GBP/USD Weekly Forecast: BOE may save sterling after massive Fed-induced 300-pip blow

- GBP/USD has tumbled down in response to a Fed decision, UK reopening delay.

- The BOE's decision and a bulk of US figures are set to move the currency pair.

- Mid-June's daily chart is showing bears are taking over.

- The FX Poll is pointing a recovery, albeit not to pre-Fed levels.

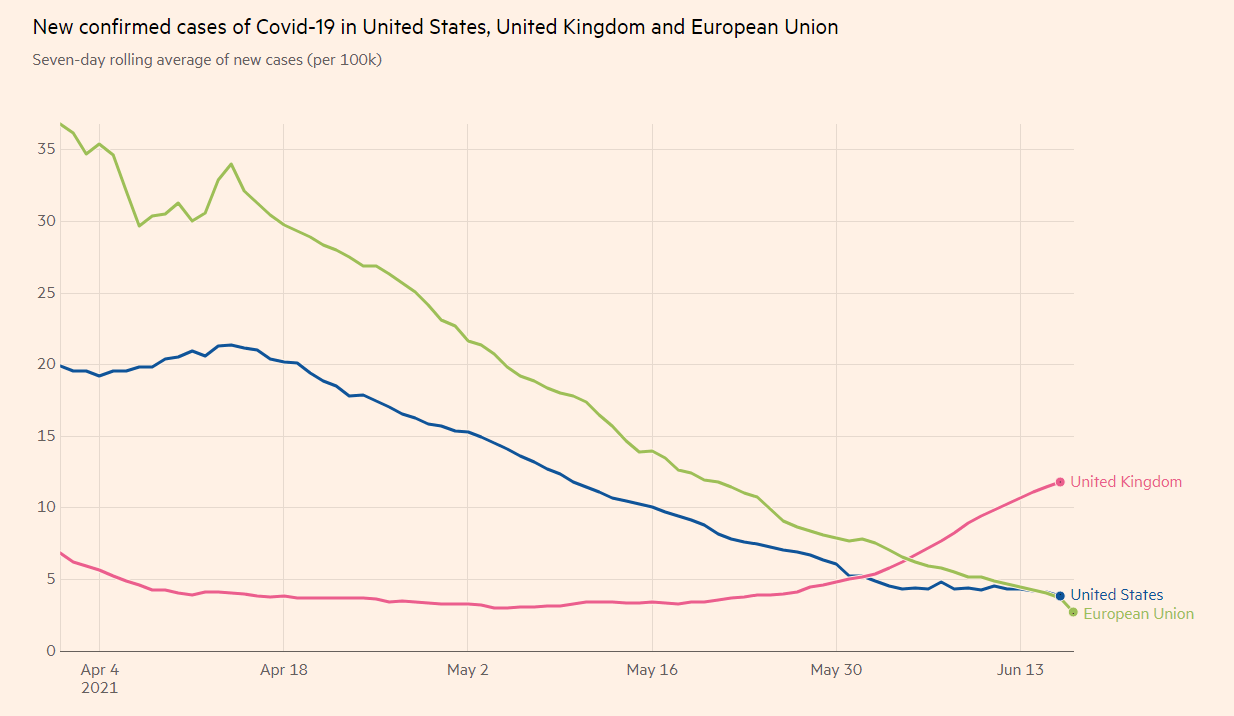

Hawkish Fed – these words have rarely been written together, and the abrupt change from the world's most powerful central bank has been boosting the dollar. For GBP/USD, the ball now shifts to the Bank of England, which has to weigh economic optimism and the spread of the Delta covid variant.

This week in GBP/USD: Powell propels the dollar

Powell Power: The Federal Reserve shocked markets by signalling two rate hikes in 2023, contrary to none at all beforehand. The bank also upgraded other forecasts such as that for inflation – with underlying prices set to hit 3% in 2021 – and hailed the rapid recovery.

Moreover, Fed Chair Jerome Powell said that the discussion about when and how to taper the pace of the bank's $120 billion/month bond-buying scheme are now underway. Investors were also surprised by Powell's intentions to act based upon improving employment expectations – moving in response to the outlook instead of the outcome.

The prospects of fewer dollars printed and higher borrowing costs sent the dollar surging across the board, and the greenback barely stopped to pause even when Treasury yields cooled down.

Freedom Day delayed: July 19 is the new June 21 – England's full reopening will have to wait another four weeks as the Delta variant of COVID-19 continues spreading rapidly across the UK. While the decision was already reported by the press ahead of the publication, sterling did drop to new two-month lows. It recovered later.

The silver lining is that UK Prime Minister Boris Johnson opened the door to an earlier loosening of restrictions if things improve. The government announced it is ramping up second doses after studies showed that one jab is insufficient to battle this strain, while the efficacy rises sharply with the second one.

COVID-19 cases in the US, EU and UK

Source: FT

Brexit: The acrimony between the EU and the UK over the implementation of the Northern Irish protocol was evident at the highest level – the G-7 Summit. However, while no resolution was found, investors seemed to ignore the topic as the media moved onto other issues.

The pound received a boost from mostly upbeat UK data. The Unemployment Rate dropped to 4.7% in April, while jobless claims tumbled by 92,600 in May. The Consumer Price Index jumped to 2.1% and also Core CPI hit 2% – raising the chances that the Bank of England could raise interest rates sooner. However, Retail Sales disappointed with a drop of 1.4% in May.

In the US, economic statistics were mixed. While Retail Sales disappointed with a drop of 1.3% in May, this fall came on top of upward revised data for April. Jobless claims edged

UK events: BOE stands out

Reopening reconfigured? July 19 is the new "Freedom Day," but it might happen earlier if Britain's covid statistics decline – and that heavily depends on getting shots in arms. Apart from opening eligibility to additional groups, health officials have shortened the wait period between the first and second shots.

An increase in people fully vaccinated is pound-positive.

Source: The Guardian

Brexit issues have yet to be resolved, and they have the tendency to provide negative surprises to the pound. After several days off the agenda, an angry comment from Brussels could send sterling lower, but that cannot be planned for.

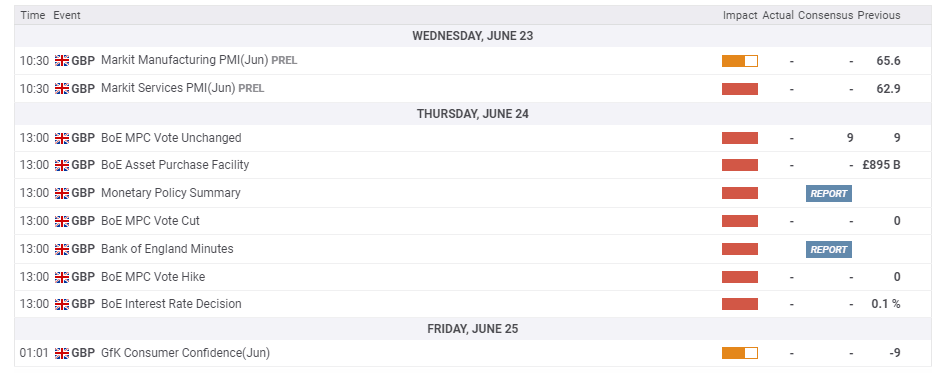

On the other hand, the Bank of England is set to rock markets on Thursday with its rate decision. While the "Old Lady" is unlikely to change its interest rates, the bank's statement may provide insights into the direction of the economy. Has the delay in Britain's reopening caused the BOE to downgrade its expectations? Or do recent satisfactory figures provide reasons to be cheerful?

Investors would also like to know if the bank is considering withdrawing some of its stimuli anytime soon. The BOE announced a minor decrease to the pace of its bond buys last time, without altering the scope. On the other hand, Chief Economist Andy Haldane suggested tapering is needed as the economy is going "gangbusters."

Governor Andrew Bailey does not have a planned press conference after the event, but he tends to give interviews. Optimism could boost the pound, while a focus on the delay of "Freedom Day" could push it lower.

Apart from the BOE, Markit's preliminary purchasing managers' indexes for June may move sterling, especially that for the large services sector.

Here is the list of UK events from the FXStreet calendar:

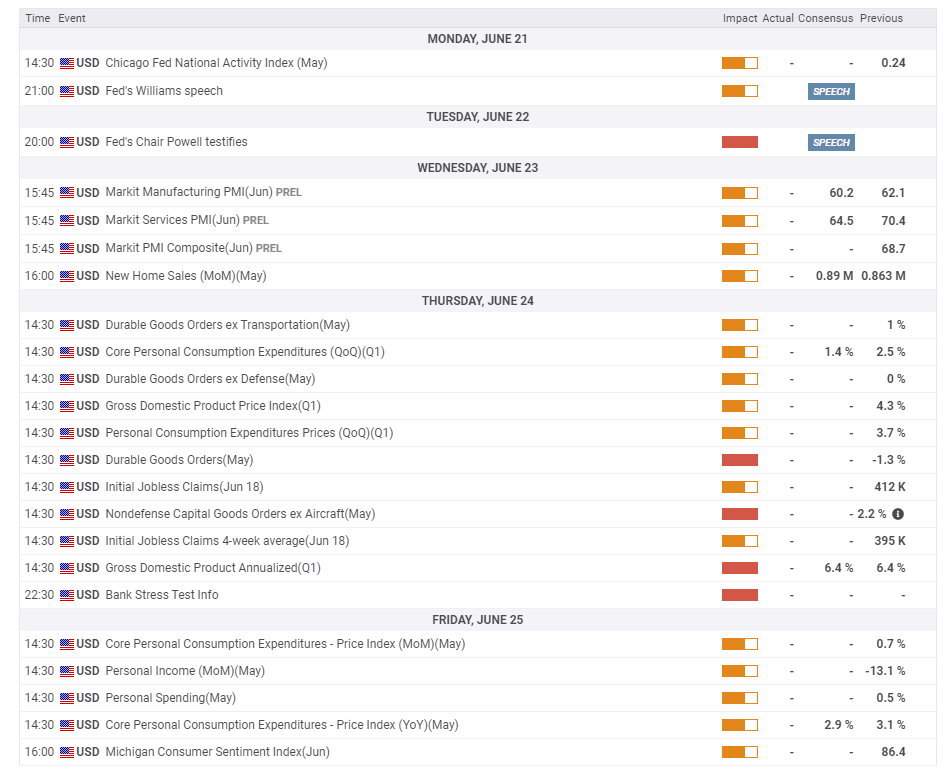

US events: Infrastructure, investment and more

Crunch time on Capitol Hill? President Biden is back to the White House and his presence may help accelerate negotiations on a bipartisan infrastructure deal. Several rounds of talks have been unfruitful, and Democrats may attempt to go it alone. For the dollar, the higher the bill, the better.

The President originally wanted a plan worth over $2 trillion while Republicans seem reluctant to settle for $1 trillion. Vaccine race: The White House set a goal of reaching 70% of adults with one COVID-19 jab by July 4, and the recent slowdown in inoculations suggest this target will be missed. Nevertheless, any upswing in the pace of vaccinations would be dollar positive.

Vaccine progress in the US:

Source: NYT

Apart from digesting the Fed decision, the economic calendar provides traders plenty to chew on. First, Powell returns to the scene in a public appearance on Tuesday, in which he might provide more clarity on the bombshell he dropped. Will he try to soften the hawkish message or double down? Markets have become more sensitive, and are set to react to any comment that would seem like a deviation from his post-decision presser.

Markit's preliminary purchasing managers' indexes for June forecast somewhat slower growth, while sales of new homes are predicted to have picked up in May.

After Wednesday's warm-up, Thursday features a long list of publications. Perhaps the most significant one is Durable Goods Orders for May, which will probably show an increase in investment after a decline last month. The Nondefence Ex-Aircraft component, aka "core of the core" is the key figure to watch.

America's economy grew at an annualized rate of 6.4% in the first quarter, according to the second estimate, and economists expect the final release to confirm that. Last but not least, weekly Jobless Claims remain of interest amid the Fed's focus on them.

Another statistic that is of high interest to the central bank is the Core Personal Consumption Expenditure (Core PCE), which is forecast to dip below 3% in May after leaping to 3.1% in April. The gauge is the Fed's preferred measure of inflation.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Bears are taking over – cable's sharp fall sent momentum on the daily chart to negative territory for the first time since April. Moreover, the pair pierced through the 50-day and the 100-day Simple Moving Average (SMA). At the time of writing, the Relative Strength Index (RSI) is still above 30, thus outside oversold territory, adding to the downside bias.

Some support is at 1.3855, which was the post-Fed trough. It is followed by 1.38, which cushioned GBP/USD in early May, and the by the all-important 1.3670 line that was a double bottom during the spring. Even lower, 1.3565 is the next downside target.

Some resistance is at 1.3930, which held cable down early last month, and then by 1.4010, the separator of trading ranges which had previously crushed recovery attempts. Further above, 1.4140 and 1.4220 are eyed.

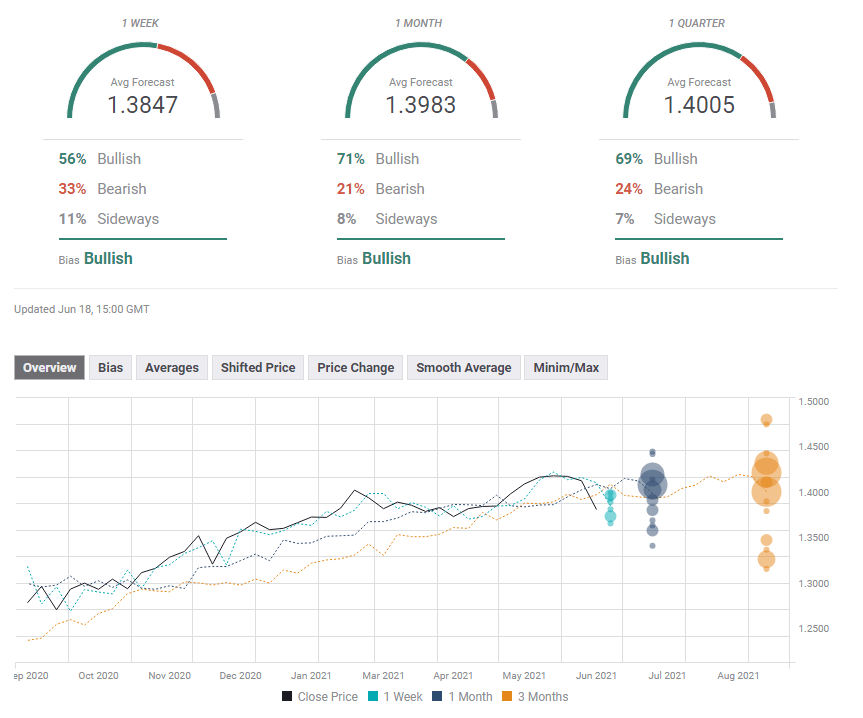

GBP/USD sentiment

The Fed's hawkish shocker will likely have further ripple effects on markets, keeping the dollar bid. The BOE is unlikely to fully mimic the Fed, and without a clear peak in covid cases, pressure on sterling is set to continue. All in all, another week of falls is on the cards, with the BOE only providing limited support.

The FXStreet Forecast Poll is showing experts expect a bounceback from current levels, albeit below the pre-Fed levels. In comparison to the previous week, targets have been downgraded.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.