GBP/USD Weekly Forecast: A technical rebound could be in the offing

- GBP/USD booked a third straight weekly decline, having renewed 28-month lows.

- The US June inflation scorcher widens the Fed-BOE policy divergence.

- UK inflation and politics will be closely followed. Time for a temporary pullback?

Having tested levels below 1.1900 a week ago, GBP/USD lost further ground and hit a new 28-month low of 1.1760 amid a combination of factors that worked against the British pound. The US inflation stood out in the week and added extra legs to the ongoing US dollar rally. Looking ahead, UK employment and inflation will hold the key as the Fed enters the ‘blackout period’.

GBP/USD: What happened last week?

Another brutal week for cable optimists, as bears refused to yield in amid UK political instability and widening monetary policy divergence between the US Federal Reserve and the Bank of England (BOE). The path of distress was a given after the major failed to sustain above the 1.2000 at the start of the week. Risk-aversion remained the main theme throughout the week amid looming recession fears and China imposing fresh covid-related lockdown measures. China’s Q2 GDP contraction of 2.6% accentuated recession risks. The US dollar remained the undisputed winner as investors sought refuge in the safe haven.

The concerns regarding an economic slowdown amplified mid-week after the US Consumer Price Index (CPI) jumped more than expected to 9.1% YoY in June, hitting the highest level in four decades. Hotter US inflation jacked up bets for a full percentage point Fed rate hike this month, driving the US dollar index to fresh two-decade highs above 109.00. The US Treasury yields also surged across the time horizon, with the inversion of the two-year and 10-year yield curve (a recession indicator) deepening further.

The commentary from Fed official James Bullard and Raphael Bostic calmed somewhat the relentless dollar demand, as they watered down hopes for a 100 bps rate hike, sticking to the pre-committed 75 bps lift-off in July. Meanwhile, the UK GDP and Manufacturing Production data rebounded in the reported period, offering a silver lining to the pound. The UK ONS reported that the monthly GDP release showed that the economy rebounded firmly in May, arriving at 0.5% vs. 0% expectations and -0.3% previous.

Sellers, however, returned, as hawkish Fed expectations underscored the policy contrast. Even with a 75 bps July rate hike, the Fed remains way ahead of the curve when compared to the BOE’s gradual 25 bps tightening path. Markets now expect the BOE to raise its policy rate by a total of 175 bps by the end of the year.

Furthermore, the commencement of the US earnings season and discouraging JP Morgan bank’s corporate result fuelled another risk-off run and revived the US dollar’s haven demand. Cable traders also remained overwhelmed by the UK political uncertainty. The latest political developments in the UK revealed that Britain's new prime minister will be announced on September 5. “Four of the eight Conservative MPs who made it through to the first round of voting are women, and four – Rishi Sunak, Nadhim Zahawi, Suella Braverman and Kemi Badenoch – are from ethnic minority backgrounds,” per BBC News.

The US also published June Retail Sales on Friday, which brought a positive surprise, as sales were up by 1% MoM, beating the 0.8% increase expected. The optimistic headline provided support to the USD, pushing GBP/USD away from its intraday high.

Week ahead: UK inflation in focus

It’s a data-busy week for pound traders, as the UK Employment data will roll out on Tuesday, followed by the critical inflation release on Wednesday. Monday is a quiet day, with no top-tier macro data from both sides of the Atlantic. However, the BOE policymaker Michael Saunders is expected to speak at the Resolution Foundation in London.

The UK inflation data will hold the key for the BOE’s next rate hike plan. The UK CPI arrived at 9.1% YoY in May, a new 40-year high. Meanwhile, the UK political news and the Fed sentiment will continue to influence the pair’s price direction.

Thursday is the European Central Bank (ECB) interest rate decision, which, if creates market volatility, the pound could be impacted by the EUR/GBP cross-driven price swings. The US weekly Jobless Claims will be reported later on Thursday.

The UK Retail Sales, S&P Global/CIPS Manufacturing and Services PMI will drop in on Friday, followed by the US S&P Global/CIPS Business PMIs. It will be a quiet week in terms of the speeches from the Fed officials as the US central bank enters a ‘blackout period’ ahead of the July 26-27 policy meeting.

GBP/USD technical outlook

From a technical point of view, the bearish momentum in GBP/USD has left the pair with extreme oversold conditions in almost every time frame. The weekly chart shows that technical indicators have resumed their declines, with the RSI indicator currently at 24. At the same time, the 20 SMA heads south almost vertically, far below the longer ones and over 700 pips above the current level.

Technical readings in the daily chart hint at a potential bullish correction while reflecting bears’ dominance. The RSI and the Momentum indicator consolidate near oversold readings as the pair develops below firmly bearish moving averages.

A potential bullish target and resistance level is 1.1960, but the pair would need to establish itself above 1.2055, a relevant high, to actually have room for a relevant upward extension. Near-term buyers have defended the 1.1800 figure, but a slide below the multi-year low of 1.1759 is needed to confirm a bearish continuation in the days to come. In this latter case, the pair has room to extend its slump towards the 1.1600 threshold.

GBP/USD sentiment poll

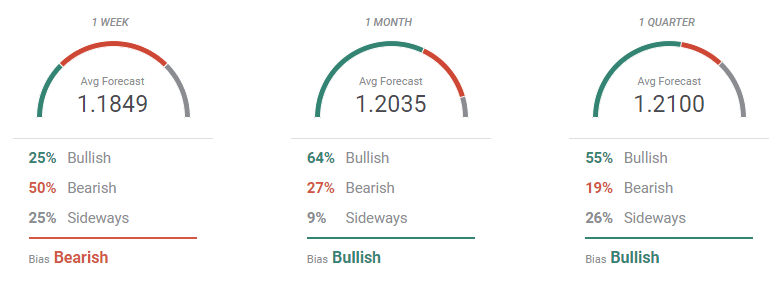

According to the FXStreet Forecast Poll, the GBP/USD pair will remain under selling pressure in the near term, as 50% of the polled experts are betting for lower targets next week. The pair is seen on average at 1.1849 and barely able to regain the 1.2000 threshold. On the other hand, the wider perspectives indicate a strong bullish sentiment, as 64% of the polled experts see the pair advancing in the monthly view, and 55% maintain such a stance in the quarterly perspective.

The Overview chart shows a firmly bearish momentum in the near term, although not far below the recent multi-year low at 1.1759. The longer moving averages also head south but are losing their downward strength. The chances of lower lows have decreased but are still present, but also a recovery beyond the 1.2500 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.