GBP/USD the bull run may have lost its way in recent days [Video]

![GBP/USD the bull run may have lost its way in recent days [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1151541926_XtraLarge.jpg)

GBP/USD

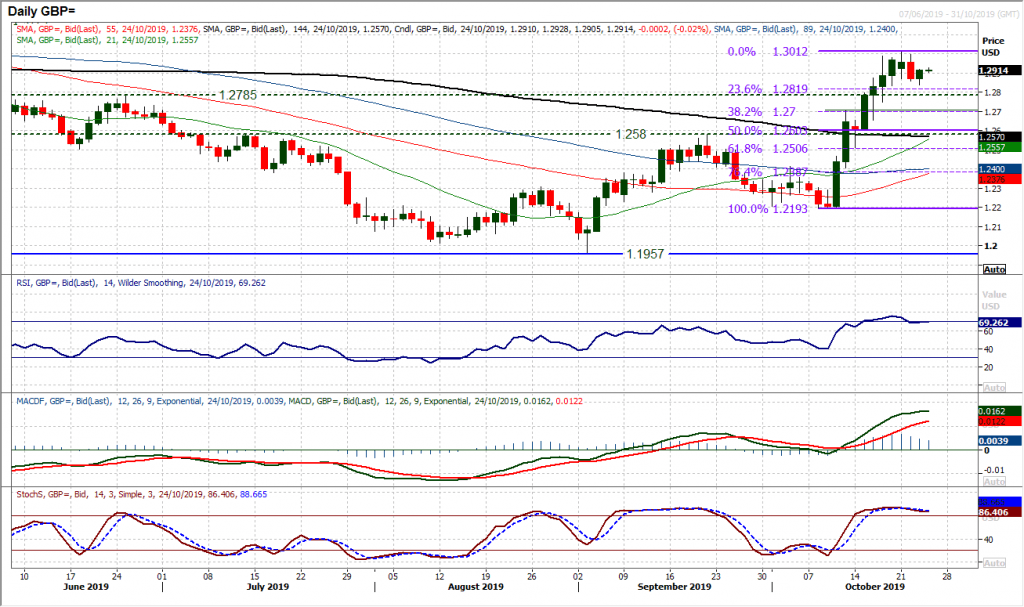

The bull run may have lost its way in recent days, but the bulls are still willing to sit in their positions. Yesterday’s candle was a strong reaction to the threat of initial profit taking. A rebound back above $1.2900 shows a degree of fight and a market in consolidation rather than near term correction. Political moves around the next step in the Brexit saga will be a key driver of the next move on Cable, but for now the technicals are developing a consolidation. Yesterday’s low at $1.2840 is initial support whilst the 23.6% Fibonacci retracement of the bull rally sits at $1.2820 and is an initial gauge for how a correction could develop. Resistance around $1.3000/$1.3010 is key.

Author

Richard Perry

Independent Analyst