesday, as it will be the first release using the new methodology. Cleveland Fed President Loretta Mester's speech will precede the US jobs data.

Thursday will see the release of the UK Final S&P Global Manufacturing PMI, which will likely have little to no impact on the pound. Later in the day, the US weekly Jobless Claims will drop in, followed by the US ISM Manufacturing PMI and Prices Paid sub-component. This data could have a significant impact on the dollar valuations ahead of Friday's American employment data. The August NFP reading will be key to determining the September Fed rate hike decision.

GBP/USD: Technical outlook

The short-term technical outlook for GBP/USD remains in favor of bears, with a break below the 1.1700 mark inevitable in the coming days. The currency pair has spotted a bear flag formation on the daily sticks.

A downside break below the rising trendline support at 1.1777 on a daily closing basis will confirm a bearish flag. The downtrend will then extend towards the 1.1650 psychological level. Ahead of that the 1.1705 demand area will challenge the bullish commitments. That zone is the confluence of the two-year lows and the falling (dashed) trendline.

The 14-day Relative Strength Index (RSI) inches lower while sitting just above the oversold region, suggesting that there is more room for a downside move. Adding credence to the bearish potential, the 21 and 50-Daily Moving Averages (DMA) bearish crossover confirmed earlier this week also remains in play.

Alternatively, bulls need a sustained move above the rising trendline resistance at 1.1879 to negate the near-term bearish bias. The next significant upside target is aligned at 1.1900 the round figure. The August 19 high at 1.1937 will be next on buyers' radars.

GBP/USD: Sentiment poll

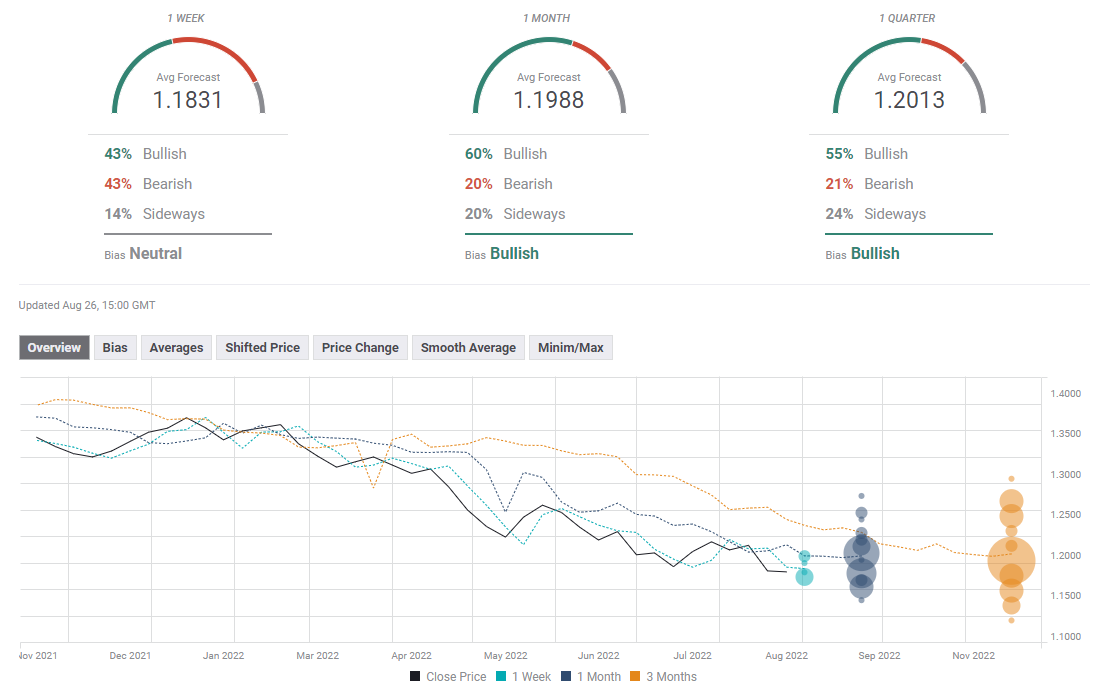

The FXStreet Forecast Poll paints a mixed picture of the GBP/USD's near-term outlook with the one-week average target sitting slightly above 1.1800. The one-month outlook remains bullish with experts' average forecast pointing to a rebound toward 1.2000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD clings to recovery gains near 1.2600 ahead of BoE rate decision

GBP/USD holds ground near 1.2600 after declining more than 1% following the Federal Reserve’s hawkish cut on Wednesday. The Pound Sterling gains upward support as the Bank of England is anticipated to keep interest rates unchanged later in the day.

EUR/USD retakes 1.0400 amid the post-Fed recovery

EUR/USD is recovering ground to near 1.0400 in the European session on Thursday. The pair corrects higher, reversing the hawkish Fed rate cut-led losses. Meanwhile, the US Dollar takes a breather ahead of US data releases.

Gold price recovers further from one-month low, climbs to $2,620 amid risk-off mood

Gold price attracts some haven flows in the wake of the post-FOMC sell-off in the equity markets. The Fed’s hawkish outlook lifts the US bond yields to a multi-month high and might the XAU/USD. Traders now look to the US Q3 GDP print for some impetus ahead of the US PCE data on Friday.

BoE expected to stand pat, highlighting gradual approach toward lowering interest rate

The Bank of England is set to keep the interest rate on hold, hinting at 2025 action. UK inflation accelerated further in November, albeit within expectations. GBP/USD trades within a well-limited 200 pips range ahead of the announcement.

Fed-ECB: 2025, the great decoupling?

The year 2024 was marked by further progress in disinflation in both the United States and the Eurozone, sufficient to pave the way for rate cuts. The Fed and the ECB did not quite follow the same timetable and tempo, but by the end of the year, the cumulative size of their rate cuts is the same: 100 basis points.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.