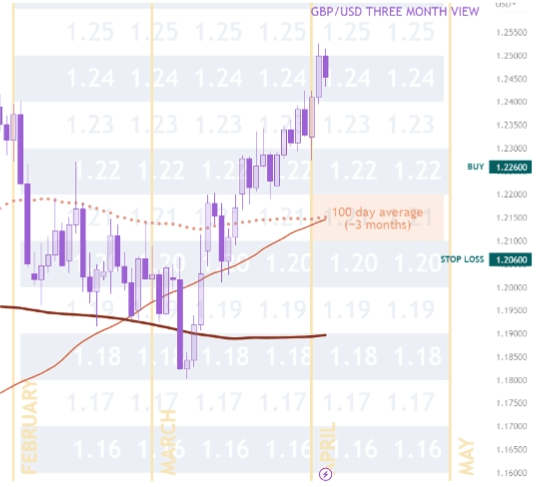

GBP/USD trade plan - Look for entries when dips

Sterling: The value of Sterling in USD is expected to remain above the $1.21 area, Re-evaluate after the US NFP on the 7th of April.

US Dollar: The value of the US Dollar in USD is expected to remain below $104.00. Re-evaluate after the US NFP on the 7th of April.

Fundamental Evaluation: The average value of the GBP/USD over the short-term (50 days) is holding around $1.21, the medium-term (100 days) is climbing and since the beginning of March has jumped from $1.19 to $1.21. The long-term (200 days) is lagging and has fallen to $1.18.

The in-house (Jeepson Trading) research suggests that the fundamental value of the GBP/USD is expected to stay above the $1.21 area.

Sentiment Evaluation: Price remains below the January peak of $1.24 although the February downtrend has since reversed. This recent optimism can be attributed to a re-pricing of the US Dollar which speculators consider to be over priced in anticipation of a Fed pivot.

The Fed appears to be resolute on their plan to retain high rates and so there may be an upside correction (to the value of USD) as new economic data is released.

This week will see fresh US NFP data with a forecast of 250K and then next week is US CPI data with a forecast of a fall to 5.8 percent. If accurate, these numbers would indicate further weakness ahead in the US dollar.

The CME FedWatch tool indicates rising odds at 60 percent in favour of a rate hold in May (against a 0.25 hike) and then 55 percent of a rate hold in June (against a 0.25 hike).

The GBP/USD plan is to Buy from levels above 1.21. Re-evaluate on Friday the 7th of April.

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.